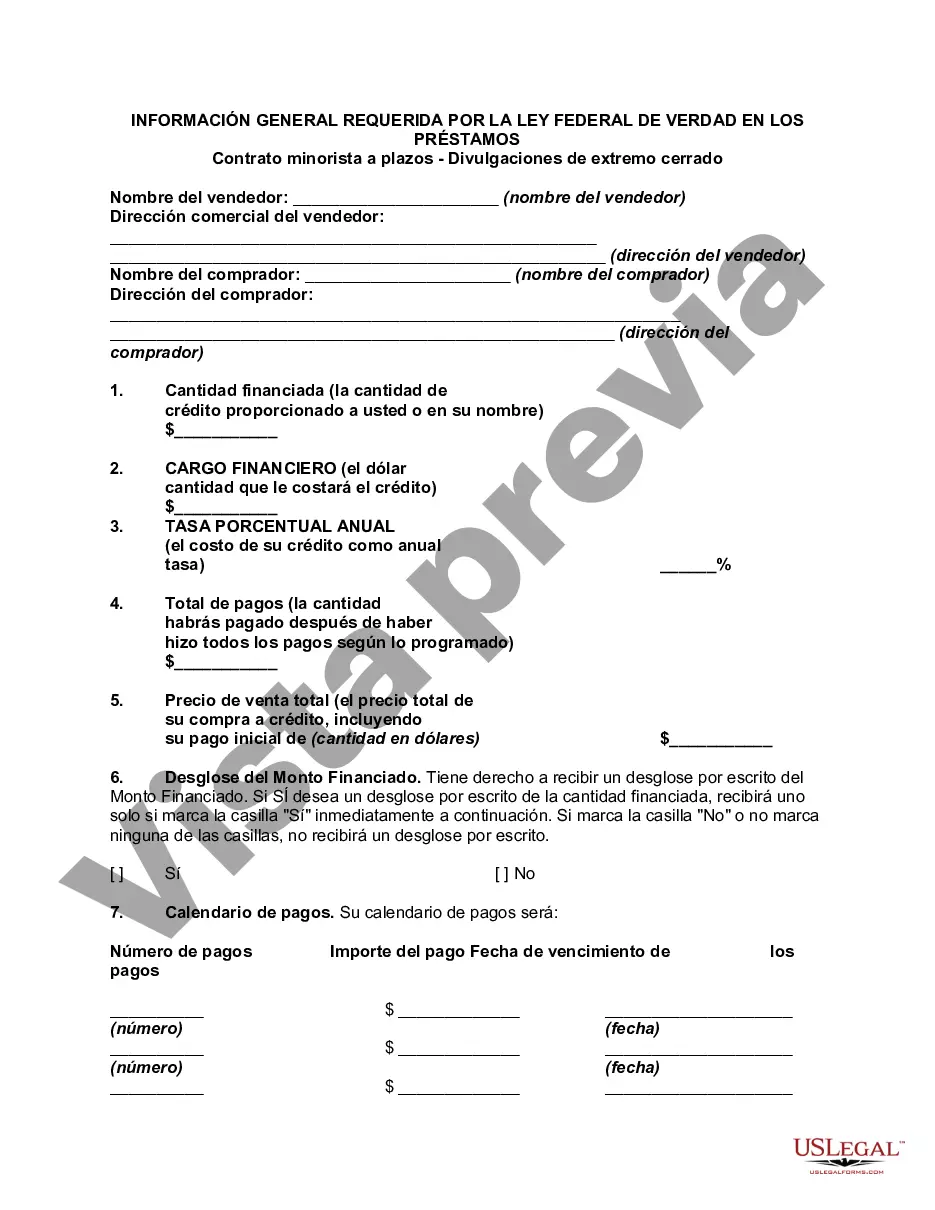

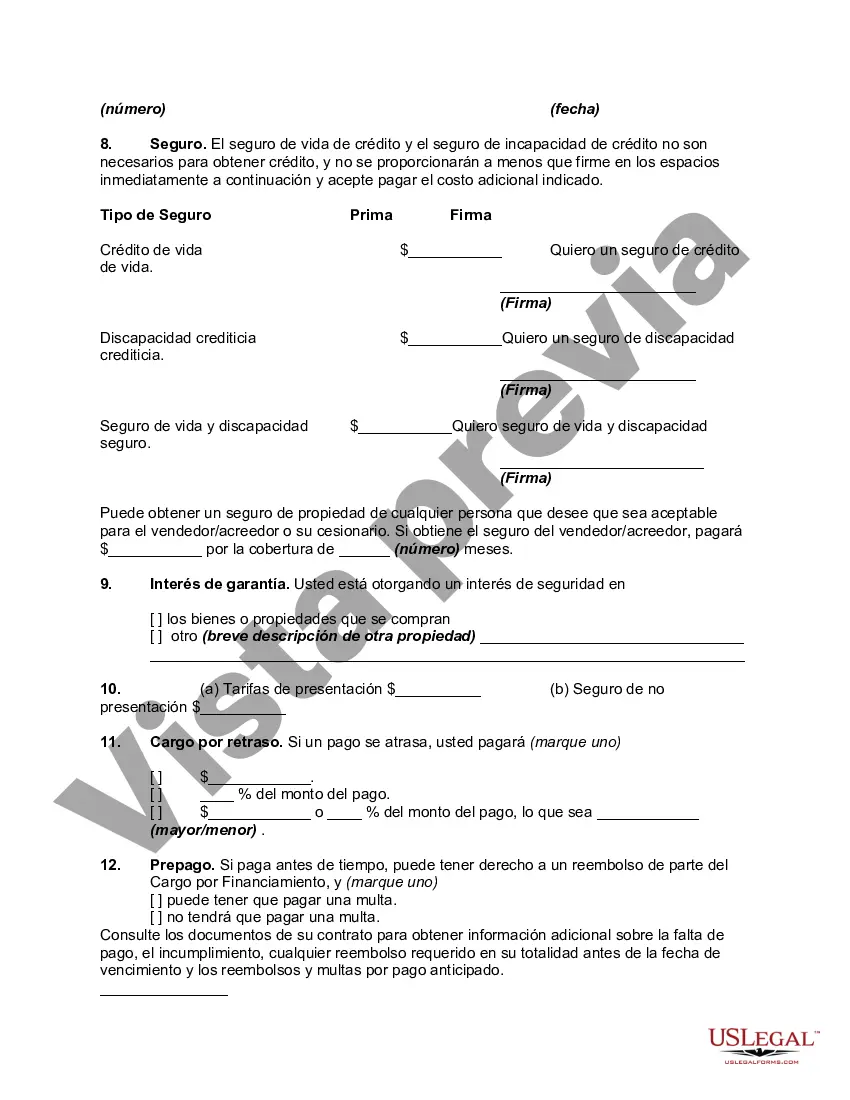

Dallas, Texas is a vibrant city located in the northeastern part of the state. Known for its rich history, diverse culture, and booming economy, Dallas has become a popular destination for residents and tourists alike. Within the realm of financial transactions, Dallas Texas General Disclosures Required By The Federal Truth In Lending Act (TILL) — Retail InstallmenContractac— - Closed End Disclosures are an important aspect that individuals and businesses should be familiar with. These disclosures are designed to ensure transparency and protect consumers when entering into retail installment contracts. The Federal Truth In Lending Act (TILL) is a federal law enacted to promote the informed use of credit by requiring full disclosure of credit terms. In the context of Dallas, Texas, this act specifically regulates the disclosure requirements for retail installment contracts, which are agreements to pay for goods or services in multiple installments over time. The General Disclosures required by TILL include various key elements that must be disclosed to the consumer in a clear and concise manner. These include the annual percentage rate (APR), the finance charge, the total amount financed, the total payments, the number and amount of payments, and any applicable late payment fees or prepayment penalties. In addition to the general disclosures, there may be specific types of disclosures required under the Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures for certain situations or transactions. These could include disclosures for loans that exceed a certain amount, disclosure of insurance premiums if required by the lender, disclosures for loans with adjustable interest rates, or disclosures for loans with balloon payments. It is important for both lenders and consumers in Dallas, Texas to understand these disclosure requirements to ensure compliance with federal law and to make informed financial decisions. By providing clear and comprehensive disclosures, lenders can promote trust and transparency in their transactions, while consumers can make well-informed choices based on accurate and complete information. In summary, Dallas, Texas General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures play a crucial role in ensuring transparency and protecting consumers in financial transactions. These disclosures encompass various key elements such as APR, finance charges, total payments, and payment terms. Different types of disclosures may be required for specific situations or transactions. Understanding and adhering to these requirements is essential for both lenders and consumers in Dallas, Texas to navigate the realm of retail installment contracts effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Dallas Texas Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

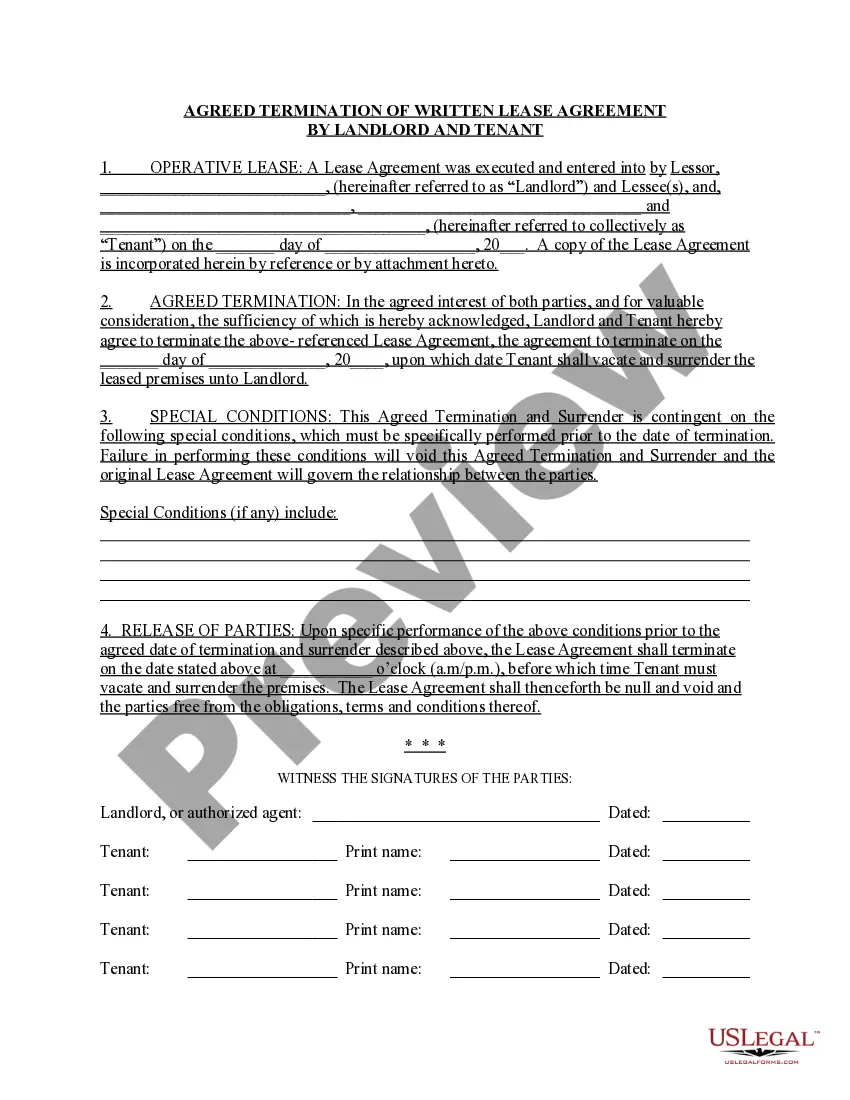

Preparing documents for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Dallas General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Dallas General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Dallas General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!