An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

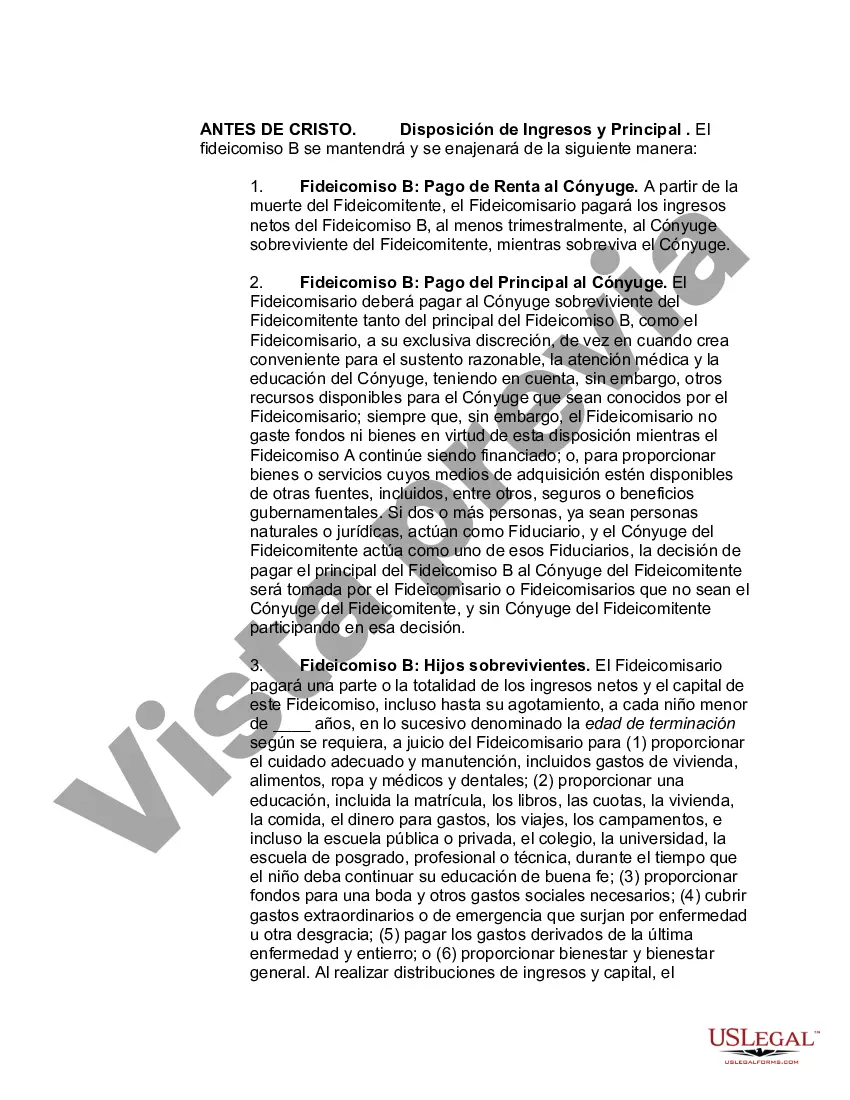

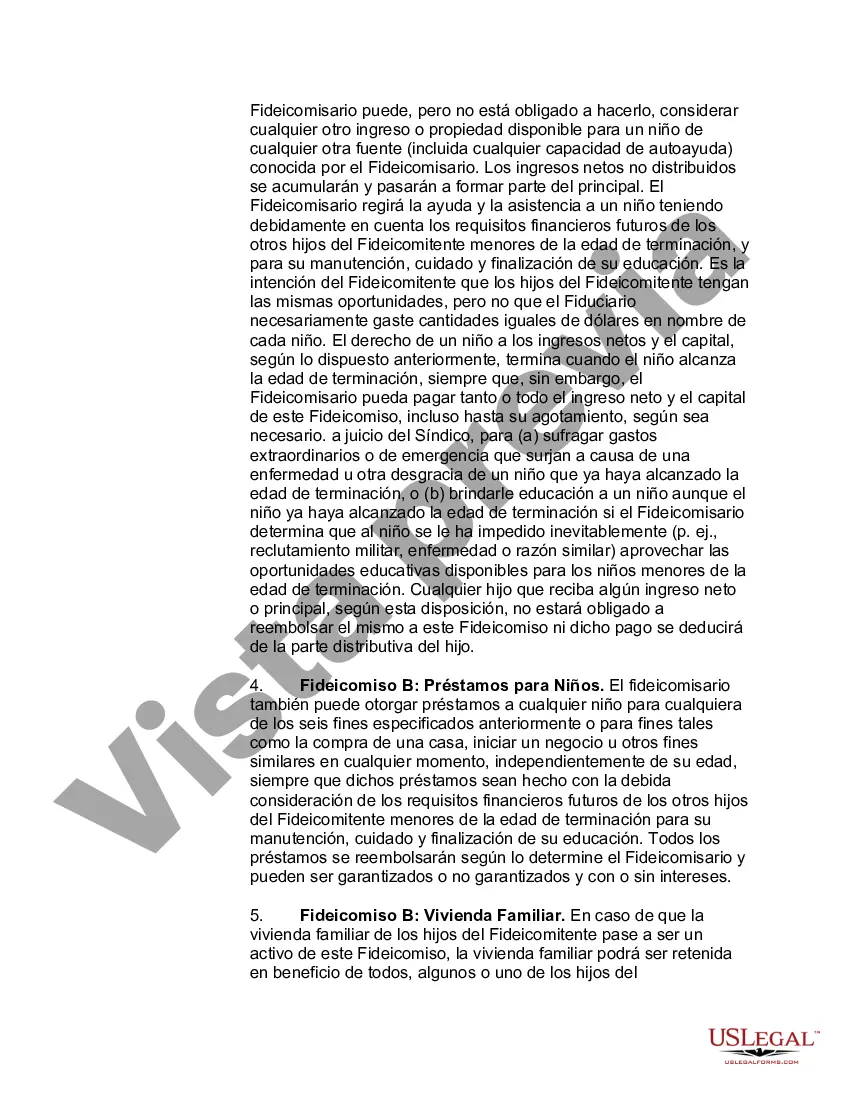

Fairfax Virginia Marital Deduction Trust — Trust A and Bypass Trust B are estate planning tools commonly used by married couples in the state of Virginia to ensure efficient management and distribution of their assets upon death. Trust A, also known as the Marital Deduction Trust, is designed to take advantage of the marital deduction for federal estate tax purposes. When the first spouse passes away, their assets are transferred into Trust A, which is created for the surviving spouse's benefit. The surviving spouse has access to income and principal of the trust during their lifetime. Upon the death of the surviving spouse, any remaining assets in Trust A are distributed to the named beneficiaries, typically the couple's children or other chosen heirs. Bypass Trust B, also known as the Credit Shelter Trust or the Family Trust, is created alongside Trust A and serves a different purpose. It is designed to maximize estate tax savings by utilizing the deceased spouse's federal estate tax exemption. When the first spouse passes away, a portion of their assets, up to the federal estate tax exemption amount, is transferred into Trust B. The surviving spouse may receive income from the trust, but the principal is generally preserved for the benefit of the couple's children or chosen beneficiaries. Because Trust B is funded up to the estate tax exemption, it effectively bypasses federal estate taxes. There may be variations or subtypes of Fairfax Virginia Marital Deduction Trusts depending on specific circumstances or individual needs. These trust variations could include: 1. Qualified Terminable Interest Property (TIP) Trust: This is a type of Trust A that is often used when a spouse wants to provide for their surviving spouse while ensuring the ultimate distribution of the assets to chosen beneficiaries. 2. Disclaimer Trust: This is a variation of Trust B that allows the surviving spouse to disclaim or refuse a portion of the deceased spouse's assets. This disclaimer can enable the assets to pass directly to the next generation or be allocated to another trust, reducing estate tax liability. 3. Irrevocable Life Insurance Trust (IIT): Although not directly a Fairfax Virginia Marital Deduction Trust, an IIT is often used in conjunction with Trust A and Trust B to remove life insurance proceeds from the taxable estate, providing liquidity for estate tax obligations. In summary, the Fairfax Virginia Marital Deduction Trust — Trust A and Bypass Trust B offer a structured approach to estate planning, ensuring efficient asset distribution while maximizing tax benefits for married couples in the state of Virginia. It is important to consult with an experienced attorney to determine the most suitable trust options based on individual circumstances and objectives.Fairfax Virginia Marital Deduction Trust — Trust A and Bypass Trust B are estate planning tools commonly used by married couples in the state of Virginia to ensure efficient management and distribution of their assets upon death. Trust A, also known as the Marital Deduction Trust, is designed to take advantage of the marital deduction for federal estate tax purposes. When the first spouse passes away, their assets are transferred into Trust A, which is created for the surviving spouse's benefit. The surviving spouse has access to income and principal of the trust during their lifetime. Upon the death of the surviving spouse, any remaining assets in Trust A are distributed to the named beneficiaries, typically the couple's children or other chosen heirs. Bypass Trust B, also known as the Credit Shelter Trust or the Family Trust, is created alongside Trust A and serves a different purpose. It is designed to maximize estate tax savings by utilizing the deceased spouse's federal estate tax exemption. When the first spouse passes away, a portion of their assets, up to the federal estate tax exemption amount, is transferred into Trust B. The surviving spouse may receive income from the trust, but the principal is generally preserved for the benefit of the couple's children or chosen beneficiaries. Because Trust B is funded up to the estate tax exemption, it effectively bypasses federal estate taxes. There may be variations or subtypes of Fairfax Virginia Marital Deduction Trusts depending on specific circumstances or individual needs. These trust variations could include: 1. Qualified Terminable Interest Property (TIP) Trust: This is a type of Trust A that is often used when a spouse wants to provide for their surviving spouse while ensuring the ultimate distribution of the assets to chosen beneficiaries. 2. Disclaimer Trust: This is a variation of Trust B that allows the surviving spouse to disclaim or refuse a portion of the deceased spouse's assets. This disclaimer can enable the assets to pass directly to the next generation or be allocated to another trust, reducing estate tax liability. 3. Irrevocable Life Insurance Trust (IIT): Although not directly a Fairfax Virginia Marital Deduction Trust, an IIT is often used in conjunction with Trust A and Trust B to remove life insurance proceeds from the taxable estate, providing liquidity for estate tax obligations. In summary, the Fairfax Virginia Marital Deduction Trust — Trust A and Bypass Trust B offer a structured approach to estate planning, ensuring efficient asset distribution while maximizing tax benefits for married couples in the state of Virginia. It is important to consult with an experienced attorney to determine the most suitable trust options based on individual circumstances and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.