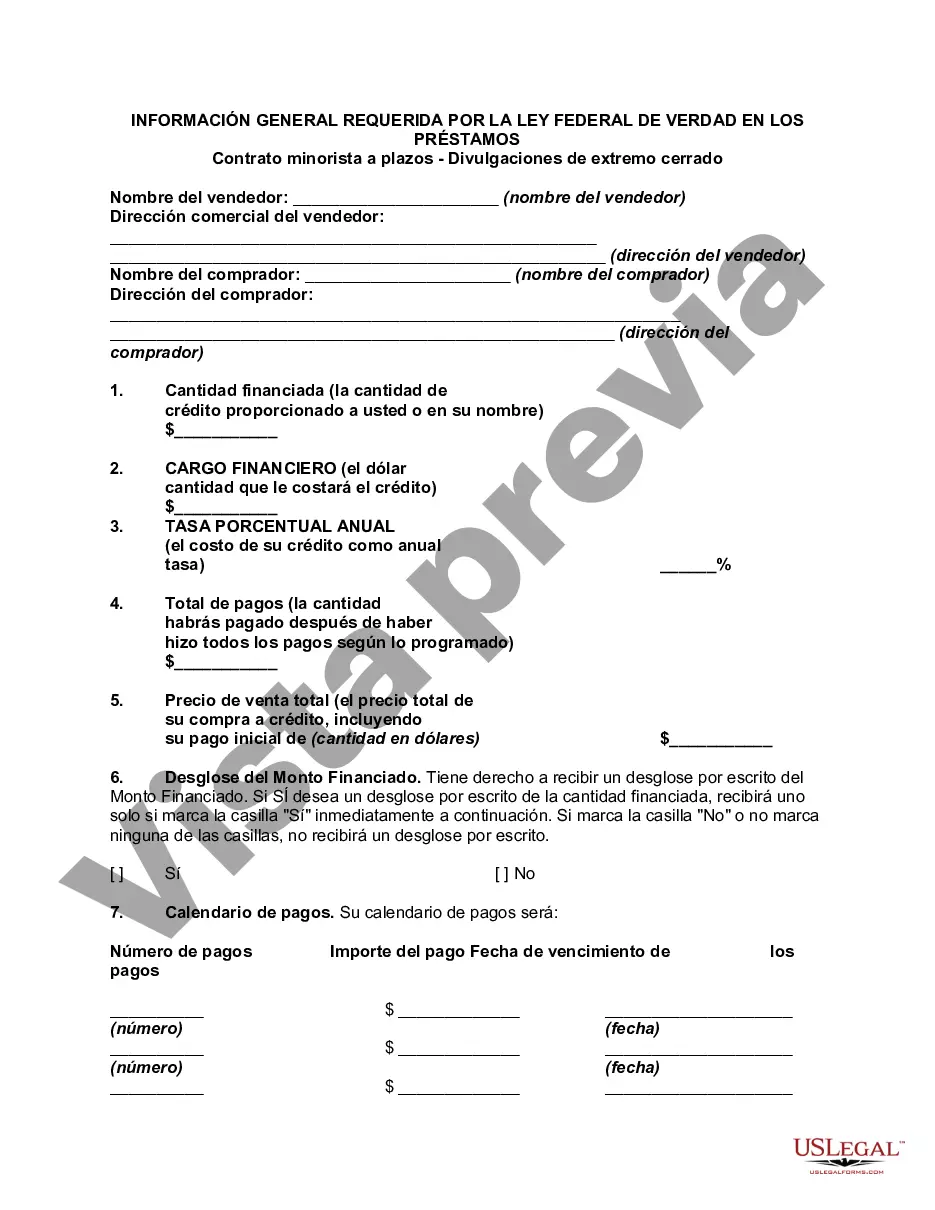

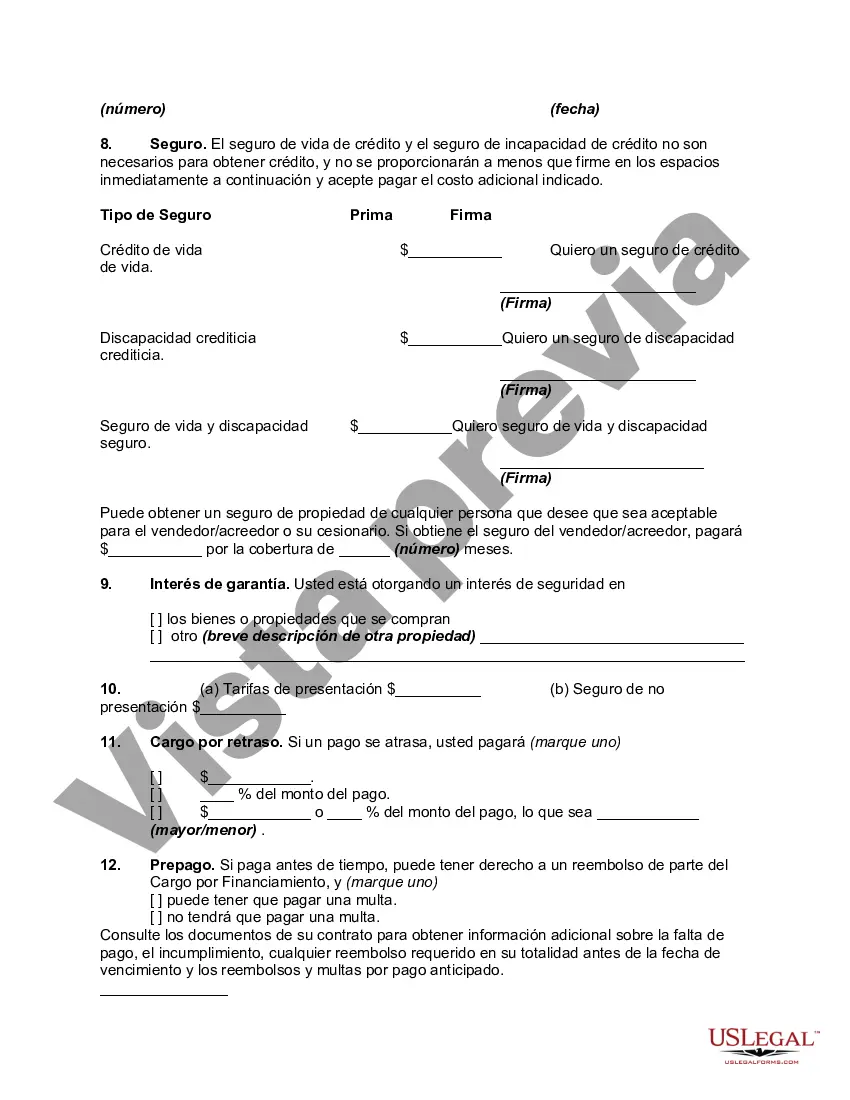

Houston, Texas, is a vibrant city located in the southeastern part of the state, known for its rich history, diverse culture, and thriving economy. It is the fourth-largest city in the United States and home to a population of over 2.3 million people. When it comes to financial transactions in Houston, there are specific regulations and requirements that must be followed to ensure transparency and protect consumers. One important set of regulations is the General Disclosures required by the Federal Truth in Lending Act (TILL) for Retail Installment Contracts — Closed End Disclosures. Under the TILL, lenders and sellers are required to provide certain information to borrowers or buyers before entering into a retail installment contract for the purchase of goods or services. These disclosures help consumers make informed decisions about borrowing money or purchasing goods on credit. Some essential General Disclosures required by the TILL for Retail Installment Contracts — Closed End Disclosures include: 1. Annual Percentage Rate (APR): The APR represents the cost of credit on a yearly basis, including interest rate, fees, and other finance charges. It allows consumers to compare the cost of credit from different lenders. 2. Finance Charge: The finance charge is the total cost of credit expressed in dollars. It includes the interest paid over the life of the loan as well as any other applicable fees. 3. Total Amount Financed: This refers to the principal amount borrowed or the total purchase price of goods or services financed through a retail installment contract. 4. Total Sale Price: The total sale price includes the total amount financed plus the finance charge. It represents the overall cost of the goods or services being purchased on credit. 5. Payment Schedule: The payment schedule outlines the number of payments to be made, their frequency (e.g., monthly), and the due dates. This information helps borrowers plan their budget and understand their repayment obligations. 6. Prepayment Penalties: Some loan agreements may include penalties for early repayment. The disclosure should clearly state if any prepayment penalties apply. 7. Rights and Responsibilities: Borrowers should be informed about their rights and responsibilities under the loan agreement, including the consequences of defaulting on payments or late payment fees. 8. Other Terms and Conditions: The contract should outline any additional terms and conditions related to the loan, such as late payment fees, grace periods, and any other relevant restrictions or limitations. It is important to note that these General Disclosures are required by the Federal Truth in Lending Act and are applicable to Retail Installment Contracts — Closed End Disclosures. However, depending on the specific nature of the transaction and state laws, there may be additional disclosures or variations in the terminology used. In conclusion, the General Disclosures required by the Federal Truth in Lending Act for Retail Installment Contracts — Closed End Disclosures provide crucial information to consumers in Houston, Texas, and ensure transparency in financial transactions. By understanding these disclosures, borrowers can make more informed decisions when borrowing money or purchasing goods on credit, ultimately protecting their rights and financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Houston Texas Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Are you looking to quickly create a legally-binding Houston General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures or probably any other document to handle your own or business affairs? You can select one of the two options: hire a legal advisor to draft a valid document for you or create it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Houston General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the Houston General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process again if the document isn’t what you were hoping to find by utilizing the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Houston General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Moreover, the templates we offer are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!