The Harris Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legal document that outlines the terms and conditions of the sale of a sole proprietorship business in Harris County, Texas. This agreement serves as a binding contract for both the buyer and the seller and ensures a smooth transfer of assets, liabilities, and overall ownership rights. Keywords: Harris Texas, Agreement for Sale of Business, Sole Proprietorship, Asset Purchase, legal document, terms and conditions, sale, business, Harris County, Texas, binding contract, buyer, seller, transfer of assets, liabilities, ownership rights. There may be different types of Harris Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase, including: 1. Standard Agreement: This is the most common type of agreement used for the sale of a sole proprietorship business. It covers typical provisions regarding the purchase price, payment terms, asset transfer, liabilities, warranties, and any other relevant details. 2. Confidentiality Agreement: Sometimes, buyers and sellers may wish to negotiate the terms of the sale before disclosing sensitive business information. To protect this information, a separate confidentiality agreement can be signed by both parties, outlining the obligations to keep the discussions and disclosed details confidential. 3. Promissory Note Agreement: In some cases, the buyer may choose to pay for the purchased assets over time instead of upfront. A promissory note agreement can be included alongside the sale of business agreement, specifying the installment payment terms, interest rates, and any potential consequences for defaulting on the payments. 4. Non-Compete Agreement: When selling a sole proprietorship business, the seller may want to ensure that the buyer does not enter into direct competition within a specific market or geographic area. The addition of a non-compete agreement can prevent the buyer from engaging in similar business activities that may pose a threat to the seller's interests. 5. Bill of Sale: Although the sale of a sole proprietorship primarily involves asset transfer, there may be instances where physical property or valuable inventory is included. A bill of sale can be used to itemize and transfer ownership rights of these tangible assets alongside the main sale of business agreement. By considering the specific circumstances and preferences of the buyer and seller, different types of Harris Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase can be customized to meet their requirements while ensuring a fair and secure transaction.

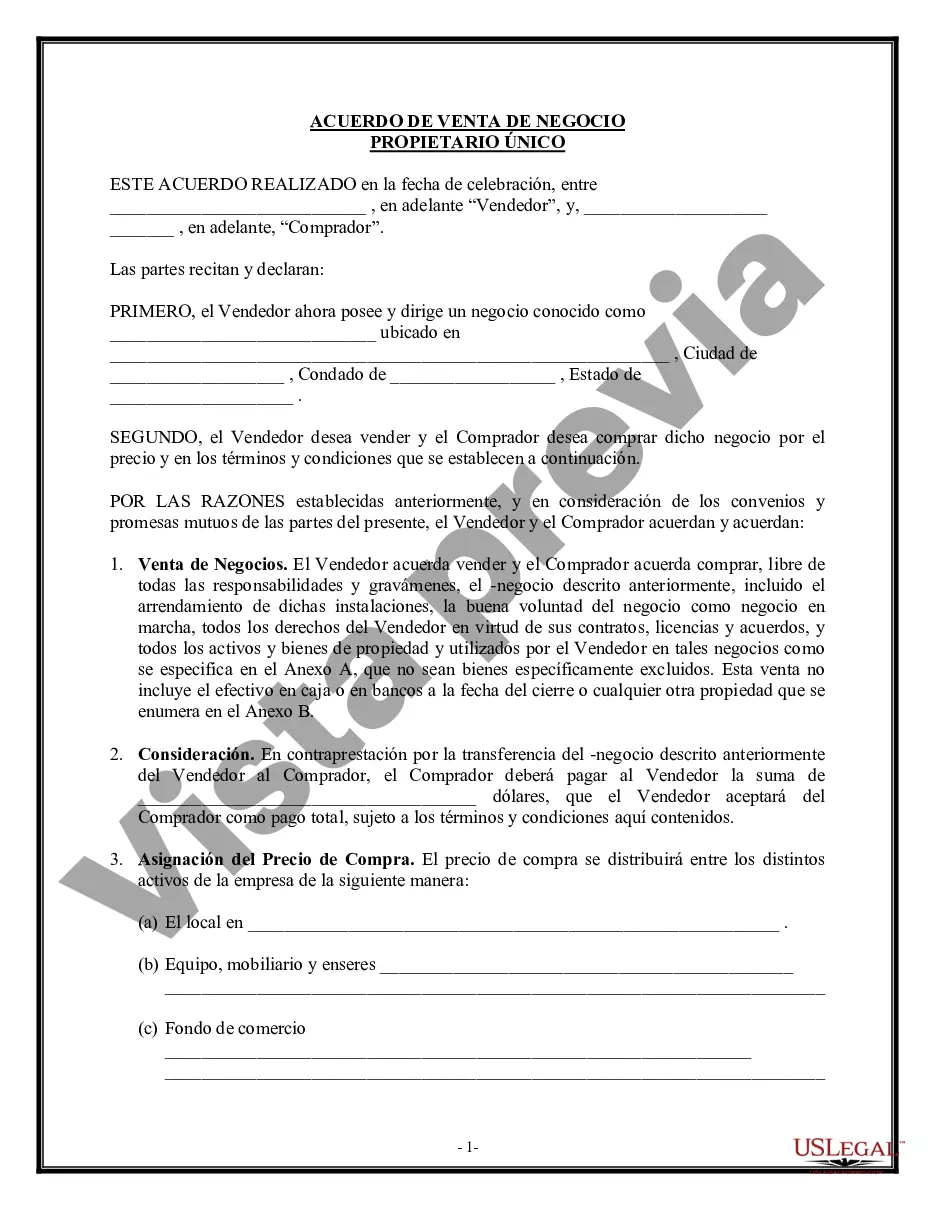

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de Venta de Negocio - Empresa Unipersonal - Compra de Activos - Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Harris Texas Acuerdo De Venta De Negocio - Empresa Unipersonal - Compra De Activos?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Harris Agreement for Sale of Business - Sole Proprietorship - Asset Purchase, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Harris Agreement for Sale of Business - Sole Proprietorship - Asset Purchase from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Harris Agreement for Sale of Business - Sole Proprietorship - Asset Purchase:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!