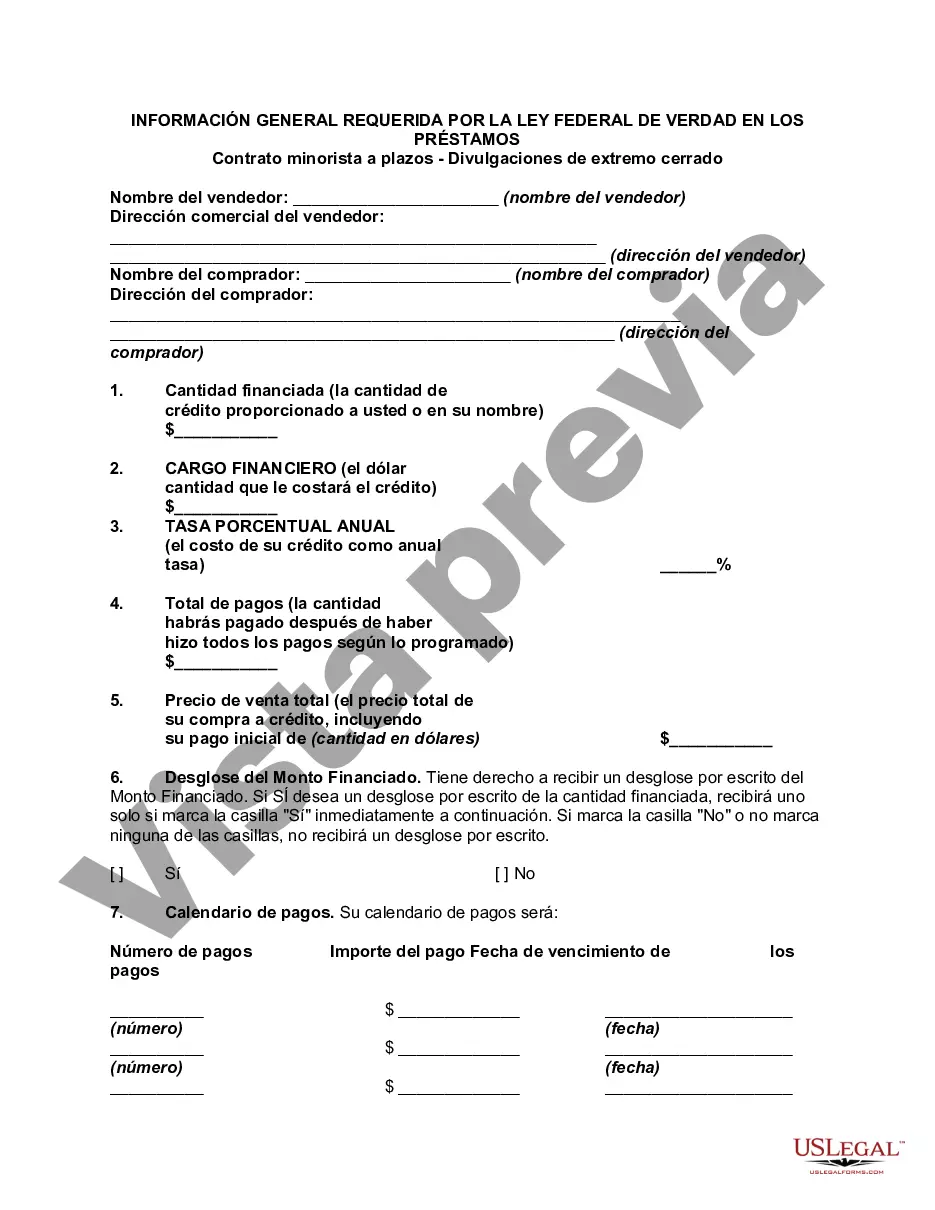

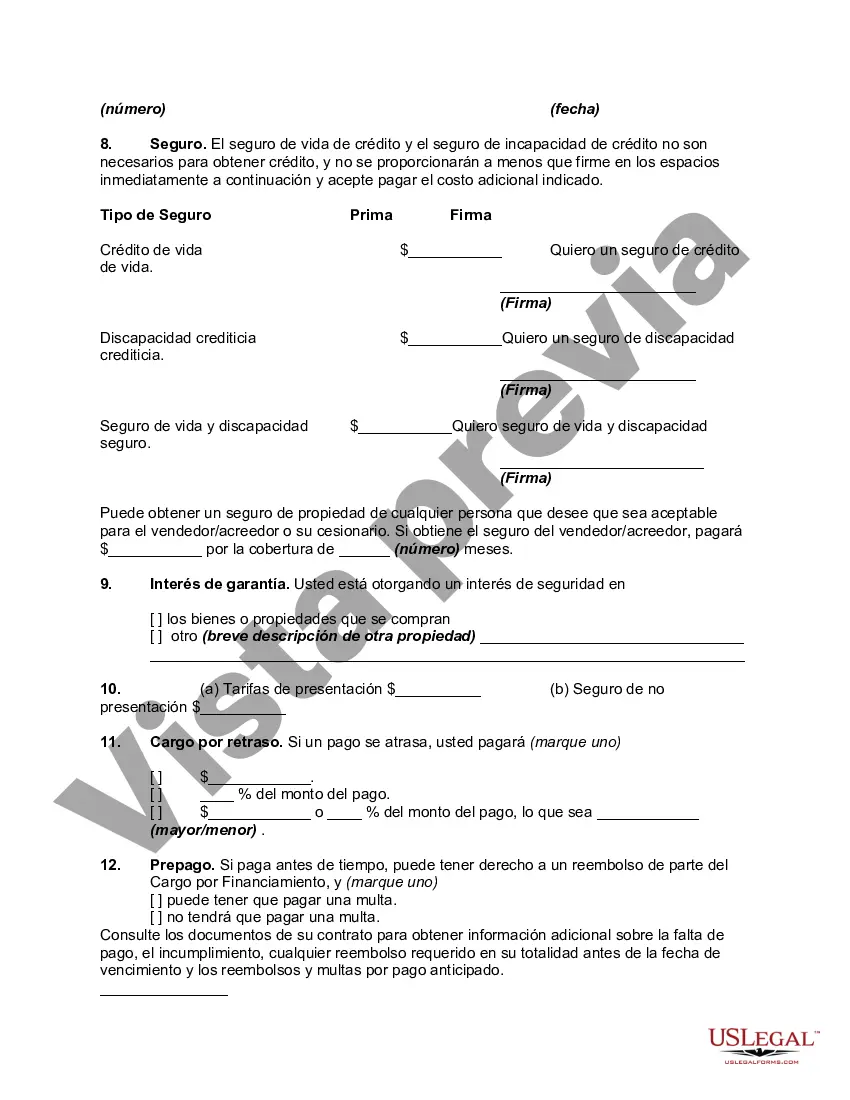

Maricopa, Arizona General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures The Federal Truth in Lending Act (TILL) is a federal law implemented to protect consumers when they engage in credit transactions. In Maricopa, Arizona, consumers who enter into a retail installment contract for closed-end credit are required to receive certain disclosures in compliance with TILL regulations. These disclosures aim to provide transparency and enable consumers to make informed decisions about their credit obligations. Under the TILL, Maricopa, Arizona General Disclosures for Retail Installment Contracts — Closed End Disclosures include: 1. Loan amount and terms: The disclosure must clearly state the amount financed, the total number of payments, the payment amount, the annual percentage rate (APR), and any additional charges or fees associated with the loan. 2. Finance charge: This disclosure outlines the total cost of credit, including interest charges, the origination fee, and any other costs imposed on the consumer. 3. Total payment amount: The disclosure must clearly state the total amount the consumer will have paid by the end of the loan term, including principal, interest charges, and any applicable fees. 4. Prepayment penalties: If prepayment penalties exist, they must be disclosed in this section. It outlines any penalties or fees imposed on the consumer for paying off the loan prior to the agreed-upon term. 5. Security interest: This disclosure identifies any collateral used to secure the loan and informs the consumer about the consequences of default if the collateral is repossessed. 6. Late payment fees: If late payment fees are imposed, this section outlines the amount and conditions under which they will be applied. 7. Right to cancel: The disclosure explains the consumer's right to cancel the contract within a specified period, usually three business days, without penalty. 8. Arbitration clause: If the contract contains an arbitration clause, it must be disclosed. The disclosure provides information about the arbitration process and its implications for dispute resolution. It's important to note that while these general disclosures are required by the TILL, they are not exhaustive. The specific content and format of these disclosures may vary depending on the lending institution and the circumstances of the transaction. It's crucial for consumers in Maricopa, Arizona, to carefully review all the disclosures provided by their lender to ensure they have a clear understanding of the terms and conditions of their credit agreement. Other types of Maricopa, Arizona General Disclosures under the Federal Truth in Lending Act — Retail InstallmenContractac— - Closed End Disclosures may include: Variable interest rate disclosures, balloon payment disclosures, total of payments over time disclosures, and disclosures related to any credit insurance or debt cancellation products offered in conjunction with the loan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

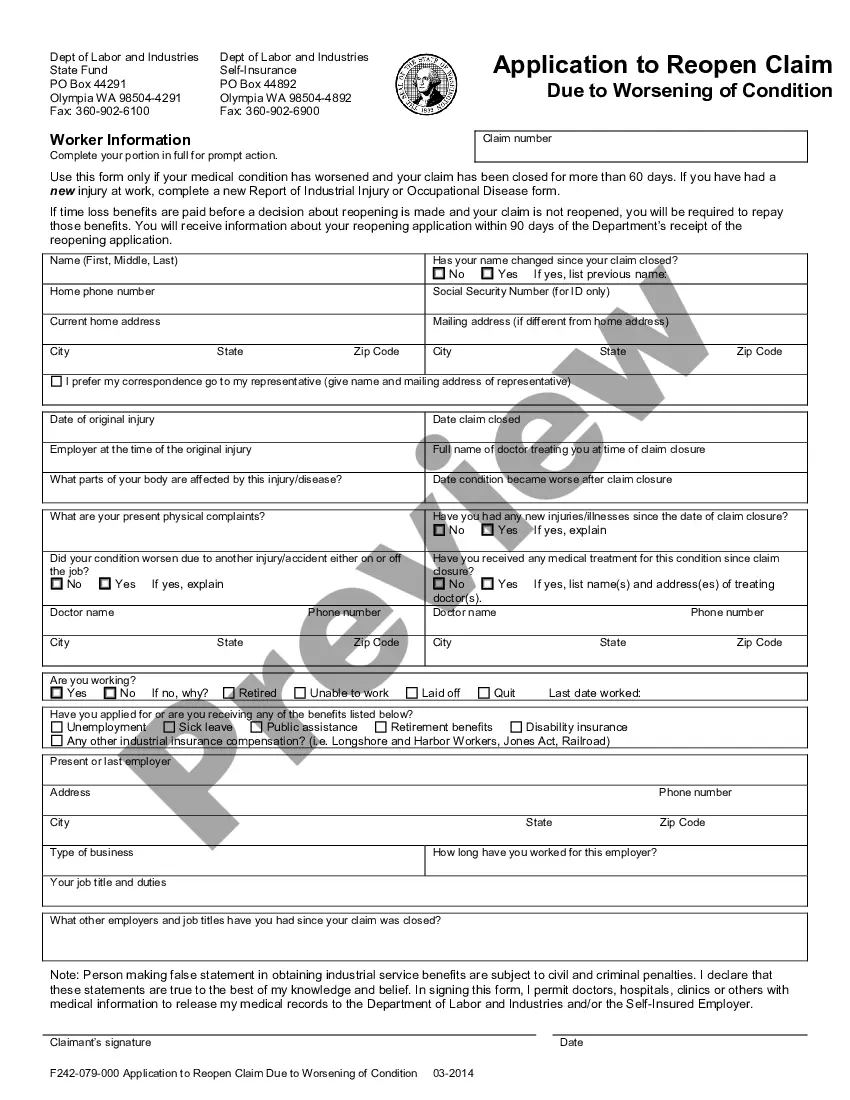

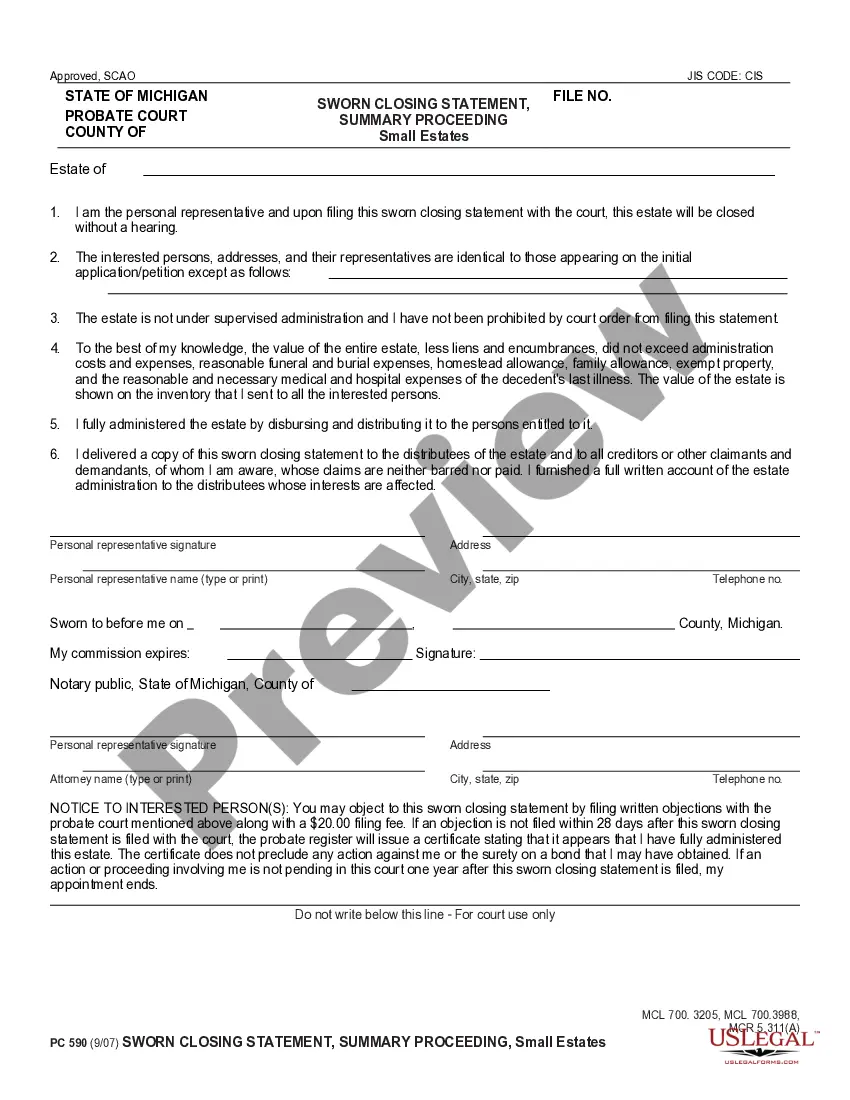

How to fill out Maricopa Arizona Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Creating documents, like Maricopa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, to manage your legal matters is a tough and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for a variety of scenarios and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Maricopa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting Maricopa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Ensure that your document is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Maricopa General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!