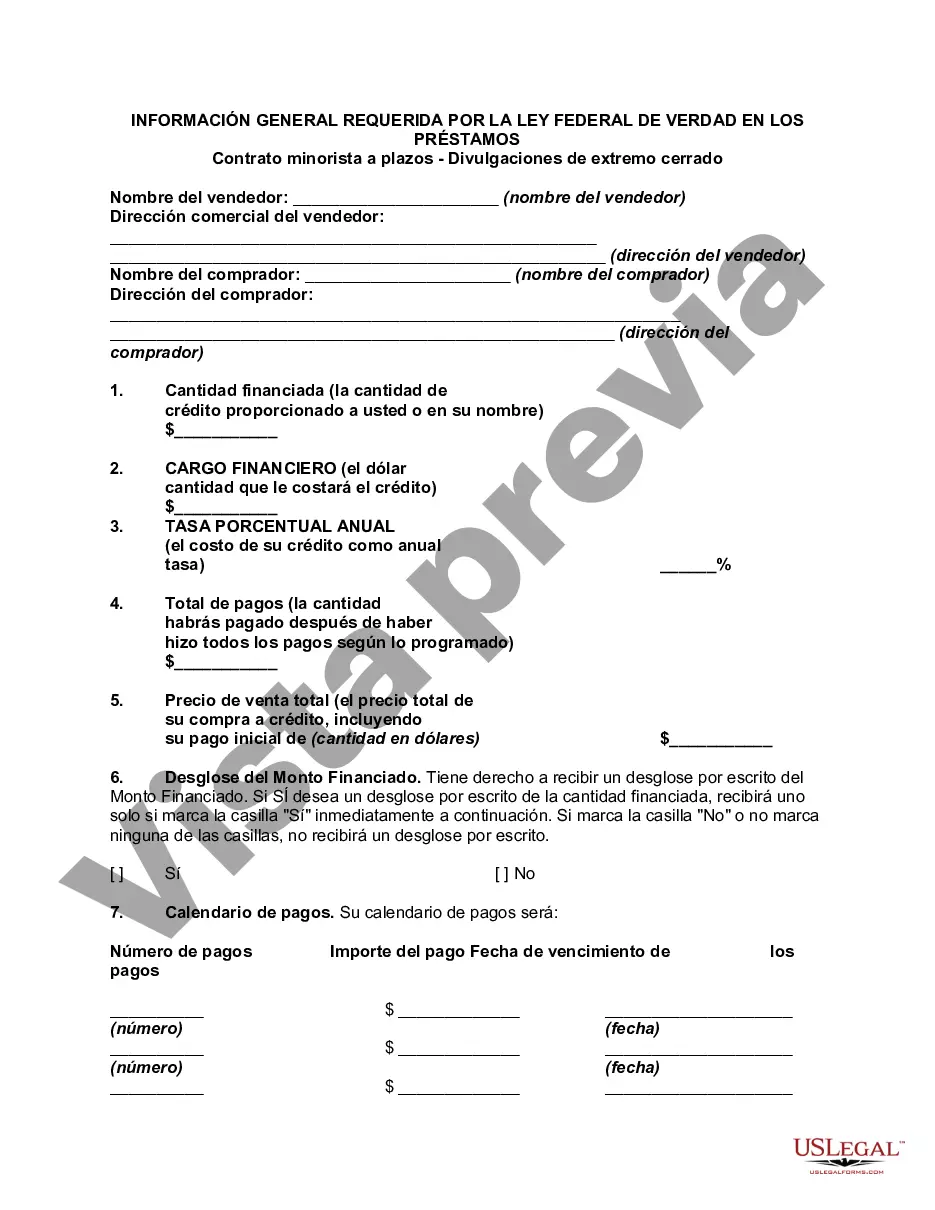

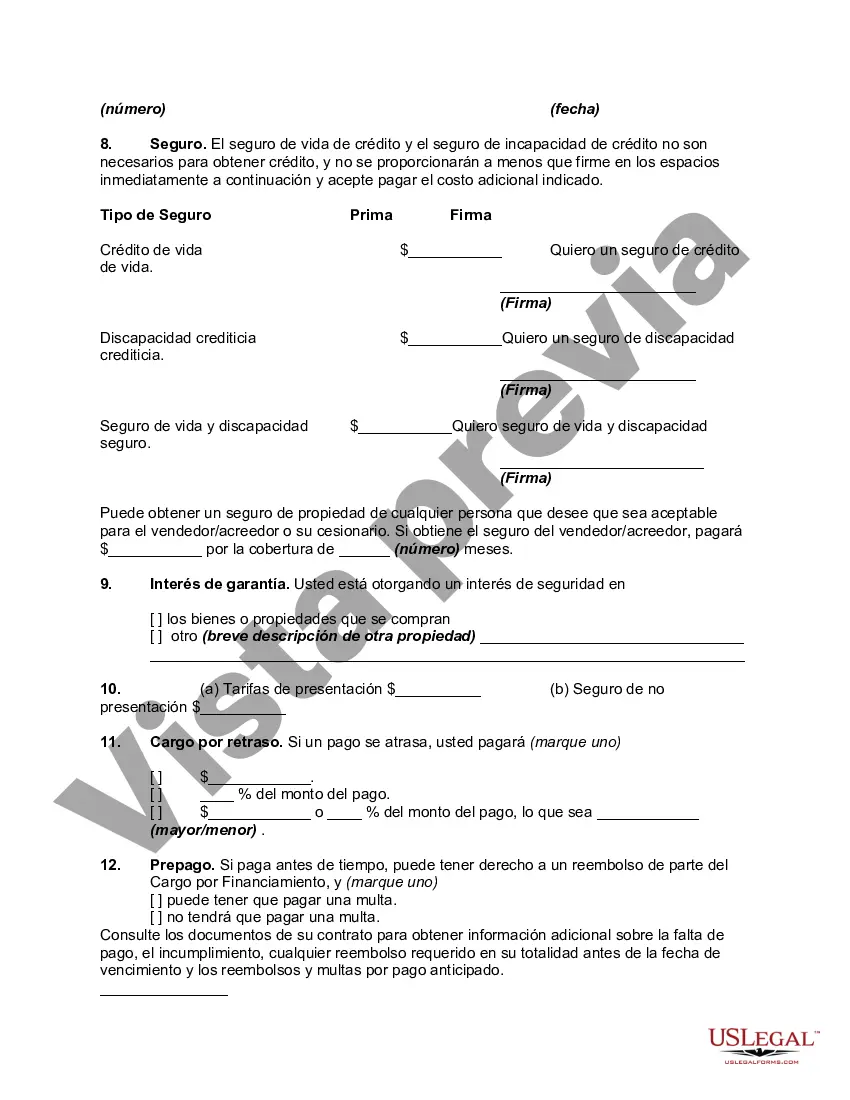

San Diego, California is a vibrant coastal city located in the southwestern corner of the United States. Known for its beautiful beaches, warm climate, and diverse culture, San Diego offers a plethora of attractions and activities for both locals and tourists alike. When it comes to financial matters, it is crucial to understand the San Diego California General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures. These disclosures are mandated by federal law to ensure transparency and fairness in lending practices. Under the Federal Truth in Lending Act, lenders in San Diego are obligated to provide specific disclosures to consumers before finalizing a retail installment contract. These disclosures encompass various important details concerning the loan, such as the annual percentage rate (APR), finance charges, total amount financed, total payments, and payment schedule. Additionally, the Truth in Lending Act requires lenders to disclose any additional fees or charges associated with the loan, such as late payment fees or prepayment penalties. These disclosures aim to empower consumers with clear and comprehensive information, allowing them to make informed decisions about their financial commitments. It's worth noting that while the general disclosures outlined above are essential for any retail installment contract in San Diego, there may be specific variations or additional disclosures depending on the nature of the loan. For example, if the loan is secured by collateral, such as a vehicle or property, additional disclosures relating to the security interest may be required. Moreover, if the loan terms involve adjustable interest rates or specific provisions for variable payments, further disclosures outlining these terms must also be provided. These specialized disclosures ensure that borrowers have a complete understanding of how their loan will be structured and how it may potentially change over time. In conclusion, the San Diego California General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures play a vital role in protecting consumers' rights and ensuring transparency in lending practices. By familiarizing oneself with these disclosures, individuals can make informed decisions when entering into retail installment contracts and safeguard their financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out San Diego California Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the San Diego General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the San Diego General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures from the My Forms tab.

For new users, it's necessary to make some more steps to get the San Diego General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!