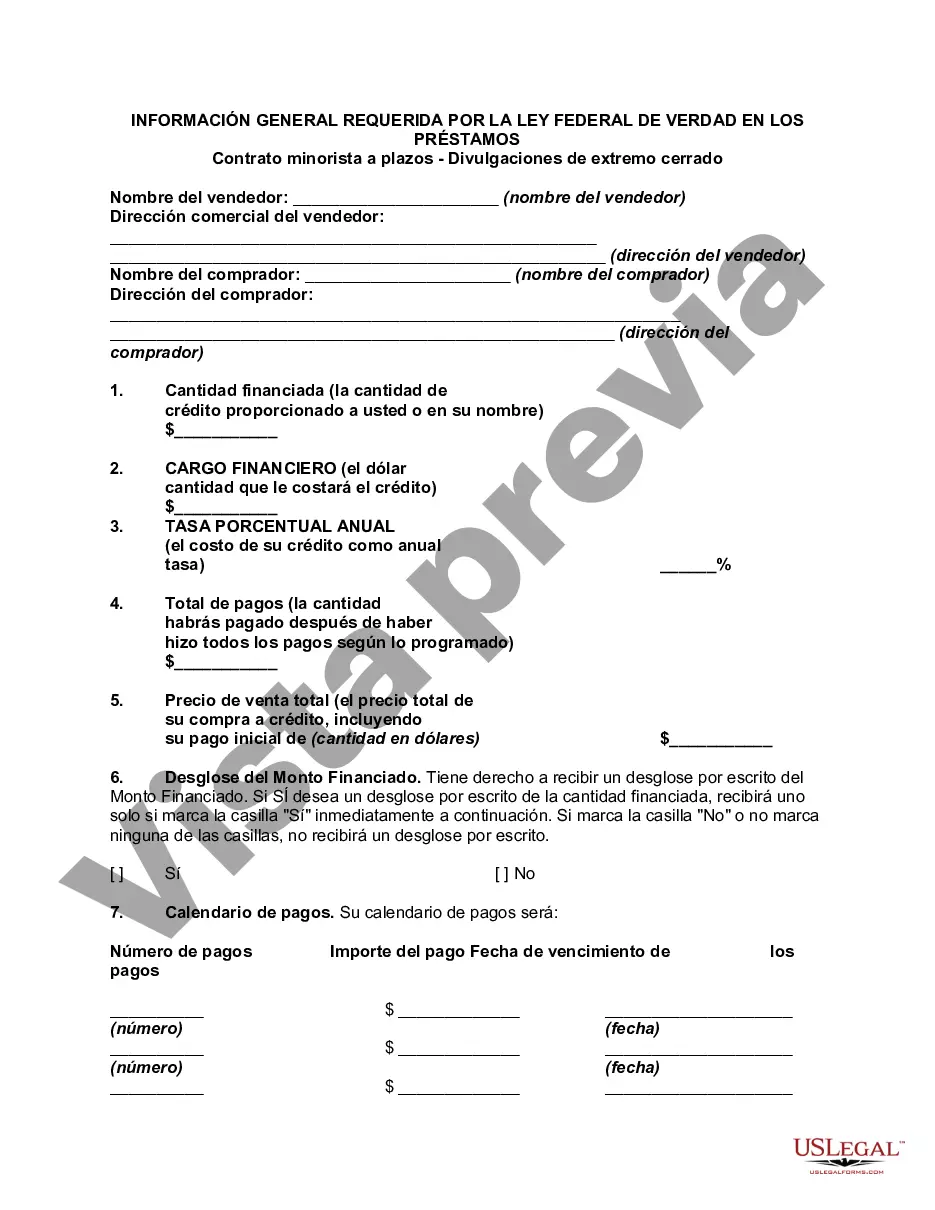

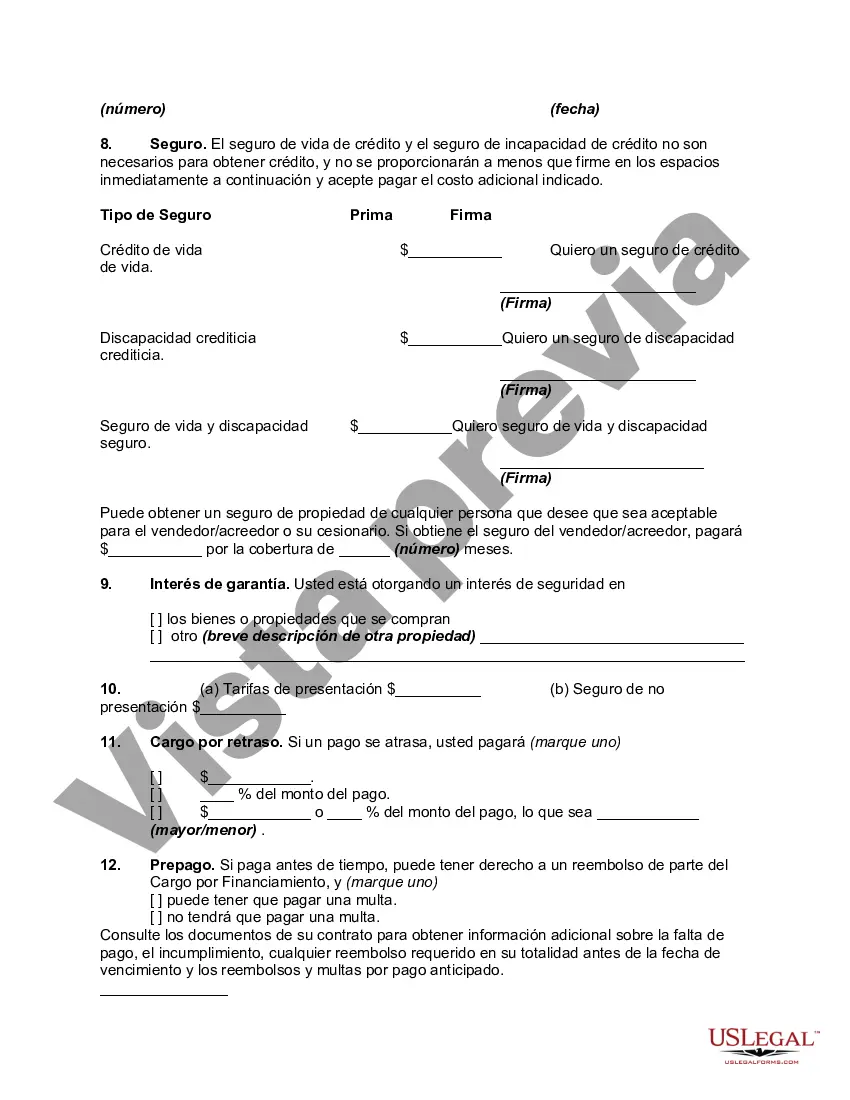

Fairfax, Virginia is a vibrant and historic city located in the northern region of the state. As a part of the United States, Fairfax is subject to various federal laws and regulations, including the Federal Truth in Lending Act (TILL). TILL regulates lending and credit practices ensuring transparency and protect consumers. Under TILL, certain general disclosures are required in retail installment contracts for closed-end credit in Fairfax, Virginia. These disclosures aim to inform borrowers about key terms and conditions of their loans or credit agreements. One important disclosure required by TILL is the Annual Percentage Rate (APR). The APR represents the cost of credit as an annual rate and includes both the interest rate and other applicable fees or charges. By providing the APR, lenders in Fairfax must disclose the true cost of credit to borrowers, allowing them to effectively compare different loan or credit offers. Another key disclosure mandated by TILL is the finance charge. This is the total dollar amount that the borrower will pay as a result of obtaining credit. It includes all interest charges, fees, and any other costs associated with the credit agreement. By disclosing the finance charge, lenders help borrowers understand the total cost of their credit, beyond just the principal amount borrowed. In addition to these general disclosures, Fairfax, Virginia, also requires other specific disclosures under TILL. These may include the amount financed, which is the total amount the borrower will receive as credit, and the total of payments, which represents the sum of all installments or payments required by the credit agreement. Other details, such as the number of payments, due dates, and late payment fees, may also be required to be disclosed in the agreement. It is worth noting that while these general disclosures are required under TILL, the specific requirements and format may vary depending on the type of credit transaction. For example, home mortgage loans have additional specific provisions and disclosures compared to other types of loans. In summary, Fairfax, Virginia adheres to the General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures. By providing these disclosures, lenders ensure that borrowers in Fairfax have access to important information about the terms, costs, and conditions of their credit agreements, promoting fair and transparent lending practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Fairfax Virginia Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Whether you intend to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Fairfax General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Fairfax General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Fairfax General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!