Harris Texas Equity Share Agreement is a legally binding contract that outlines the terms and conditions of the relationship between shareholders in Harris County, Texas. This agreement sets forth the ownership rights, duties, obligations, and responsibilities of the shareholders in a particular company or business venture. The Harris Texas Equity Share Agreement is designed to protect the interests of all parties involved in the ownership of the company. It ensures that each shareholder's rights are respected and that decisions regarding the company's operations are made in a fair and transparent manner. One type of Harris Texas Equity Share Agreement is a Common Equity Share Agreement. This agreement is used when all shareholders are entitled to the same rights and benefits, including voting rights and dividends. It establishes the rules for decision-making, such as the percentage of votes required for major decisions and the frequency of shareholder meetings. Another type of Equity Share Agreement is a Preferred Equity Share Agreement. This agreement is used when certain shareholders are given preferential treatment over others. Preferred shareholders may have priority in receiving dividends or liquidation proceeds, as well as other benefits such as voting rights or board representation. The Harris Texas Equity Share Agreement typically includes important clauses such as: 1. Equity Ownership: It specifies the proportion of shares held by each shareholder and any restrictions on transferability or sale of shares. 2. Voting Rights: It outlines the voting rights of each shareholder, including the percentage of votes required for certain decisions. 3. Dividends: It defines how dividends are to be distributed among the shareholders and whether preferred shareholders receive any preferential treatment. 4. Shareholder Meetings: It details the frequency and procedures for conducting shareholder meetings, including notification requirements and quorum. 5. Decision-Making: It establishes how major decisions are made, including the process for approving business strategies, investments, or mergers. 6. Dilution Protection: It may include provisions to protect shareholders from dilution of their ownership stake due to new share issuance or capital raises. 7. Dispute Resolution: It outlines the process for resolving disputes among shareholders, including mediation, arbitration, or court proceedings. It is essential for all parties involved to carefully review and negotiate the terms of the Harris Texas Equity Share Agreement to ensure their rights and interests are appropriately protected. Seeking legal counsel is highly recommended ensuring compliance with local laws and regulations.

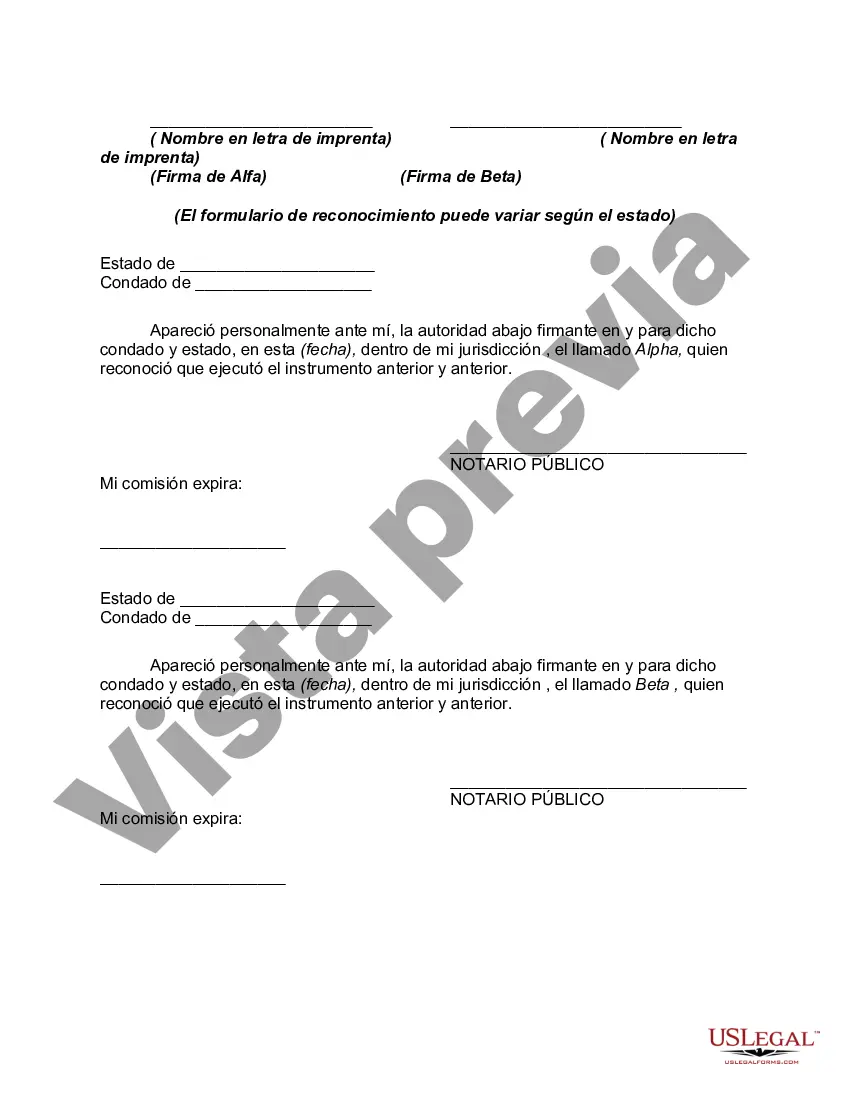

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de acciones de capital - Equity Share Agreement

Description

How to fill out Harris Texas Acuerdo De Acciones De Capital?

Creating paperwork, like Harris Equity Share Agreement, to take care of your legal affairs is a challenging and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms intended for a variety of cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Harris Equity Share Agreement template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Harris Equity Share Agreement:

- Make sure that your document is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Harris Equity Share Agreement isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!