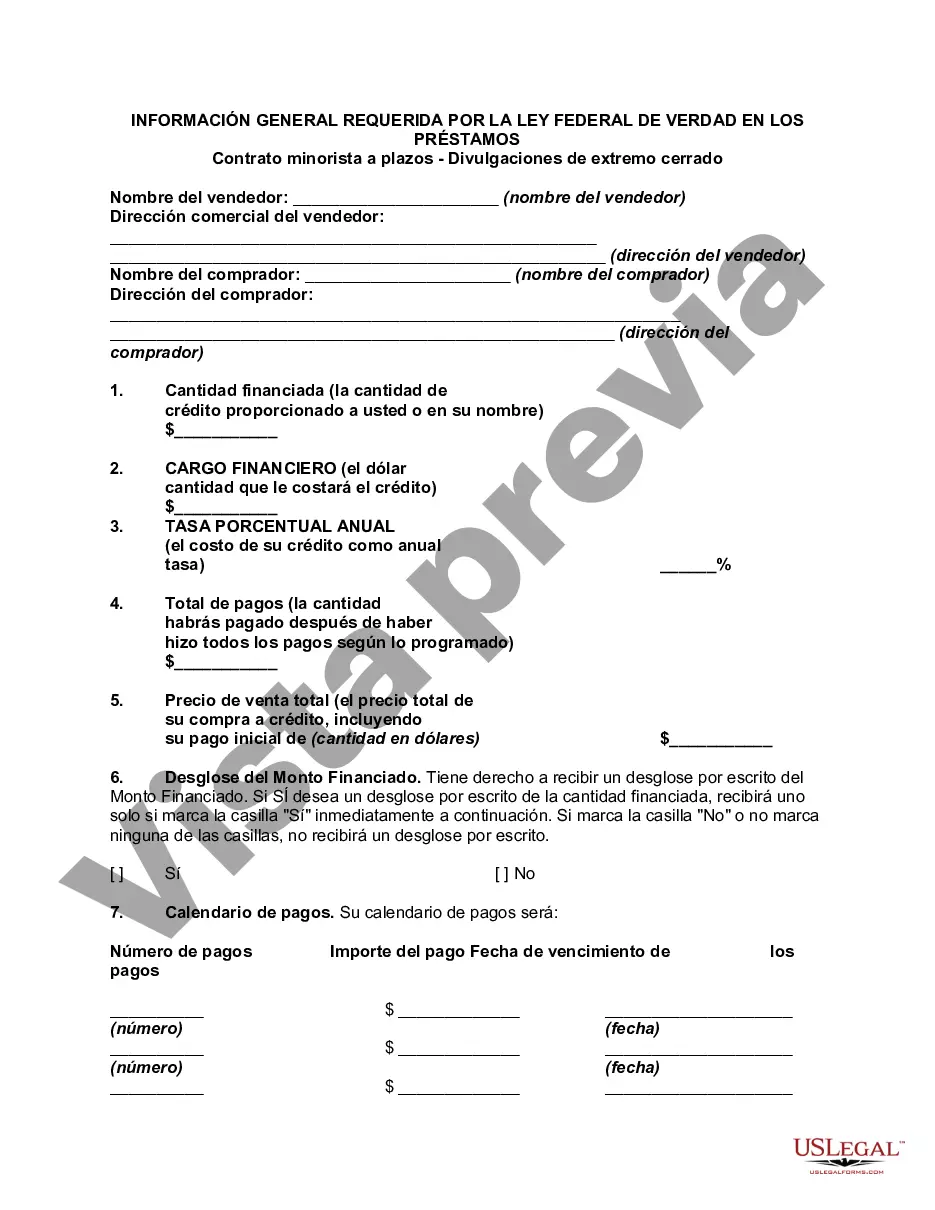

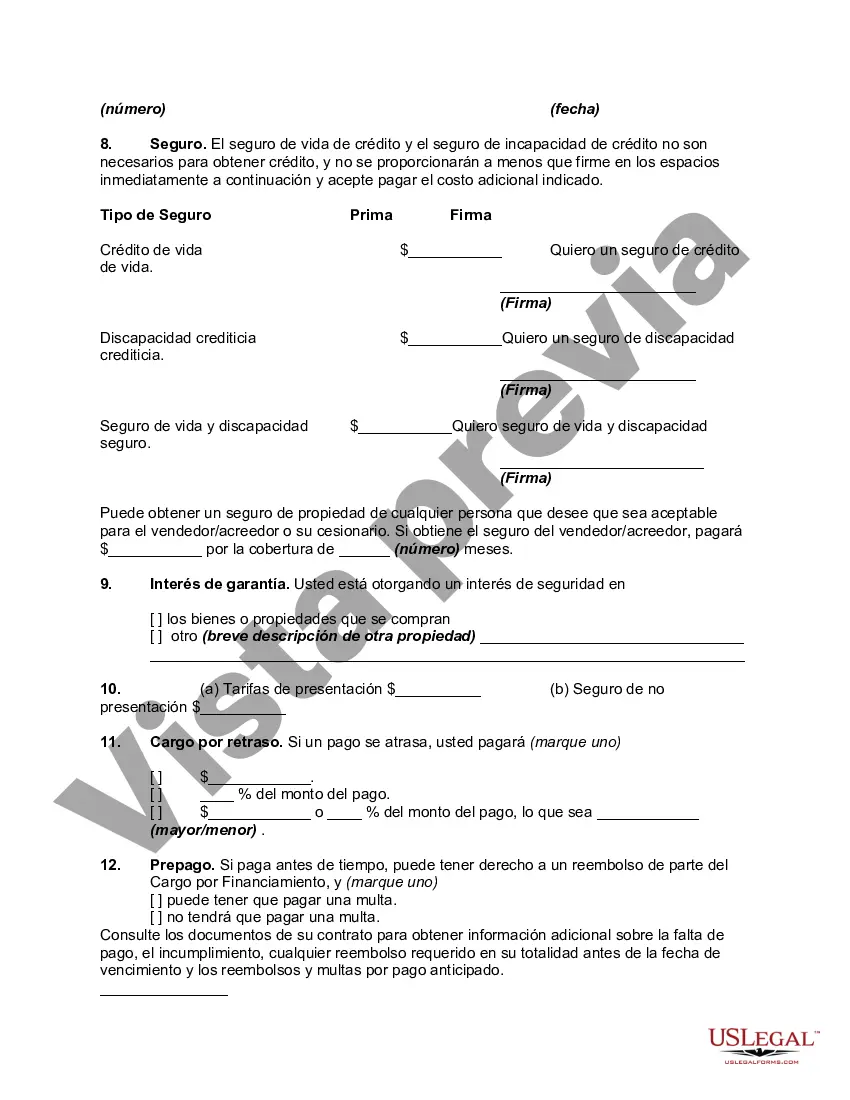

Fulton Georgia is a county located in the state of Georgia, United States. It is home to numerous communities, including various cities and towns, such as Atlanta, Sandy Springs, and Roswell. Within Fulton County, there are specific regulations and requirements that must be followed regarding consumer financial transactions, particularly in relation to the Federal Truth In Lending Act (TILL). Under the TILL, there are general disclosures that are mandatory for retail installment contracts in the closed end category. These disclosures aim to provide consumers with clear and transparent information about the terms and costs associated with their credit agreements. Compliance with these disclosures is crucial for lenders, retailers, and other parties involved in these transactions. The general disclosures required by the Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures in Fulton Georgia may include: 1. Annual Percentage Rate (APR): This is a comprehensive disclosure that represents the cost of credit expressed as a yearly rate. The APR encompasses both the interest rate and other additional fees, allowing consumers to compare different loan options accurately. 2. Finance Charge: The finance charge is the total cost of credit, including both interest and any additional fees associated with the loan. It is expressed in dollars and cents, providing a clear understanding of the overall costs to borrowers. 3. Amount Financed: This disclosure states the total amount of credit provided to the consumer, excluding any prepaid finance charges. The amount financed reflects the initial loan amount and allows borrowers to understand how much they are borrowing. 4. Total Payments: This disclosure indicates the total amount to be repaid over the loan term, including both principal and interest. It provides borrowers with a comprehensive view of their financial obligations throughout the duration of the loan. 5. Payment Schedule: The payment schedule outlines the number of payments required, the due dates, and the amount due for each payment. This disclosure ensures that borrowers are aware of their repayment obligations and can plan their finances accordingly. Other types of Fulton Georgia General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures may include additional information specific to certain types of loans, such as car loans or mortgages. However, the general disclosures mentioned above are applicable to most closed-end retail installment contracts. Compliance with these disclosures is essential to protect consumers from deceptive practices and ensure transparency in lending transactions. Both lenders and borrowers should be familiar with these requirements to ensure a fair and informed credit agreement. Consulting a legal professional or referring to the official TILL guidelines is recommended for accurate and up-to-date information on the specific requirements in Fulton Georgia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Fulton Georgia Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Fulton General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Fulton General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Fulton General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Fulton General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!