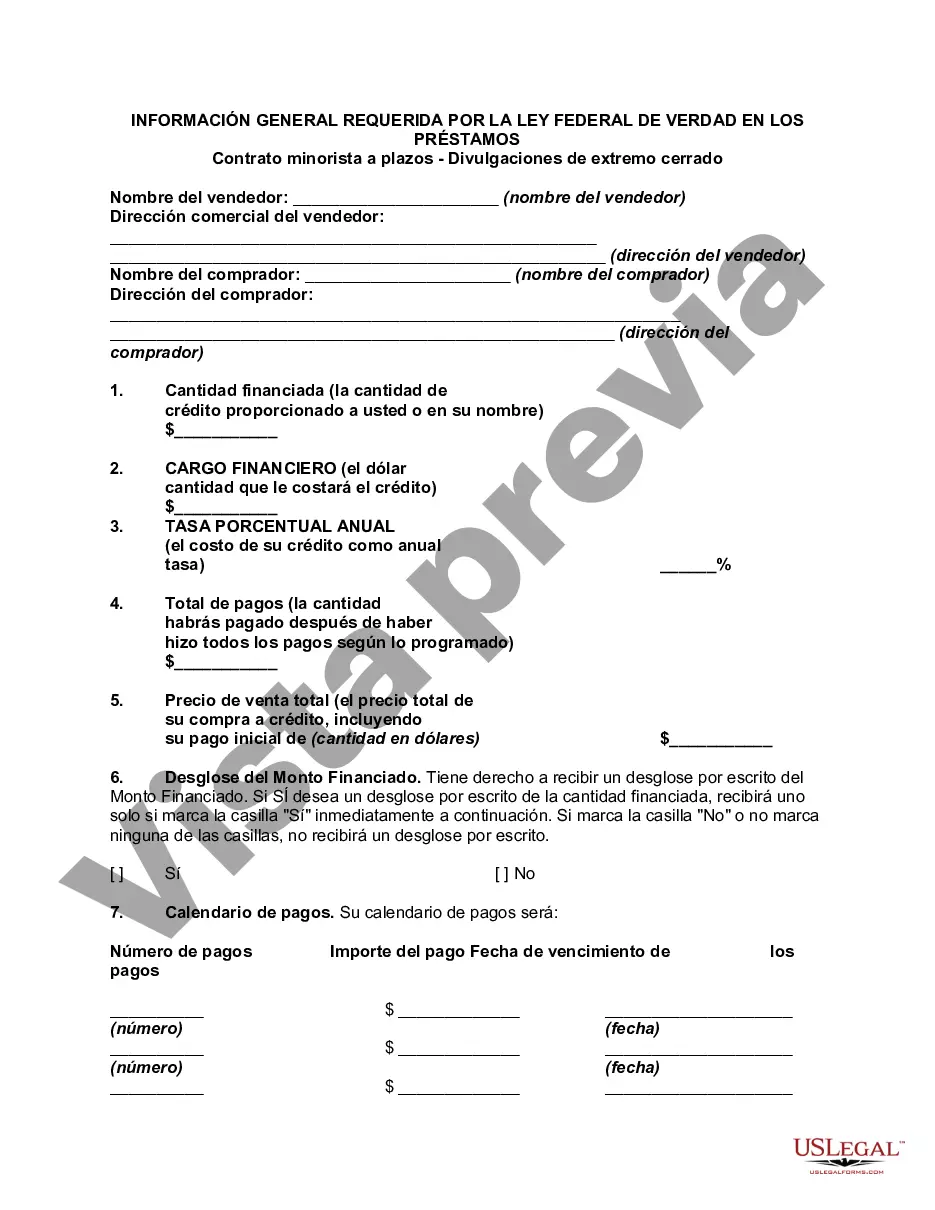

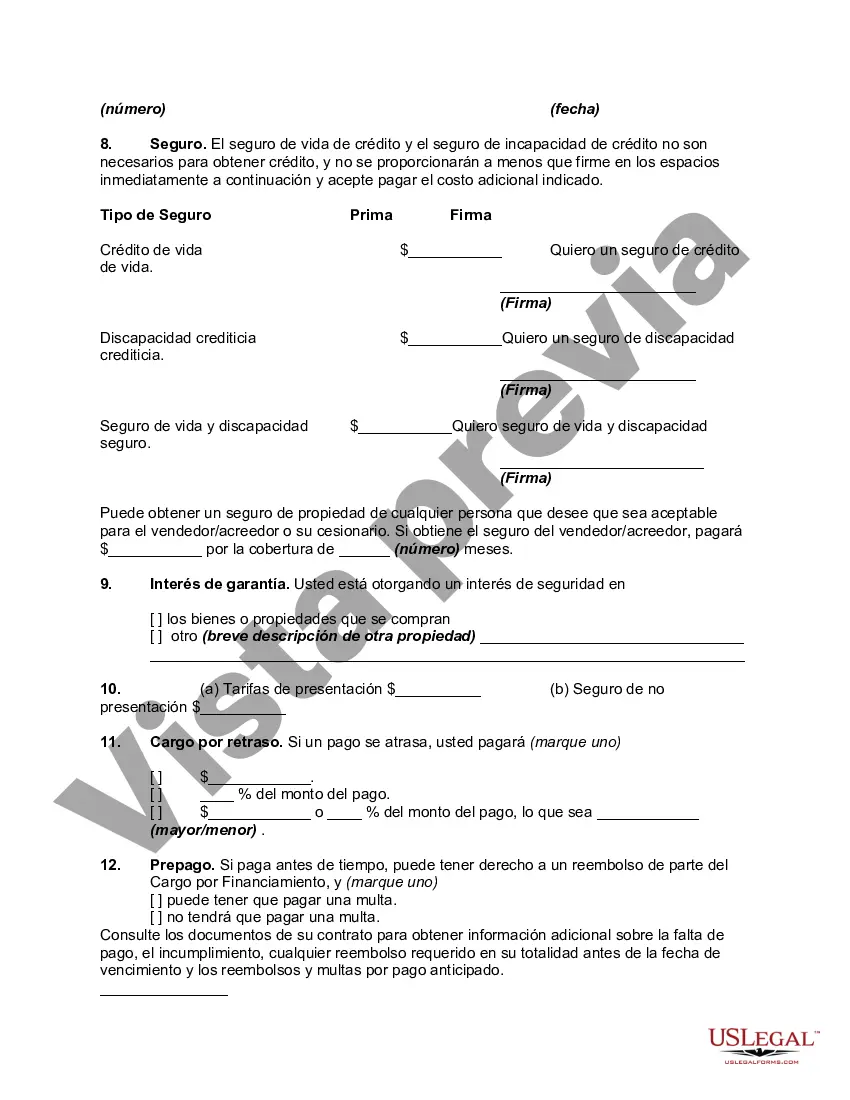

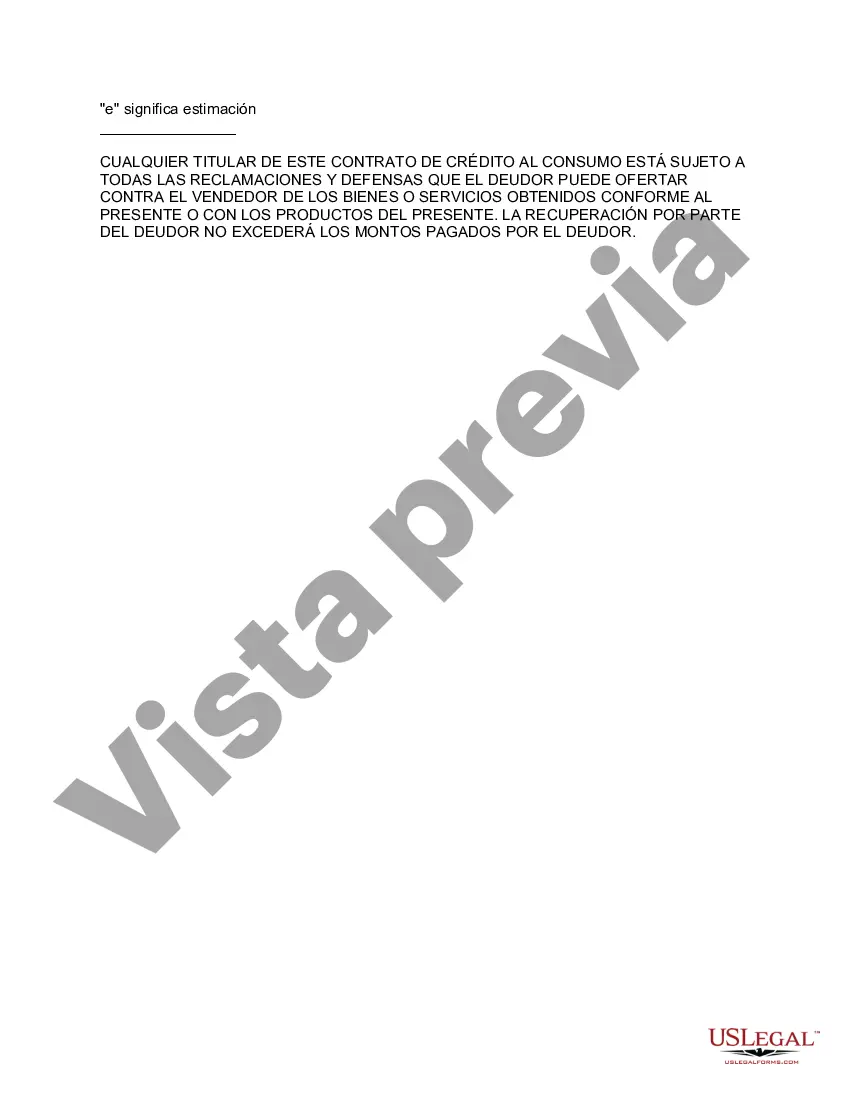

San Jose, California is a vibrant city located in the heart of Silicon Valley. It is the third-largest city in California and home to a diverse population of over one million residents. In terms of the Federal Truth in Lending Act, there are certain general disclosures required for retail installment contracts in San Jose, California. These disclosures are meant to provide transparency and protect consumers in financial transactions. The retail installment contract is a closed-end agreement between a consumer and a creditor for the purchase of goods or services. The Federal Truth in Lending Act requires that specific information be disclosed to the consumer before the contract is finalized. Some general disclosures required by the Federal Truth in Lending Act for a retail installment contract in San Jose, California include: 1. Annual Percentage Rate (APR): This is the cost of credit expressed as an annual percentage rate. It includes the interest rate and any other charges associated with the credit. 2. Finance Charge: The finance charge is the cost of credit expressed in dollars. It includes any interest charges, fees, and other costs associated with the loan. 3. Amount Financed: This is the total amount borrowed by the consumer, excluding any finance charges. 4. Total of Payments: This is the total amount the consumer will repay over the life of the loan, including both principal and interest. 5. Payment Schedule: The payment schedule outlines the number of payments, their due dates, and the amount of each payment. 6. Prepayment Penalties: If applicable, the contract must disclose whether there are any penalties for paying off the loan early. These are just a few examples of the general disclosures required for retail installment contracts in San Jose, California under the Federal Truth in Lending Act. It's important for consumers to review and understand these disclosures before entering into any financial agreement. Different types of San Jose California General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures may vary based on the specific details of the transaction. Some additional types may include: 1. Late Payment Fees: If the consumer fails to make a payment on time, the contract may disclose the amount of the late fee and any applicable grace periods. 2. Insurance Requirements: The contract might require the consumer to maintain certain insurance coverage on the goods being purchased. 3. Total Cost of Credit: This disclosure may provide an overall summary of the total amount the consumer will pay, including all interest, fees, and other charges. It's crucial for both consumers and creditors in San Jose, California to comply with these general disclosures to promote fair and transparent financial transactions. Consumers should read and understand all the terms and conditions presented in the retail installment contracts to make informed decisions about their purchases and borrowings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out San Jose California Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including San Jose General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to document execution simple.

Here's how to purchase and download San Jose General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the validity of some records.

- Check the related document templates or start the search over to find the right document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy San Jose General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate San Jose General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you have to cope with an exceptionally complicated situation, we advise using the services of a lawyer to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Join them today and purchase your state-specific documents with ease!