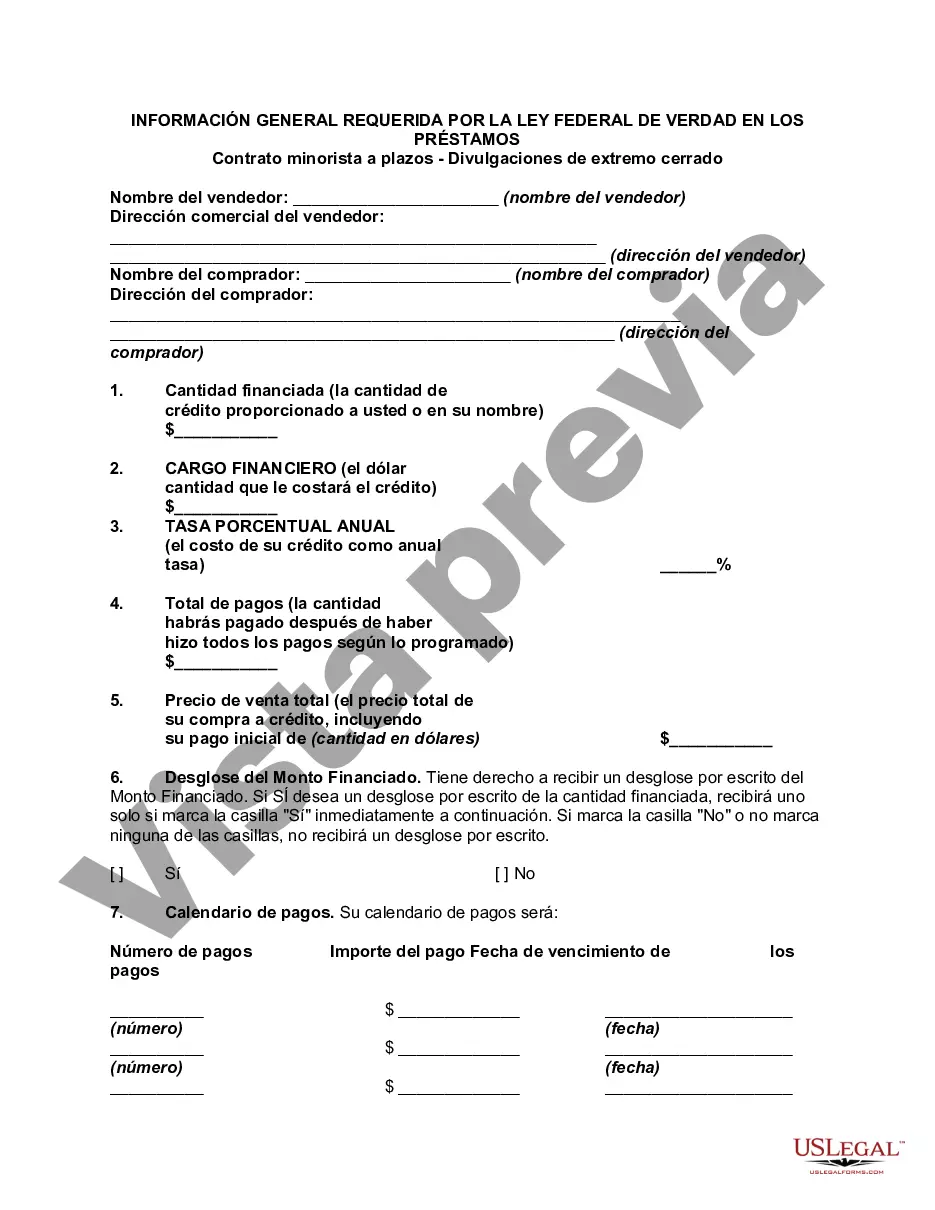

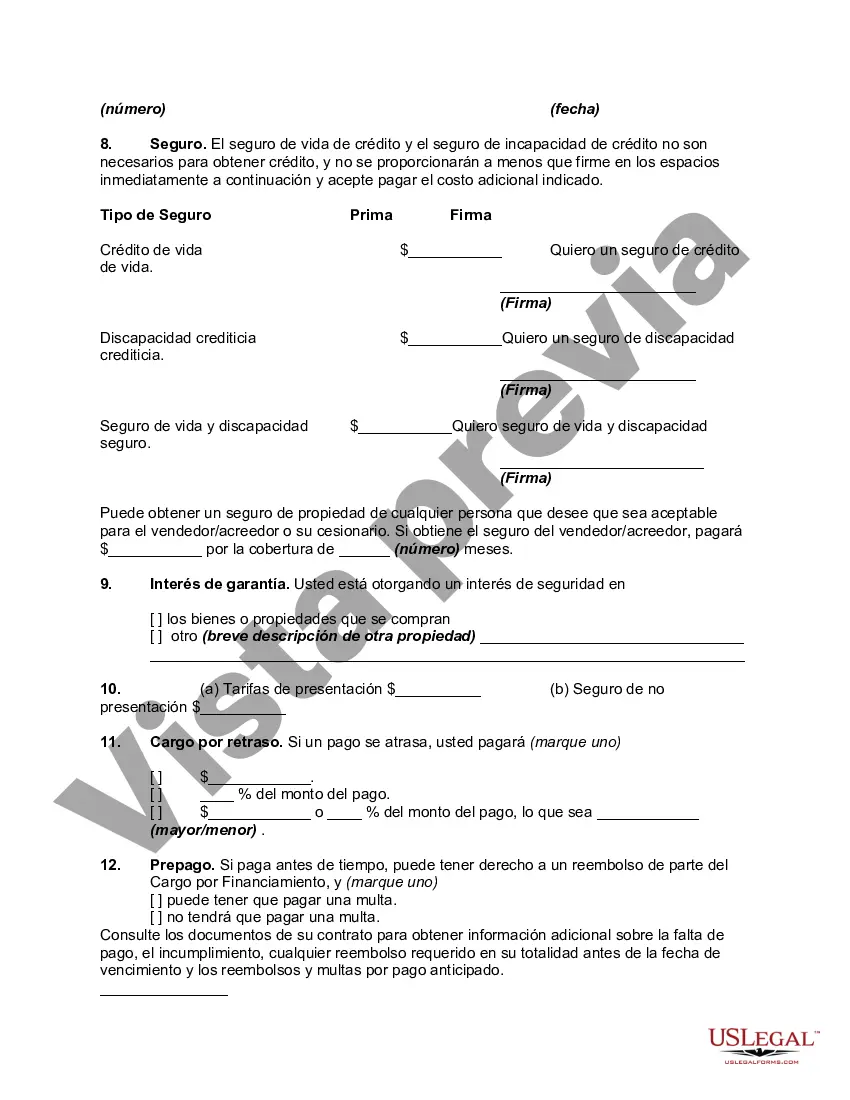

Riverside, California is a vibrant city located in the Inland Empire region of Southern California. Known for its beautiful scenery, diverse population, and thriving economy, Riverside is a hub of cultural, educational, and business activities. In this article, we will delve into the various types of Riverside California General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures. The Federal Truth In Lending Act (TILL) is a federal law implemented to protect consumers from deceptive lending practices and ensure transparency in credit transactions. It requires lenders and creditors to provide specific disclosures to borrowers when extending credit. In the case of retail installment contracts in Riverside, California, several general disclosures must be made as per the TILL requirements. These disclosures include: 1. Annual Percentage Rate (APR): The APR is a representation of the actual cost of borrowing and includes the interest rate, additional fees, and charges associated with the loan. It helps borrowers compare the cost of different loan offers accurately. 2. Finance Charge: This disclosure provides the total cost of borrowing expressed in monetary terms. It encompasses all the fees and charges associated with the loan, including application fees, origination fees, and any other required charges. 3. Total Amount Financed: This disclosure indicates the total amount of credit extended to the borrower. It includes the principal loan amount and any prepaid finance charges. 4. Total Payments: The total payments' disclosure lists the sum of all payments a borrower will make over the life of the loan, including principal, interest, and any other applicable charges. 5. Payment Schedule: This disclosure outlines the number and timing of loan payments, including the amount of each payment and the due dates. It helps borrowers plan and budget their finances accordingly. 6. Prepayment Penalty: If there is a prepayment penalty associated with the loan, it must be disclosed. A prepayment penalty is a fee charged to borrowers who pay off their loan before the agreed-upon term. Not all loans have prepayment penalties, but if they do, it must be clearly disclosed. These are the primary general disclosures required by the TILL for retail installment contracts in Riverside, California. Lenders and creditors must provide this information to borrowers in a clear and conspicuous manner before closing the loan. It is important for borrowers to review and understand these disclosures to make informed financial decisions. If any of the required disclosures are missing or inaccurate, borrowers have the right to question and seek clarification from the lender or creditor. Remember, the TILL's general disclosures ensure that consumers have access to essential information about their loans, empowering them to choose the best credit options that align with their financial goals and capabilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Riverside California Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

If you need to get a reliable legal form provider to find the Riverside General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, consider US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it easy to find and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Riverside General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, either by a keyword or by the state/county the document is created for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Riverside General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate agreement, or execute the Riverside General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures - all from the convenience of your sofa.

Join US Legal Forms now!