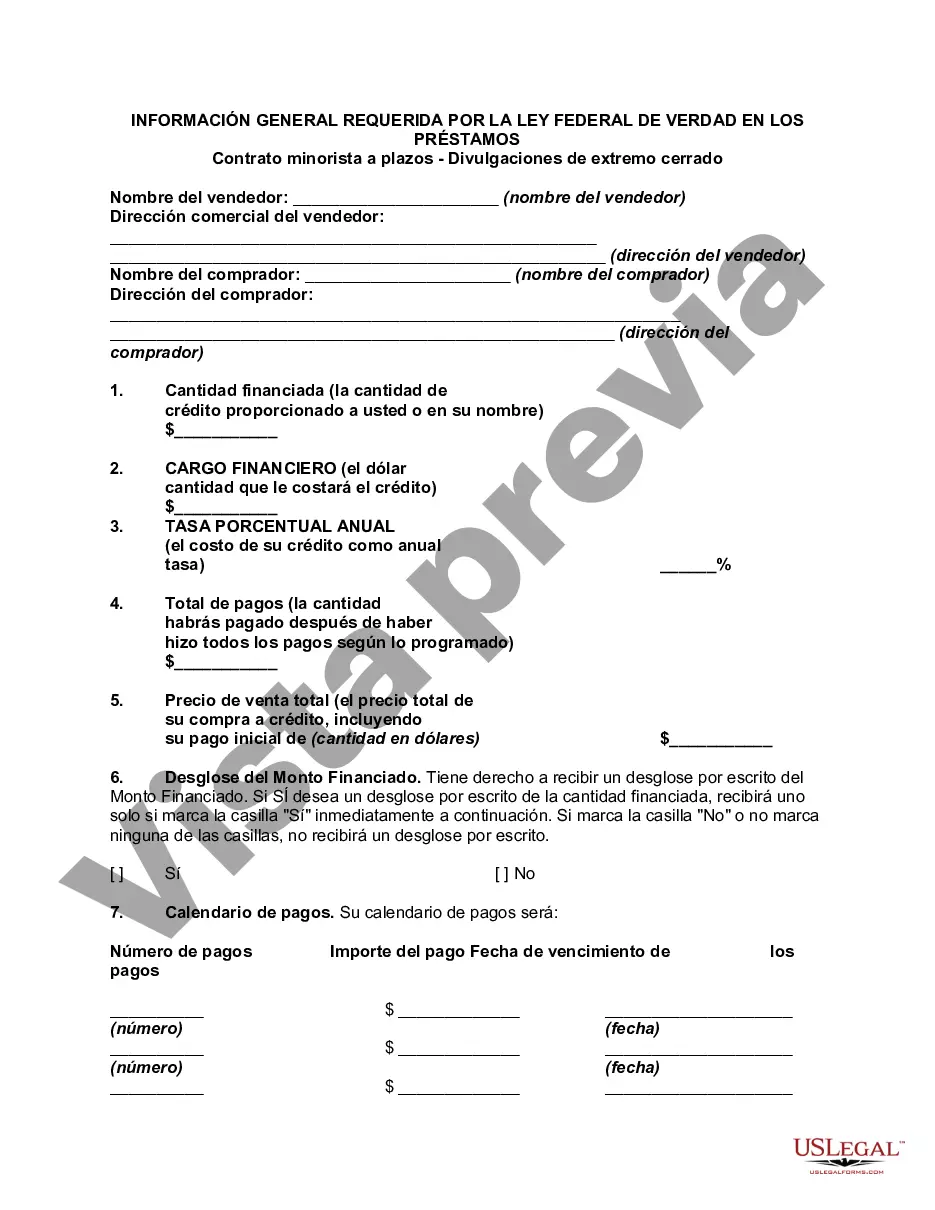

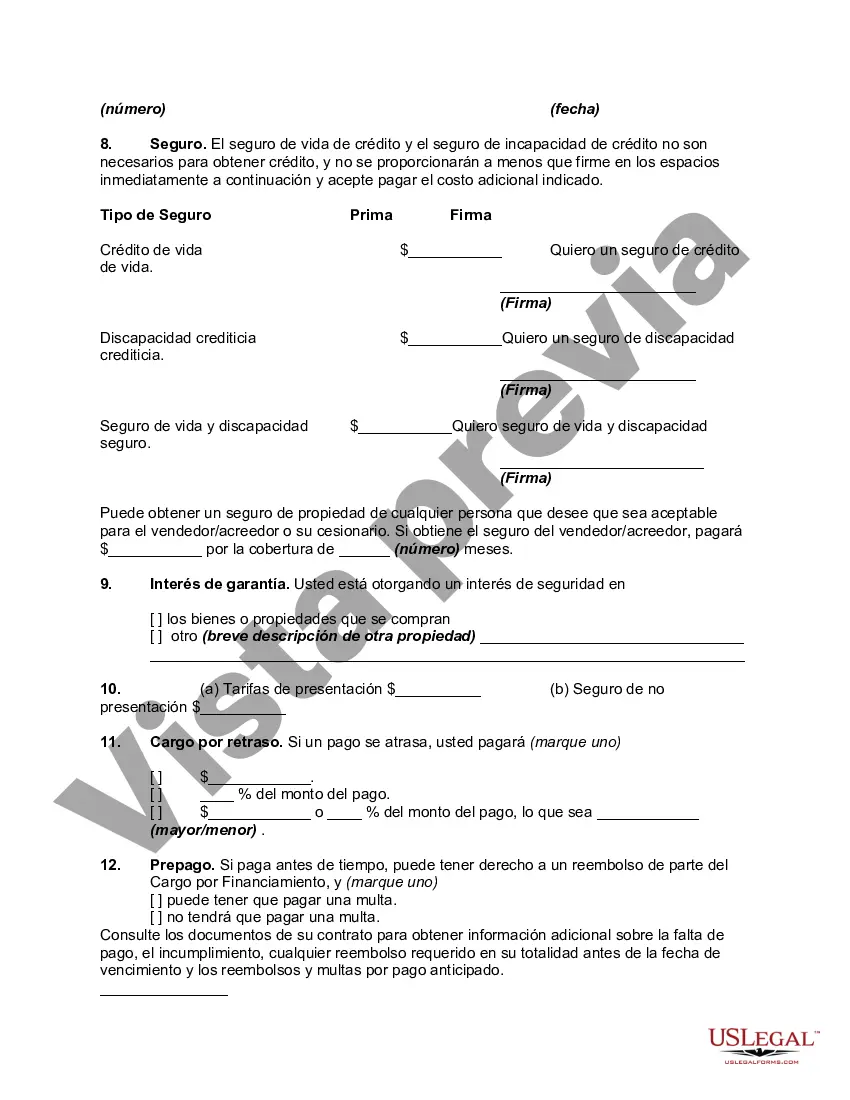

Broward County, Florida, located in the southeastern part of the state, is subject to the General Disclosures Required by the Federal Truth in Lending Act for retail installment contracts and closed-end credit transactions. These disclosures ensure transparency and provide consumers with crucial information related to borrowing money. Below is a detailed description of the required disclosures and the various types that may exist: 1. Annual Percentage Rate (APR): The APR represents the overall cost of credit on an annual basis, including interest rate and additional fees. This disclosure allows borrowers to compare different loan offers and understand the total cost of their borrowing. 2. Finance Charge: The finance charge encompasses all costs associated with acquiring credit, such as interest, fees, and any other charges applicable to the loan. It is important for borrowers to be aware of the total finance charge as it directly affects the overall cost of the loan. 3. Amount Financed: This disclosure reveals the actual amount borrowed by the consumer, excluding any upfront charges or interest. It helps borrowers understand the precise amount they will receive and subsequently be obligated to repay. 4. Total of Payments: The total of payments reflects the sum of all payments the borrower will make over the loan term, including both principal and interest. This disclosure allows individuals to gauge the true cost of the loan and plan accordingly. 5. Payment Schedule: The payment schedule illustrates the frequency, amount, and duration of each payment. It provides the borrower with a clear understanding of their payment obligations and assists in budgeting and financial planning. 6. Prepayment Penalties: If applicable, prepayment penalties must be disclosed to borrowers. These penalties are charges imposed when borrowers pay off their loans before the predetermined term. Knowing if prepayment penalties exist allows borrowers to make informed decisions about possible early repayment. 7. Late Payment Fees: The disclosure of late payment fees informs borrowers of any charges they may incur for missing or delaying payments. It allows individuals to understand the potential consequences of not meeting payment obligations and encourages timely repayments. 8. Other Charges: This disclosure includes any additional fees or charges associated with the loan that are not already considered part of the finance charge. It helps borrowers understand if there are any extra costs they may encounter throughout the loan term. 9. Right of Rescission: In certain cases, there may be a right of rescission, allowing borrowers to cancel a loan within a specific period after signing the contract. If this right exists, it must be clearly disclosed to borrowers. These are the primary general disclosures required by the Federal Truth in Lending Act for retail installment contracts and closed-end credit transactions in Broward County, Florida. It is critical for consumers to review and understand these disclosures to make informed financial decisions and prevent potential pitfalls associated with borrowing money.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Broward Florida Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Broward General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to get the Broward General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Broward General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!