An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

The Suffolk New York Marital Deduction Trust, also known as Trust A, and the Bypass Trust, also referred to as Trust B, are essential estate planning tools that offer various benefits and advantages for couples residing in Suffolk County, New York. Trust A, or the Marital Deduction Trust, is a type of irrevocable trust designed to take full advantage of the federal estate tax marital deduction. This trust allows one spouse (the settler) to transfer assets to the trust, ensuring that they are not included in their taxable estate upon death. The surviving spouse is typically the primary beneficiary of Trust A, with access to income or principal distributions, providing financial security while minimizing estate taxes. On the other hand, Trust B, also known as the Bypass Trust or Credit Shelter Trust, is another irrevocable trust set up by a married couple to maximize their estate tax exemptions. This trust holds assets up to the value of the federal estate tax exemption, which is currently over $11 million per individual as of 2021. By utilizing Trust B, the assets placed within the trust are shielded from estate taxes upon the death of the first spouse, passing on tax-free to the beneficiaries specified in the trust document. There are slight variations and alternative formats of these trusts that may be utilized depending on the specific needs of the individuals and their estate planning goals. Some examples include: 1. Qualified Terminable Interest Property (TIP) Trust: This trust combines elements of both Trust A and Trust B. It allows the first spouse to provide income for the surviving spouse while still maintaining control over how the assets will be distributed upon the second spouse's death. 2. Disclaimer Trust: In this type of bypass trust, the surviving spouse has the option to disclaim or refuse some or all of the assets within the trust. By doing so, the disclaimed portion can then pass to the next generation, potentially minimizing estate taxes for the overall family wealth. It is essential to consult with an experienced estate planning attorney or professional to determine the most suitable trust structure for your specific circumstances and to ensure compliance with the intricacies of Suffolk County, New York, and federal laws. Proper estate planning using Trust A and Trust B can provide spouses with myriad benefits, including reducing estate taxes, protecting assets, ensuring financial security for the surviving spouse, and facilitating efficient wealth transfer to future generations.The Suffolk New York Marital Deduction Trust, also known as Trust A, and the Bypass Trust, also referred to as Trust B, are essential estate planning tools that offer various benefits and advantages for couples residing in Suffolk County, New York. Trust A, or the Marital Deduction Trust, is a type of irrevocable trust designed to take full advantage of the federal estate tax marital deduction. This trust allows one spouse (the settler) to transfer assets to the trust, ensuring that they are not included in their taxable estate upon death. The surviving spouse is typically the primary beneficiary of Trust A, with access to income or principal distributions, providing financial security while minimizing estate taxes. On the other hand, Trust B, also known as the Bypass Trust or Credit Shelter Trust, is another irrevocable trust set up by a married couple to maximize their estate tax exemptions. This trust holds assets up to the value of the federal estate tax exemption, which is currently over $11 million per individual as of 2021. By utilizing Trust B, the assets placed within the trust are shielded from estate taxes upon the death of the first spouse, passing on tax-free to the beneficiaries specified in the trust document. There are slight variations and alternative formats of these trusts that may be utilized depending on the specific needs of the individuals and their estate planning goals. Some examples include: 1. Qualified Terminable Interest Property (TIP) Trust: This trust combines elements of both Trust A and Trust B. It allows the first spouse to provide income for the surviving spouse while still maintaining control over how the assets will be distributed upon the second spouse's death. 2. Disclaimer Trust: In this type of bypass trust, the surviving spouse has the option to disclaim or refuse some or all of the assets within the trust. By doing so, the disclaimed portion can then pass to the next generation, potentially minimizing estate taxes for the overall family wealth. It is essential to consult with an experienced estate planning attorney or professional to determine the most suitable trust structure for your specific circumstances and to ensure compliance with the intricacies of Suffolk County, New York, and federal laws. Proper estate planning using Trust A and Trust B can provide spouses with myriad benefits, including reducing estate taxes, protecting assets, ensuring financial security for the surviving spouse, and facilitating efficient wealth transfer to future generations.

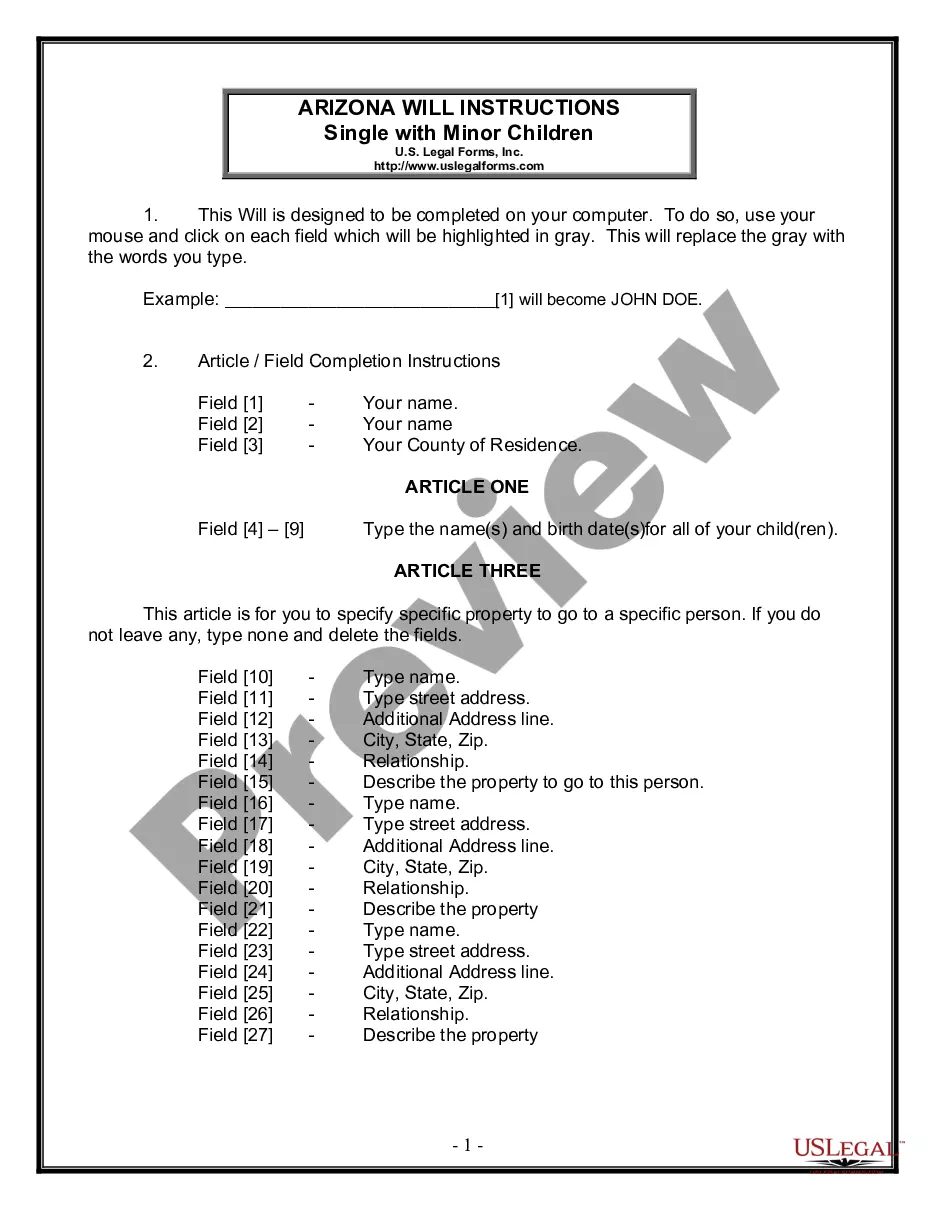

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.