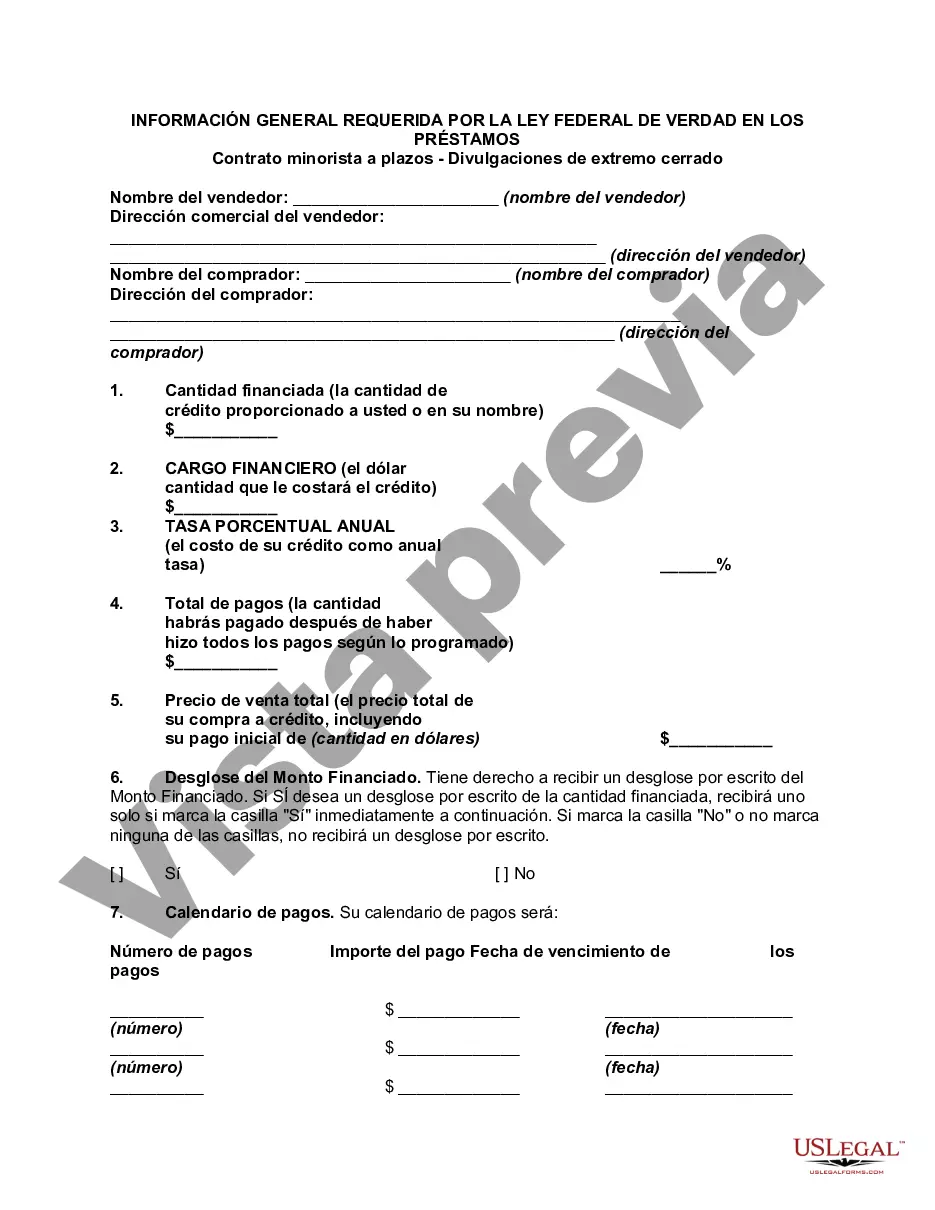

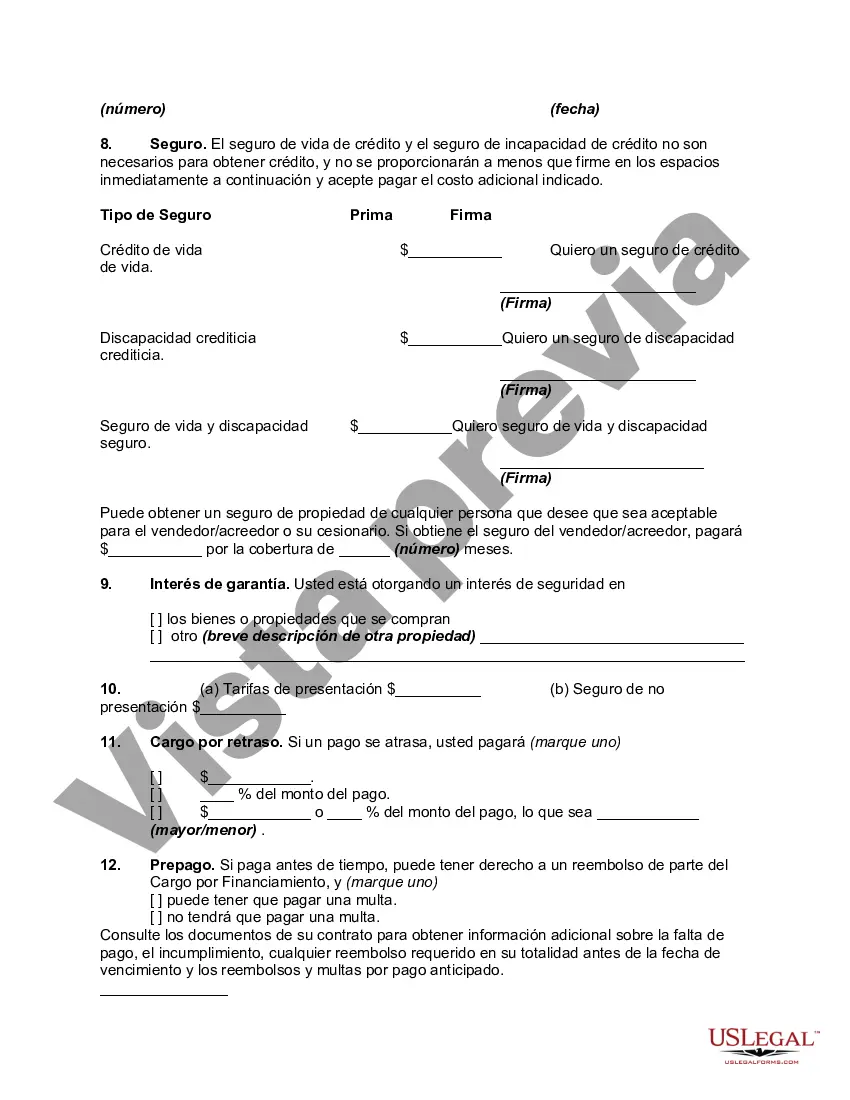

Harris, Texas General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures refer to the legal requirements that lenders must adhere to when providing installment contracts in Harris County, Texas. These disclosures ensure that borrowers are fully informed about the terms and costs associated with their loan. Here are some important aspects to consider: 1. Annual Percentage Rate (APR): One of the primary disclosures mandated by the Truth in Lending Act is the APR. This is the total cost of credit expressed as an annual percentage rate, which includes not only the interest rate but also other fees and charges associated with the loan. 2. Finance Charges: Lenders must disclose the total finance charges applicable to the loan. This includes interest charges, origination fees, prepaid interest, and any other fees imposed by the lender. 3. Amount Financed: The disclosure should clearly state the total amount of money that the borrower will receive from the loan, or the credit extended to them. 4. Total Payments: This disclosure outlines the total amount the borrower will repay over the life of the loan, including both principal and interest payments. 5. Payment Schedule: The lender is required to provide a detailed payment schedule, specifying the number of payments, the due dates, and the amount due for each payment. 6. Prepayment Penalty: If the loan includes a prepayment penalty, it must be disclosed in the contract. This clause imposes a fee if the borrower pays off the loan early. 7. Late Payment Penalties: The contract should include information about any penalties or fees that apply if the borrower fails to make timely payments. 8. Security Interest: If the loan is secured by collateral, such as a car or property, the contract should clearly state the property being used as security. While the essential elements of the disclosures listed above are generally required in all retail installment contracts, variations might exist based on specific state laws and regulations. Therefore, it's important to consult with legal professionals or review the applicable laws in Harris County, Texas, for precise and up-to-date information about the exact requirements and disclosures necessary for closed-end contracts in that jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Harris Texas Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Harris General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Harris General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Harris General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!