A Franklin Ohio Resignation Letter from an Accounting Firm to a Client is a formal document that signifies the termination of the auditing services provided to the client by the accounting firm. This letter is crucial for maintaining transparency and professionalism in the business relationship between the firm and the client. Keywords: Franklin Ohio, resignation letter, accounting firm, client, auditors, termination, auditing services, transparency, professionalism, business relationship. Types of Franklin Ohio Resignation Letters from Accounting Firm to Client as Auditors for Client: 1. Standard Resignation Letter: A standard type of resignation letter is commonly used when the accounting firm no longer wishes to continue auditing services for the client. This letter will typically include the necessary details such as the reason for resignation, effective date, and a professional tone. 2. Unsatisfactory Performance Resignation Letter: If the accounting firm is resigning due to the unsatisfactory performance of the client, a specific resignation letter highlighting the reasons for termination can be chosen. This type of letter may include instances where the client did not comply with accounting standards or failed to provide essential documents required for auditing. 3. Conflict of Interest Resignation Letter: In situations where there is a conflict of interest between the accounting firm and the client, a conflict of interest resignation letter can be utilized. This letter will highlight the reasons for the potential conflict and the firm's decision to resign from the client. 4. Ethical Concerns Resignation Letter: If the accounting firm discovers unethical practices or potential fraud within the client's financial records, an ethical concerns resignation letter can be employed. This type of letter will address the discovery of such issues, express concern, and state that the firm can no longer continue providing services to the client due to ethical reasons. 5. Mutual Agreement Resignation Letter: In some cases, the accounting firm and the client may mutually agree upon terminating their business relationship. In this scenario, a mutual agreement resignation letter is used to formalize the decision. This letter will outline the agreement, specify both parties' consent, and establish a smooth transition process. By incorporating relevant keywords and understanding the various types of resignation letters, the content can be tailored to accurately describe the Franklin Ohio Resignation Letter from an Accounting Firm to a Client as Auditors for the Client.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Carta de renuncia de la firma de contabilidad al cliente como auditores para el cliente - Resignation Letter from Accounting Firm to Client as Auditors for Client

Description

How to fill out Franklin Ohio Carta De Renuncia De La Firma De Contabilidad Al Cliente Como Auditores Para El Cliente?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Franklin Resignation Letter from Accounting Firm to Client as Auditors for Client, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Franklin Resignation Letter from Accounting Firm to Client as Auditors for Client from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Franklin Resignation Letter from Accounting Firm to Client as Auditors for Client:

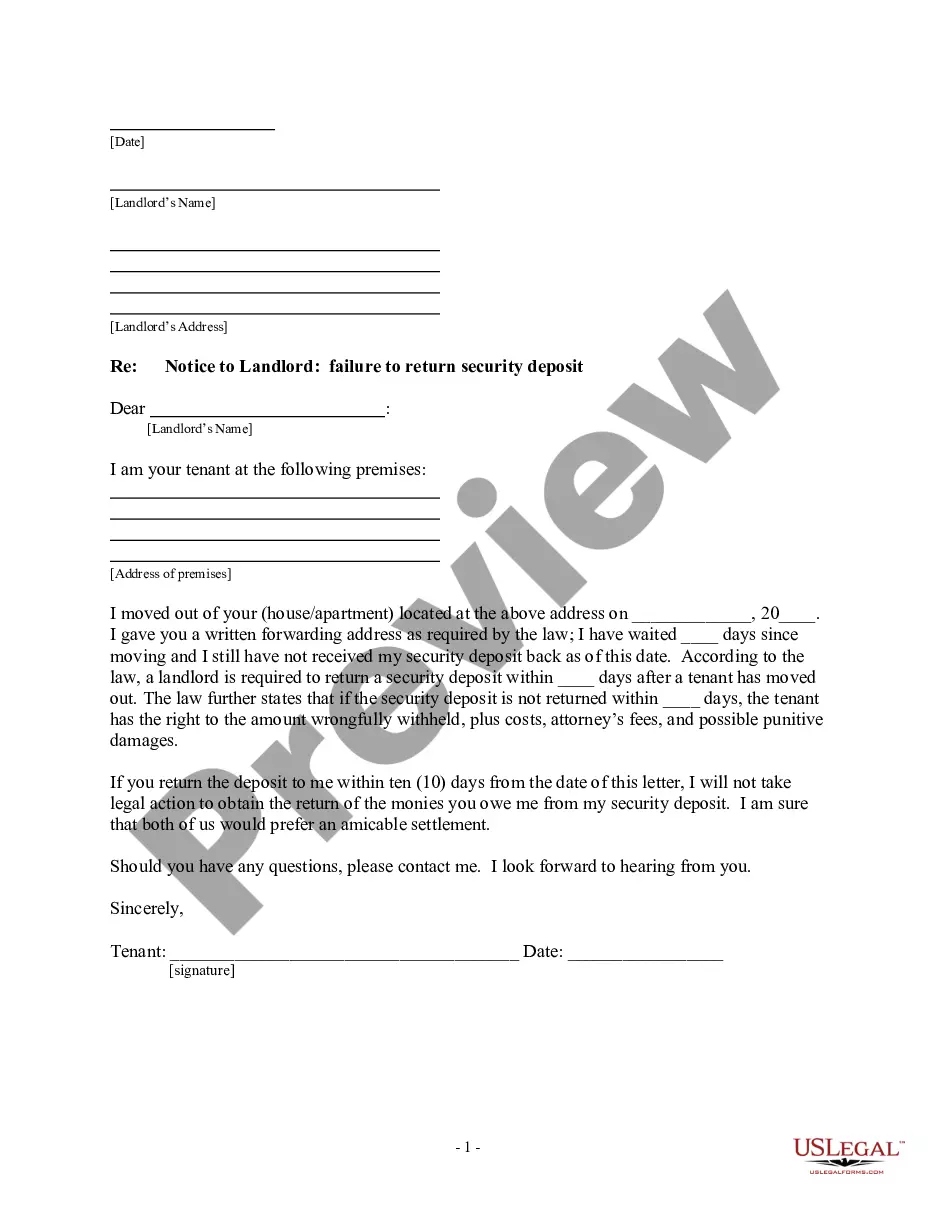

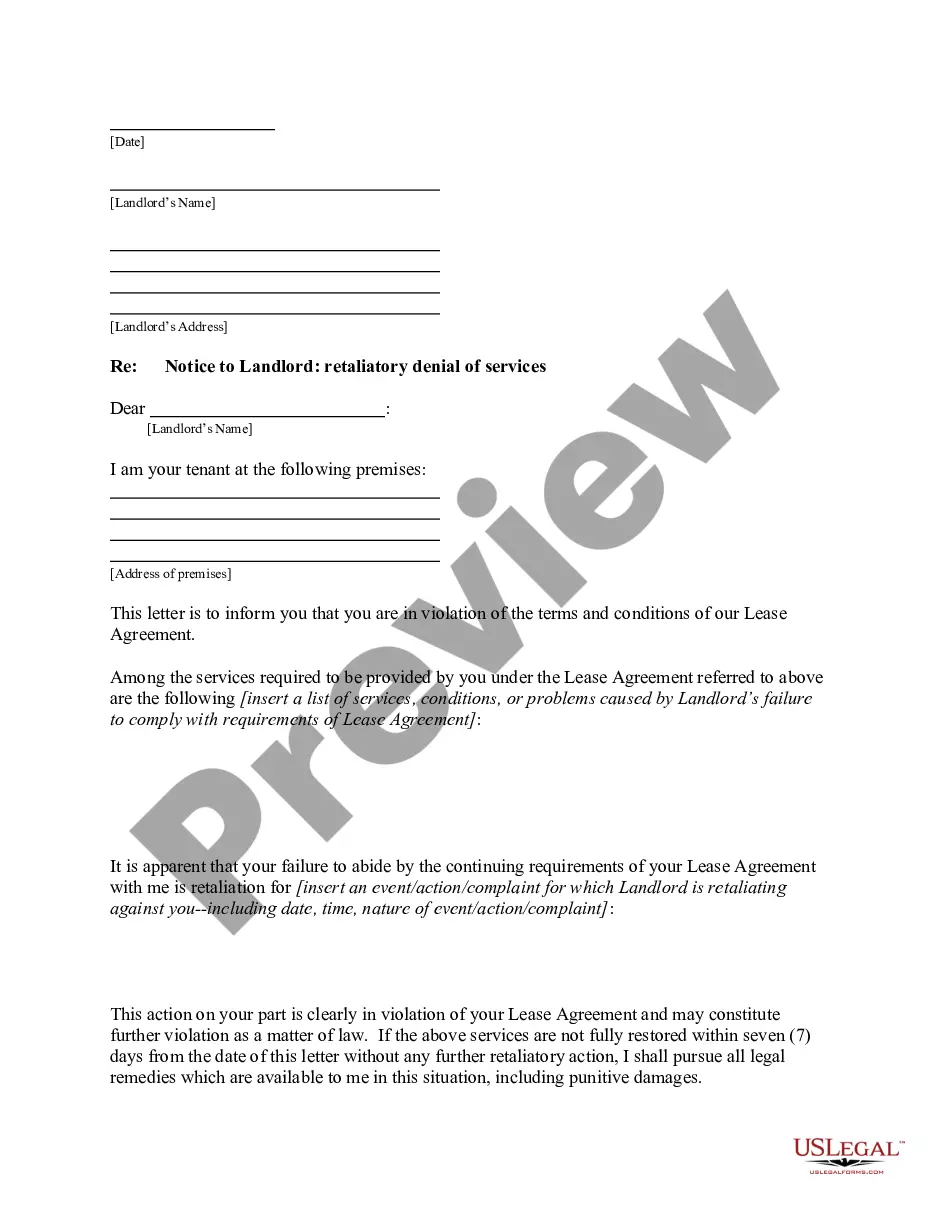

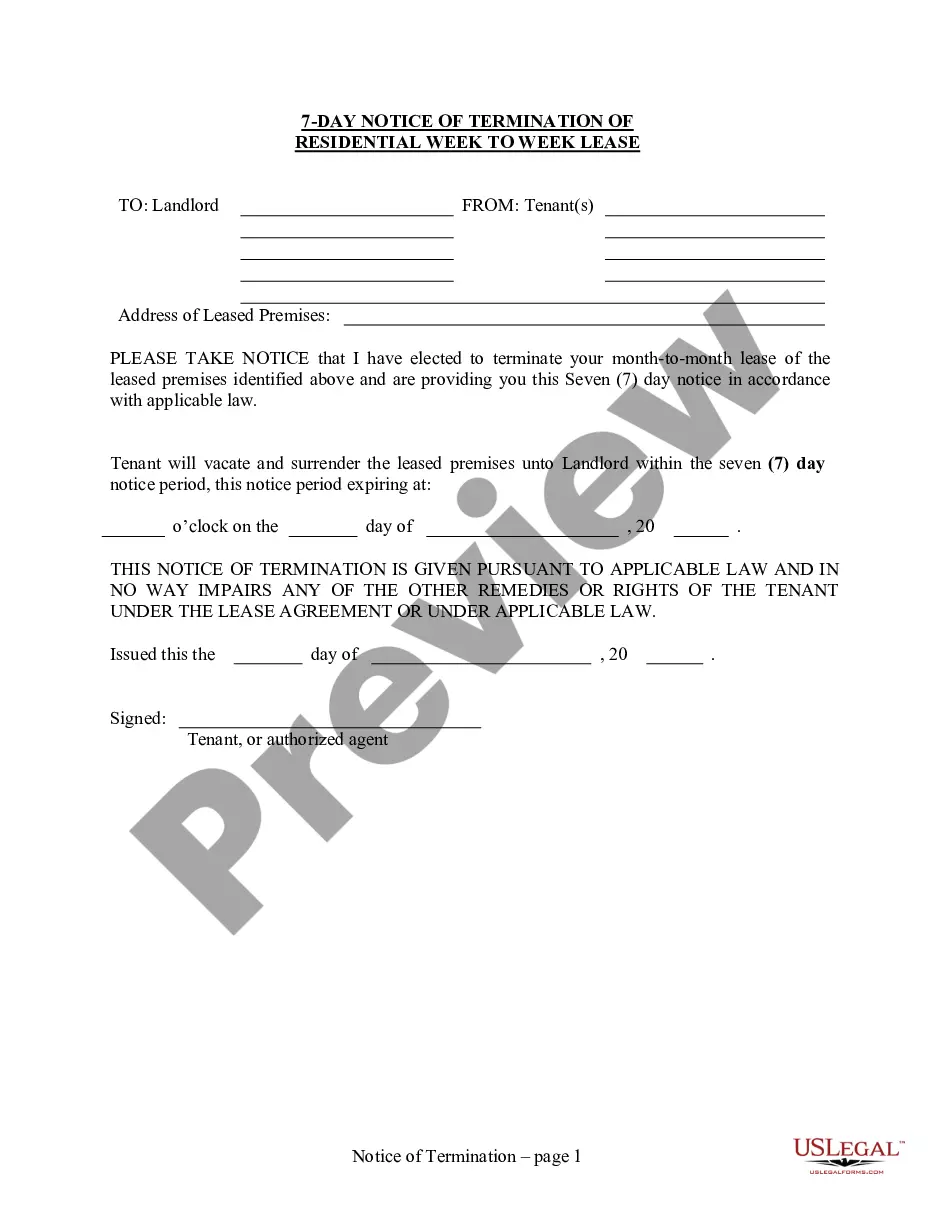

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!