This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

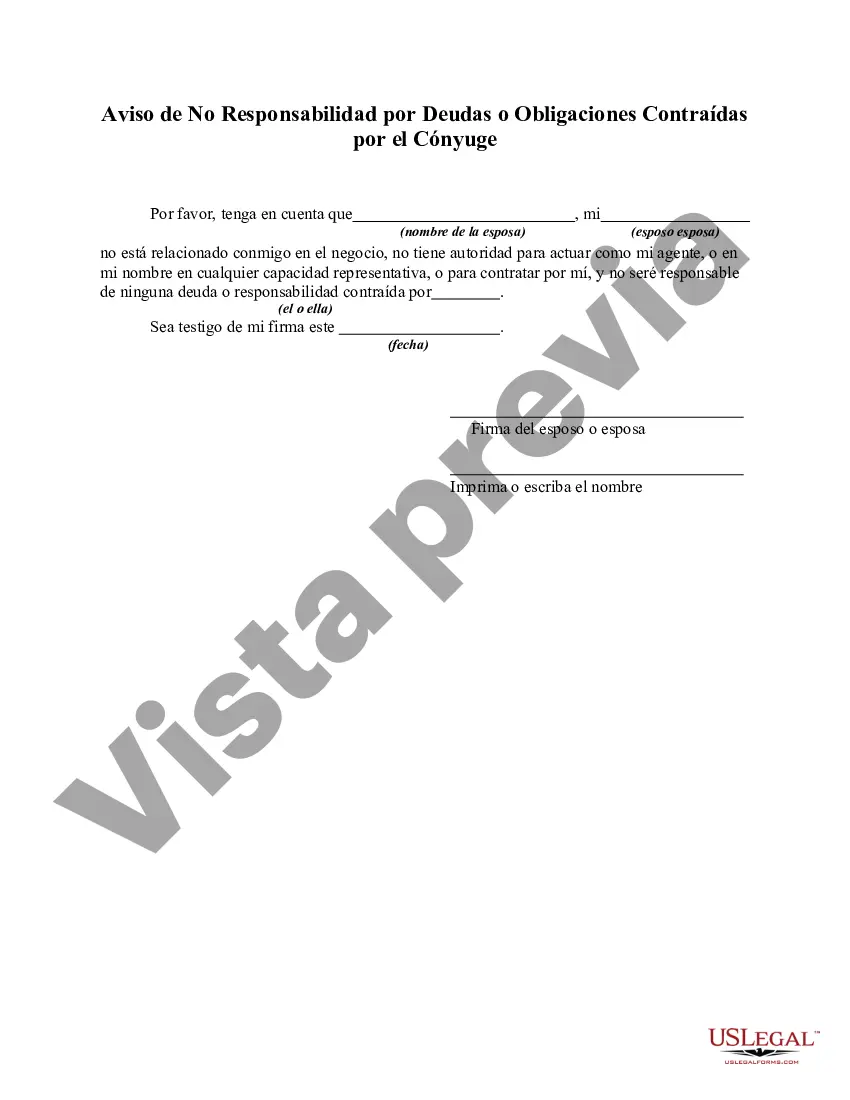

Title: Understanding Cook Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse Introduction: The Cook Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse is a legal document designed to protect one spouse (referred to as the "innocent spouse") from being held responsible for the debts or liabilities incurred solely by their spouse (referred to as the "responsible spouse"). This document is particularly relevant in the state of Illinois when the responsible spouse is engaged in activities that may financially burden the innocent spouse. Different Types of Cook Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse: While there is only one primary type of Cook Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, it can be further categorized based on the specific situation or debt involved: 1. Cook Illinois Notice of Non-Responsibility for Debt Incurred Through Business Activities: This type of notice is applicable when the responsible spouse, possibly engaged in a business venture or entrepreneurial pursuit, has incurred debts solely under their name for business-related activities. The innocent spouse can file this notice to assert non-liability for these debts, as they were not involved in any financial transactions related to the business. 2. Cook Illinois Notice of Non-Responsibility for Debts Incurred Through Legal Matters: This variant of the notice is applicable when the responsible spouse has incurred debts through legal matters such as lawsuits, settlements, or legal fees. By filing this form, the innocent spouse declares that they did not participate in or consent to any legal action that resulted in the debts. This form ensures that the innocent spouse is not held responsible for any obligations arising from such legal matters. 3. Cook Illinois Notice of Non-Responsibility for Debts Incurred Through Personal Loans or Credit Cards: This notice is relevant when the responsible spouse accumulates personal debts through personal loans or extensive credit card usage. By filing this document, the innocent spouse can protect their assets and credit from being affected by these personal debts. Legal Mechanisms and Importance: The Cook Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse empowers innocent spouses to assert their lack of involvement in any financial decisions or transactions that may potentially impact their creditworthiness, finances, and general well-being. By carefully completing this legally binding form, innocent spouses can avoid unnecessary financial burdens and protect their assets from being seized or affected by the debts of their spouse. Conclusion: Understanding the Cook Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse is vital for those who wish to protect themselves from financial liabilities caused solely by their spouse's actions. By recognizing the different types of notices tailored to specific circumstances, individuals can assert their non-liability and safeguard their financial interests effectively. Seeking legal advice or guidance during the process of filing such notices is always recommended ensuring accuracy and compliance with local laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.