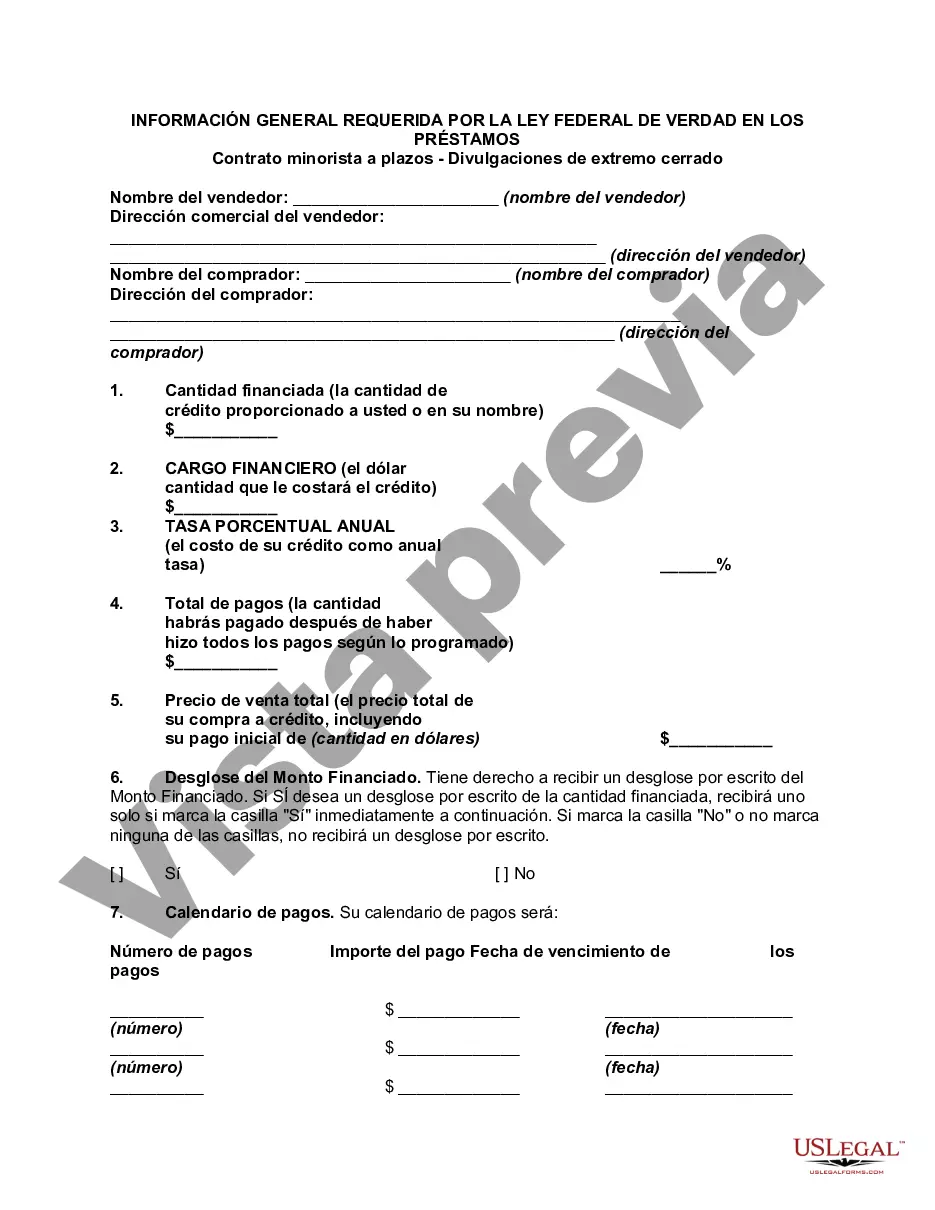

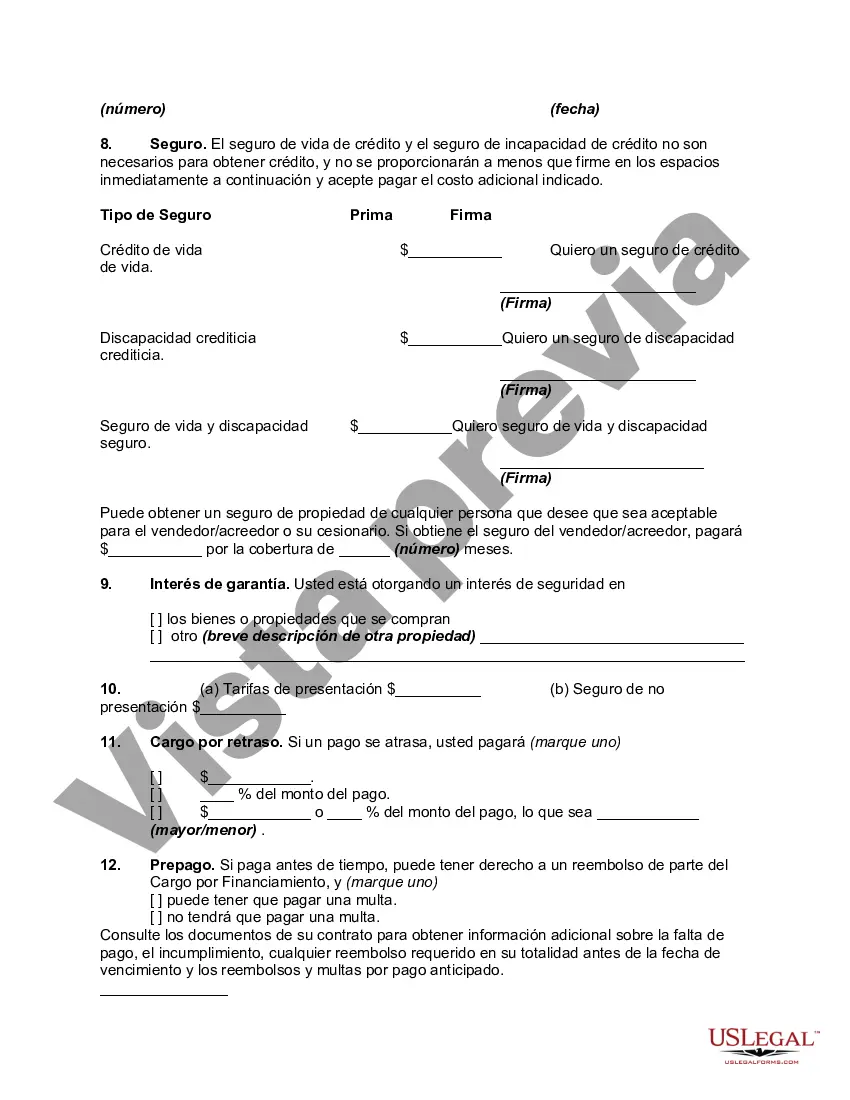

Suffolk New York General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures: Explained Suffolk, New York residents engaging in retail installment contracts under the Federal Truth in Lending Act must adhere to specific disclosures known as the General Disclosures. These disclosures provide vital information to consumers regarding the terms and conditions of the loan agreement. Let's delve into the essential details of these disclosures and examine any different types that may exist. The General Disclosures encompass key information that borrowers need to comprehend before proceeding with a retail installment contract in Suffolk, New York. These disclosures ensure transparency and protect consumers' rights. The Federal Truth in Lending Act mandates that lenders provide these disclosures prior to the signing of any retail installment contract. The General Disclosures typically include the following: 1. Annual Percentage Rate (APR): This is the cost of credit expressed as an annual rate. It factors in both the interest charges and certain loan-related fees, allowing borrowers to compare different credit offers. 2. Finance Charge: The total amount of interest and any additional charges imposed by the lender over the course of the loan. 3. Total Amount Financed: The total amount of credit provided to the borrower after deducting any prepaid finance charges. 4. Total Payments: The overall amount the borrower will have paid by the end of the loan term, including principal, interest, and any other fees. 5. Payment Schedule: A breakdown of the number of payments, their amounts, and the due dates throughout the loan tenure. 6. Late Payment Penalty: Any charges or penalties that may be imposed if the borrower fails to make timely payments. 7. Prepayment: The borrower's rights and potential penalties associated with paying off the loan before the agreed-upon term. These disclosures are crucial in enabling borrowers to make informed decisions and avoid any potential pitfalls. By understanding the full scope of their financial obligations, consumers can budget appropriately and weigh the significance of different loan offers. The General Disclosures contribute to a fair lending environment and empower borrowers to protect their financial well-being. Regarding specific variations or additional types of General Disclosures required in Suffolk, New York under the Federal Truth in Lending Act for retail installment contracts, it is important to consult relevant legal resources or consult an attorney. Keep in mind that state-specific regulations may come into play, so it is essential to be well-informed about any additional requirements specific to Suffolk, New York. In conclusion, Suffolk, New York residents entering into retail installment contracts must receive General Disclosures as mandated by the Federal Truth in Lending Act. These disclosures encompass vital loan information such as APR, finance charges, total amount financed, and more, facilitating informed decision-making. To ensure compliance, borrowers should consult legal resources or professionals familiar with Suffolk, New York's specific regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Suffolk New York Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

If you need to get a reliable legal form provider to obtain the Suffolk General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to get and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Suffolk General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Suffolk General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less pricey and more affordable. Set up your first company, arrange your advance care planning, draft a real estate agreement, or execute the Suffolk General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures - all from the convenience of your sofa.

Sign up for US Legal Forms now!