Title: Chicago, Illinois Equity Share Agreement: An In-Depth Overview Introduction: The Chicago, Illinois Equity Share Agreement is a legally binding contract between multiple parties outlining the terms and conditions of a shared equity investment in a property or business located in the city of Chicago, Illinois. This agreement sets forth the responsibilities, rights, and obligations of each party involved, aiming to ensure a fair distribution of risks, returns, and decision-making authority. In the diverse economic landscape of Chicago, several types of Equity Share Agreements have been designed to cater to different investment needs and objectives. Let's explore these types in more detail: 1. Residential Property Equity Share Agreement: This agreement is commonly used when multiple individuals jointly invest to purchase residential property, such as a house or apartment. It specifies the percentage of ownership and outlines how the property will be managed, including responsibilities for repairs, maintenance, and renovations. Additionally, it delineates the distribution of rental income (if applicable) and establishes a framework for decision-making related to the property. 2. Commercial Property Equity Share Agreement: Primarily used for investing in commercial real estate, this agreement governs the joint ownership of properties such as office buildings, retail spaces, or warehouses. It delineates the proportionate investment by each party, outlines the distribution of rental income or profits generated from operations, and defines decision-making authority for property management and major financial decisions. It may also address lease agreements, tenant relations, and exit strategies. 3. Startup Equity Share Agreement: Targeted at the dynamic startup ecosystem in Chicago, this type of agreement allows individuals or entities to pool their resources in early-stage companies, sharing equity ownership. Startup Equity Share Agreements typically define investment amounts, equity percentages, vesting schedules, and voting rights. They may also include various provisions related to intellectual property ownership, non-compete agreements, anti-dilution mechanisms, and dispute resolution methods. 4. Equity Sharing in Joint Ventures: In the context of joint ventures between businesses or entities, this agreement facilitates collaboration and risk-sharing for specific projects in Chicago. Joint ventures can range from large infrastructure developments to joint marketing campaigns. Equity Share Agreements for joint ventures outline the allocation of equity stakes, the sharing of profits or losses, governance procedures, management responsibilities, and dispute resolution mechanisms. Conclusion: The Chicago, Illinois Equity Share Agreement encompasses various types, each tailored to specific investment scenarios. Whether investing in residential or commercial property, engaging in startups, or participating in joint ventures, these agreements provide a mechanism for multiple parties to share the risks, rewards, and decision-making associated with shared equity ownership. Binding the parties with legal enforceability, these agreements protect the interests of all involved and foster collaboration in Chicago's vibrant business and investment community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de acciones de capital - Equity Share Agreement

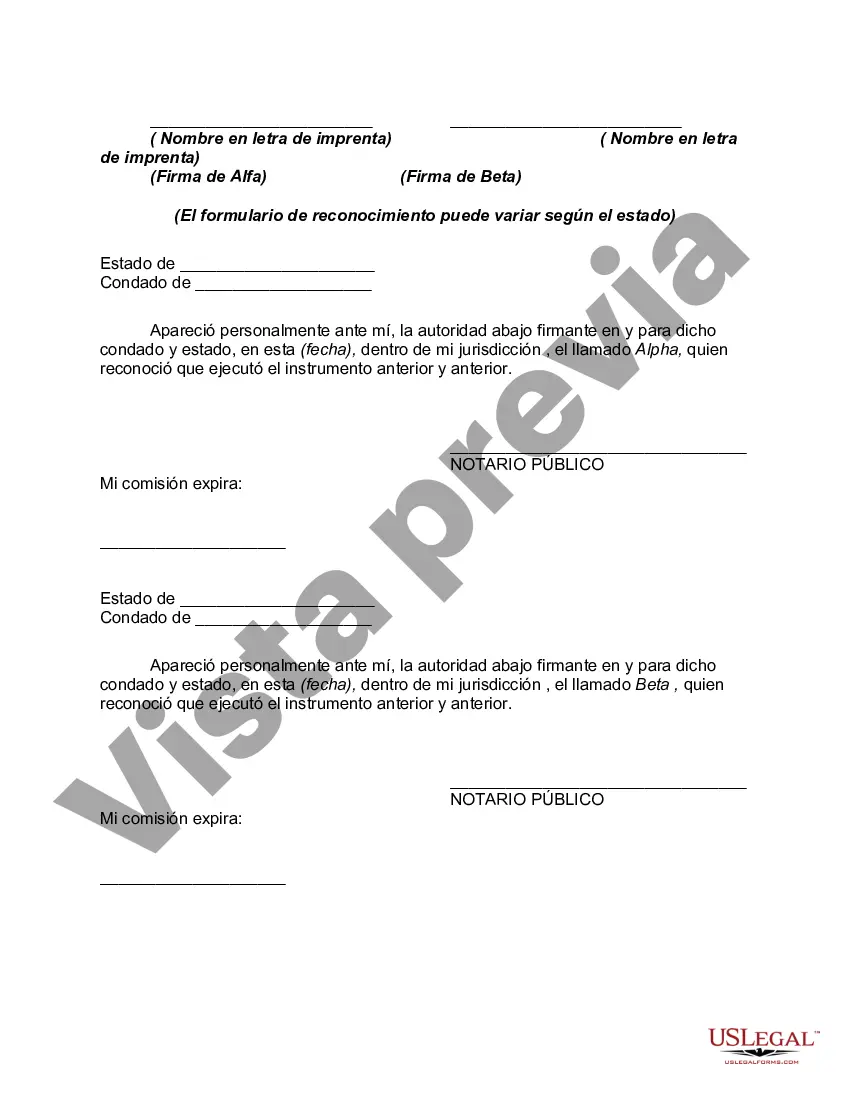

Description

How to fill out Chicago Illinois Acuerdo De Acciones De Capital?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life scenario, finding a Chicago Equity Share Agreement meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Chicago Equity Share Agreement, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Chicago Equity Share Agreement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Chicago Equity Share Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!