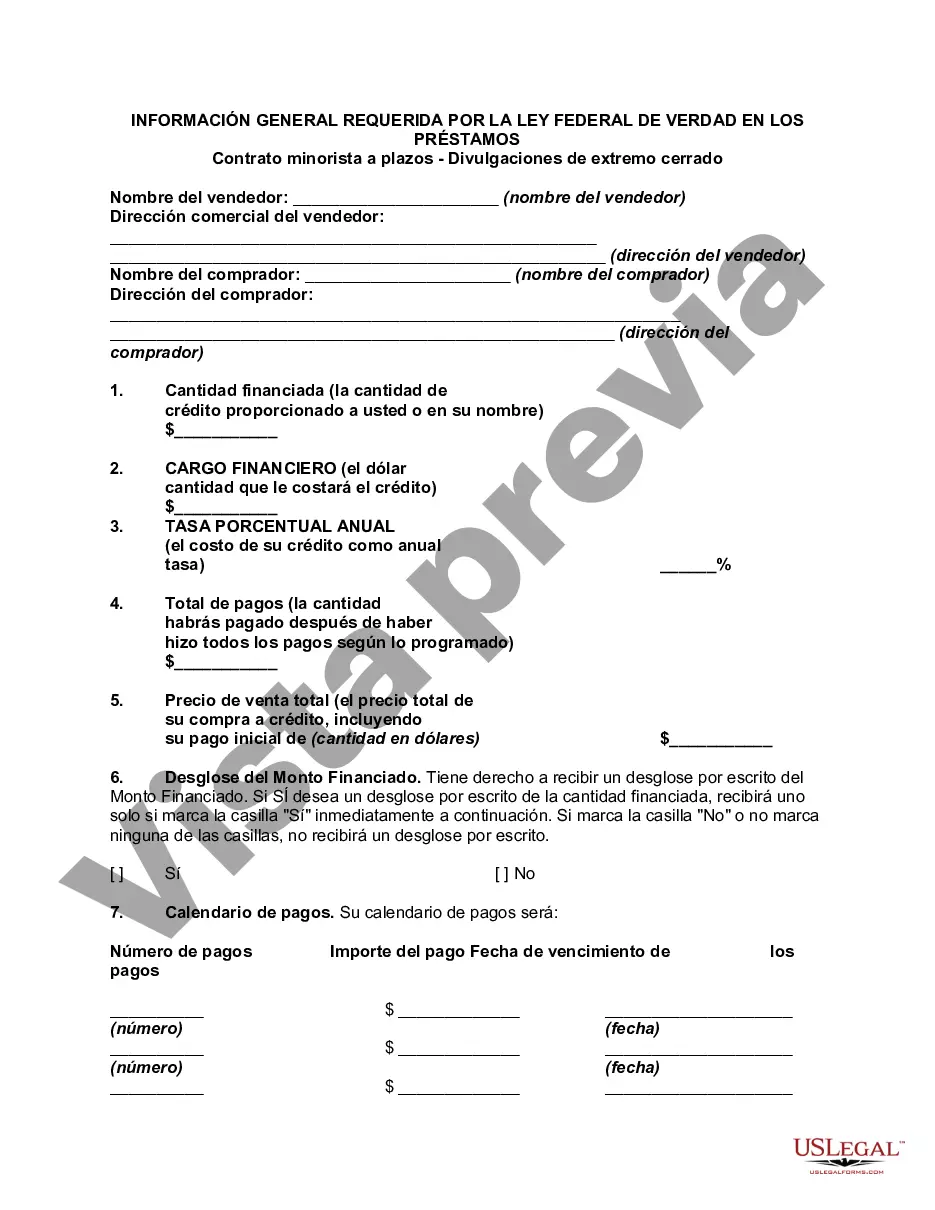

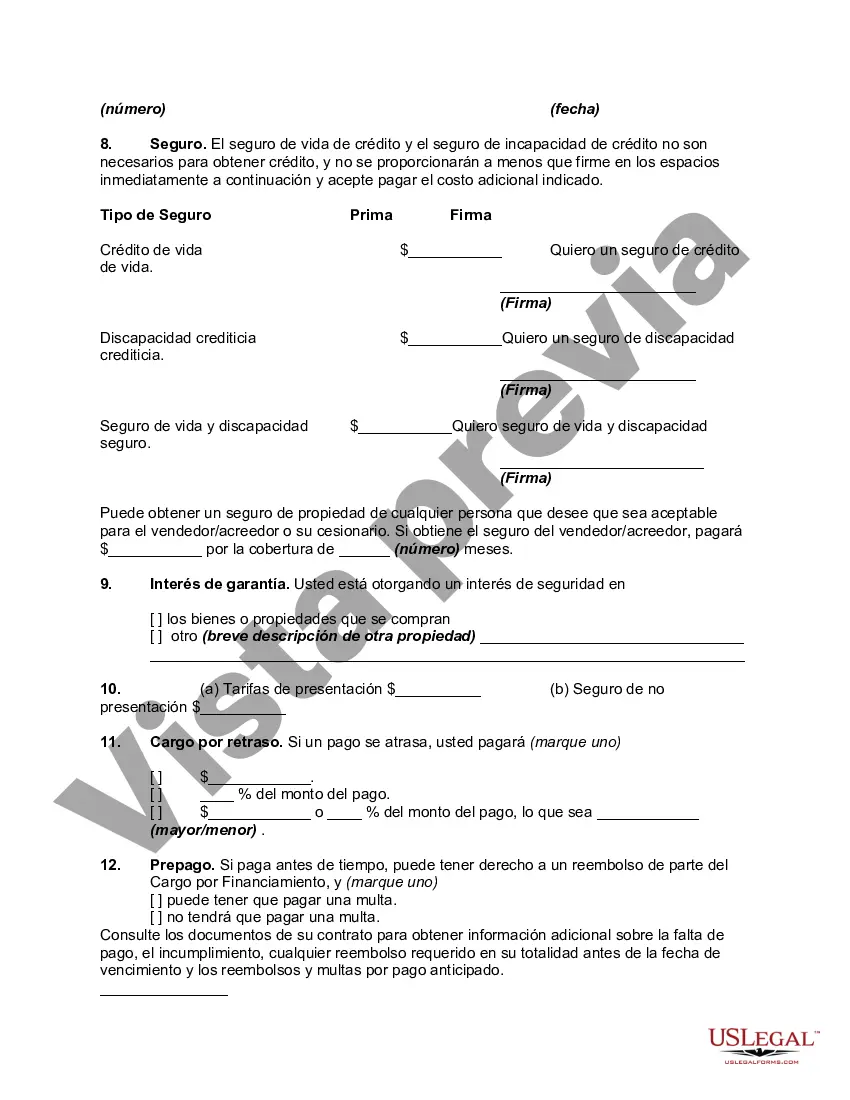

Kings New York General Disclosures Required By The Federal Truth In Lending Act outlines the essential information that must be included in a retail installment contract for closed-end transactions. These disclosures ensure transparency and protect consumers from deceptive practices in lending. Here are some of the key elements that should be included: 1. Annual Percentage Rate (APR): The APR represents the cost of credit to the consumer on an annual basis. It includes both the interest rate and any applicable fees or charges associated with the loan. The APR must be clearly stated to help borrowers understand the total cost of the credit. 2. Finance Charge: This is the total cost of credit imposed on the borrower and is represented in dollar amount. It includes interest charges, as well as any additional fees like application fees or points paid. 3. Total Loan Amount: The total amount being borrowed by the consumer should be disclosed in the contract. It includes the principal loan amount and any financed charges or fees. 4. Payment Terms: This section should provide details about the number of payments, the amount of each payment, and the payment schedule. It helps borrowers understand their repayment obligations and facilitates budgeting. 5. Late Payment Fees: If there are penalties for late payments, they must be clearly disclosed to borrowers. This allows consumers to factor in potential charges for missing payment deadlines. 6. Prepayment Penalties: If applicable, any fees or penalties associated with paying off the loan early should be stated in the contract. This information empowers borrowers to make informed decisions regarding loan repayment. 7. Total Amount Financed: This figure represents the principal loan amount minus any prepaid finance charges. It indicates the actual borrowed amount before any finance charges are added. 8. Description of the Collateral: If the loan is secured by collateral, the type of collateral and its value should be clearly described in the contract. This helps borrowers understand the associated risks and consequences of default. It's important to note that the Federal Truth in Lending Act sets these requirements to promote transparency and protect consumers. By including these disclosures in their retail installment contracts, Kings New York demonstrates its commitment to fair lending practices. Regarding different types of Kings New York General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures, it is essential to tailor the content according to the specific loan or transaction. Specific types of contracts may include mortgage loans, auto loans, personal loans, or business loans. Each type may have additional disclosures specific to that loan type. Therefore, it is crucial for Kings New York to appropriately categorize and provide the relevant disclosures required by the Truth in Lending Act for each respective loan type.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Kings New York Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

If you need to get a trustworthy legal document supplier to obtain the Kings General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support make it easy to find and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to search or browse Kings General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Kings General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less pricey and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate agreement, or complete the Kings General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures - all from the comfort of your sofa.

Join US Legal Forms now!