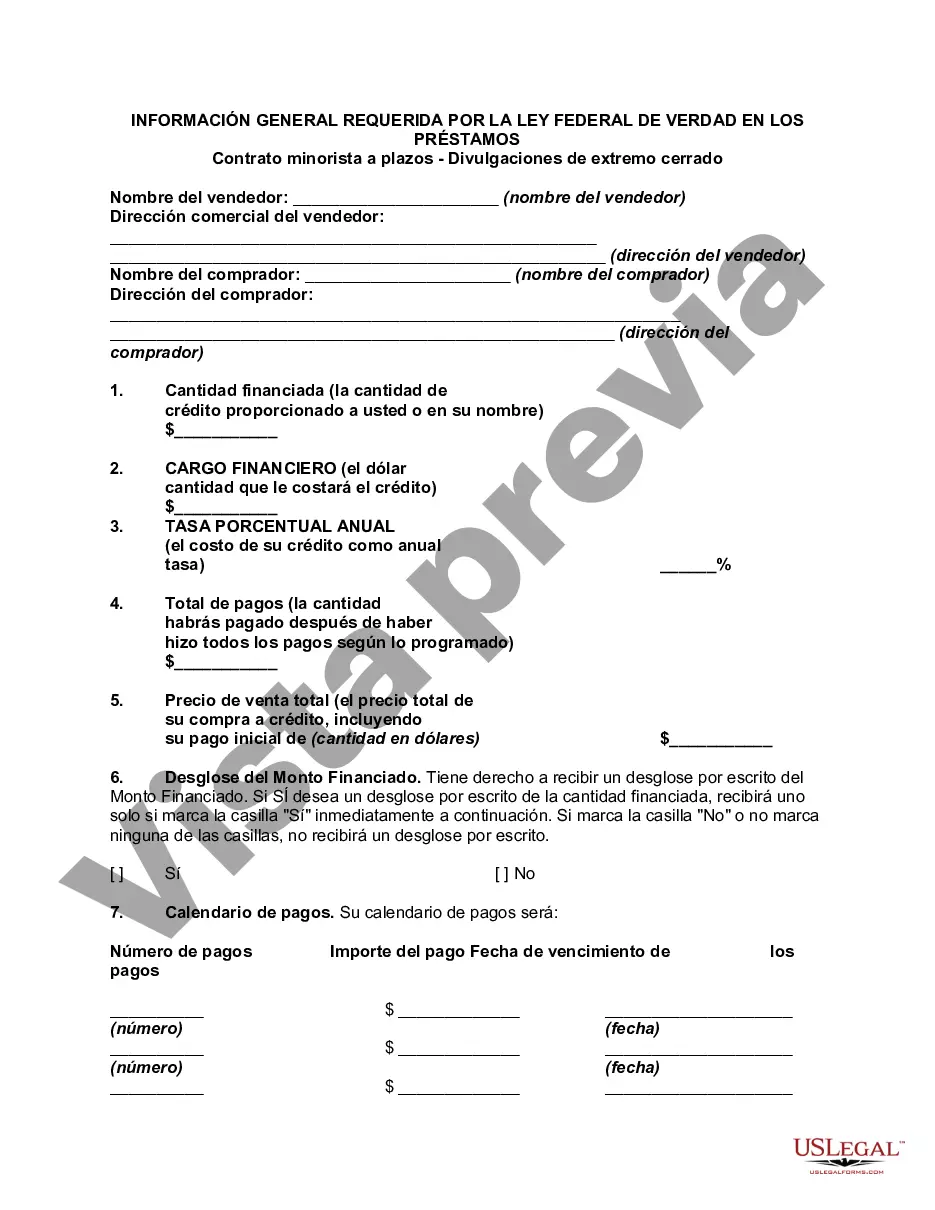

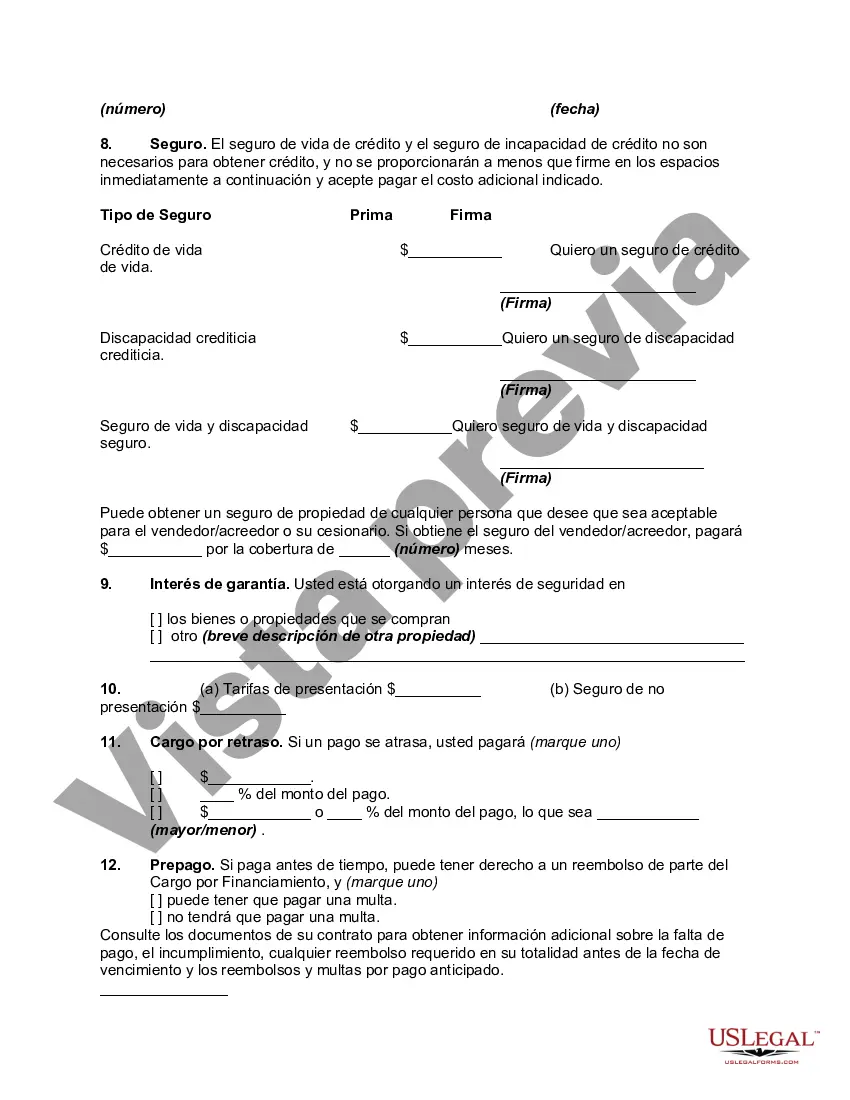

Collin, Texas is a rapidly growing city located in Collin County, Texas. It is known for its suburban charm and proximity to the bustling city of Dallas. As such, the residents of Collin, Texas often engage in various financial transactions, including retail installment contracts for purchasing goods or services. These transactions are subject to the General Disclosures Required By The Federal Truth In Lending Act, specifically pertaining to the Retail Installment Contract — Closed End Disclosures. Under the Federal Truth In Lending Act, certain information must be disclosed to consumers in Collin, Texas who enter into retail installment contracts. These disclosures aim to promote transparency and protect consumers by providing them with clear and accurate information about the terms and conditions of their financial obligations. The General Disclosures Required By The Federal Truth In Lending Act include several key components: 1. Annual Percentage Rate (APR): This disclosure represents the yearly cost of credit expressed as a percentage, including both the interest rate and any additional fees or charges associated with the loan. 2. Finance Charge: This disclosure outlines the total dollar amount a consumer will pay in interest and other financing costs over the life of the contract. 3. Amount Financed: This disclosure specifies the total amount of credit extended to the consumer, excluding any finance charges. 4. Total Payments: This disclosure indicates the total amount the consumer will repay over the term of the contract, including both the principal amount and the finance charges. 5. Payment Schedule: This disclosure provides a breakdown of the number, frequency, and amount of payments that the consumer is required to make over the duration of the contract. 6. Prepayment Penalty: If applicable, this disclosure states whether there are any penalties for early repayment of the loan and the specific terms of such penalties. It is important to note that the General Disclosures Required By The Federal Truth In Lending Act can vary depending on the specific nature of the retail installment contract. Different types of Collin, Texas General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures may include disclosures specific to auto loans, mortgage loans, personal loans, or other types of consumer financing. In each case, the disclosures aim to provide consumers with a clear understanding of the terms and costs associated with their specific loan agreement. In conclusion, Collin, Texas residents engaging in retail installment contracts must be aware of the General Disclosures Required By The Federal Truth In Lending Act. These disclosures encompass key information regarding the cost of credit, payment schedules, and potential penalties. By understanding and reviewing these disclosures, consumers can make informed decisions about their financial obligations and protect themselves from unfair practices in the lending industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Collin Texas Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Do you need to quickly create a legally-binding Collin General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures or probably any other document to manage your own or business matters? You can select one of the two options: contact a professional to draft a valid document for you or create it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Collin General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, double-check if the Collin General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search again if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Collin General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!