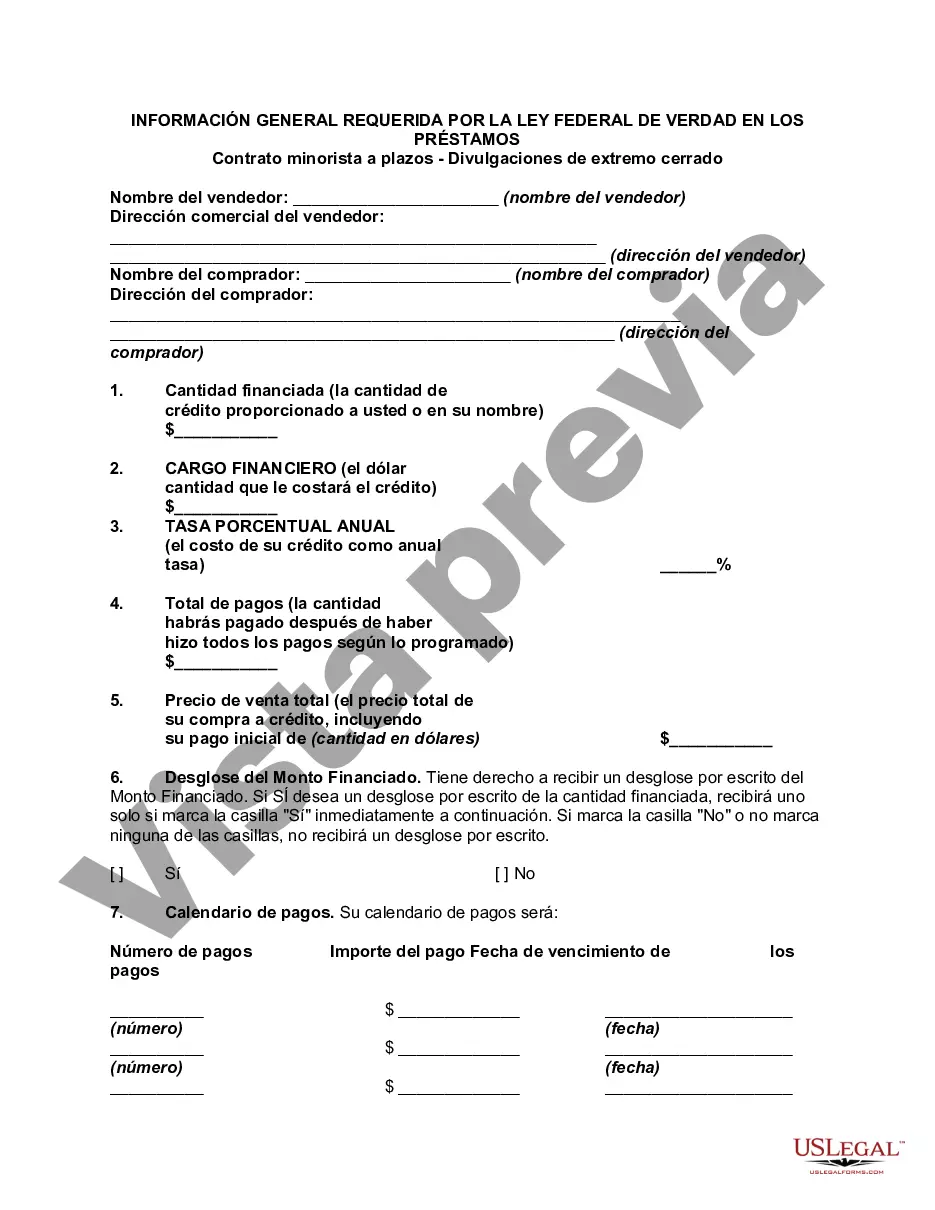

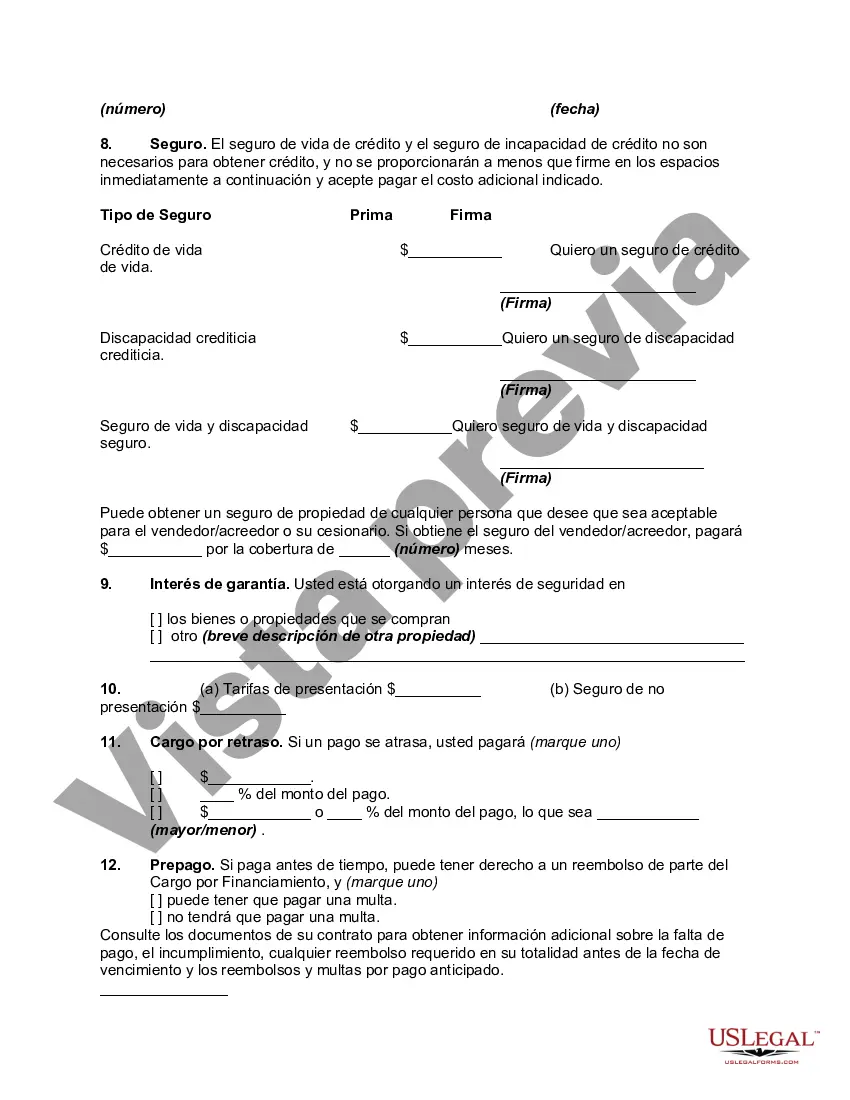

Cuyahoga County, Ohio, is located in the northeastern part of the state and is the most populous county in Ohio. As part of the county's consumer protection measures, there are certain general disclosures required by the Federal Truth in Lending Act (TILL) that apply to retail installment contracts and closed-end transactions. The Federal Truth in Lending Act is a federal law that aims to promote the informed use of consumer credit by requiring lenders to provide borrowers with clear and accurate information about the terms and costs of credit transactions. These disclosures are intended to enable consumers to compare various loan offers and make informed decisions about borrowing money. For retail installment contracts and closed-end transactions in Cuyahoga County, Ohio, the following general disclosures are required under TILL: 1. Annual Percentage Rate (APR): The APR is a key disclosure that reflects the cost of credit on an annual basis, including both interest charges and any applicable fees. It is expressed as a percentage and allows borrowers to compare the costs of different credit offers. 2. Finance Charges: The finance charge is the total cost of credit expressed in dollars. It includes any interest charges as well as certain other fees or charges associated with the loan. 3. Amount Financed: This disclosure indicates the actual amount of money that the borrower will receive from the loan. It excludes any finance charges or upfront fees that are deducted from the loan proceeds. 4. Total of Payments: This disclosure provides the total amount that the borrower will have paid over the life of the loan, including both the principal amount borrowed and the finance charges. 5. Payment Schedule: Lenders are required to provide a payment schedule that outlines the number of payments, the amount due for each payment, and the due dates. Additionally, it's important to note that there may be specific variations or additional disclosures required for certain types of loans or transactions in Cuyahoga County, Ohio. Some examples include: 1. Mortgage Loans: Mortgage loans generally have additional disclosure requirements, such as the Total Interest Percentage (TIP) disclosure, which shows the total amount of interest paid over the loan term as a percentage of the loan amount. 2. Auto Loans: For auto loans, lenders may be required to provide disclosures related to vehicle-specific terms, such as the vehicle identification number (VIN), make and model, and any warranties or insurance coverage included in the loan. 3. Credit Cards: Credit card disclosures may include information on the card's annual fee, grace period, penalty fees, and the method of calculating finance charges. In conclusion, Cuyahoga County, Ohio, adheres to the general disclosure requirements mandated by the Federal Truth in Lending Act for retail installment contracts and closed-end transactions. These disclosures provide consumers with important information about the costs and terms of credit, helping them to make informed decisions when borrowing money.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Cuyahoga Ohio Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business objective utilized in your region, including the Cuyahoga General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Cuyahoga General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Cuyahoga General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Cuyahoga General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!