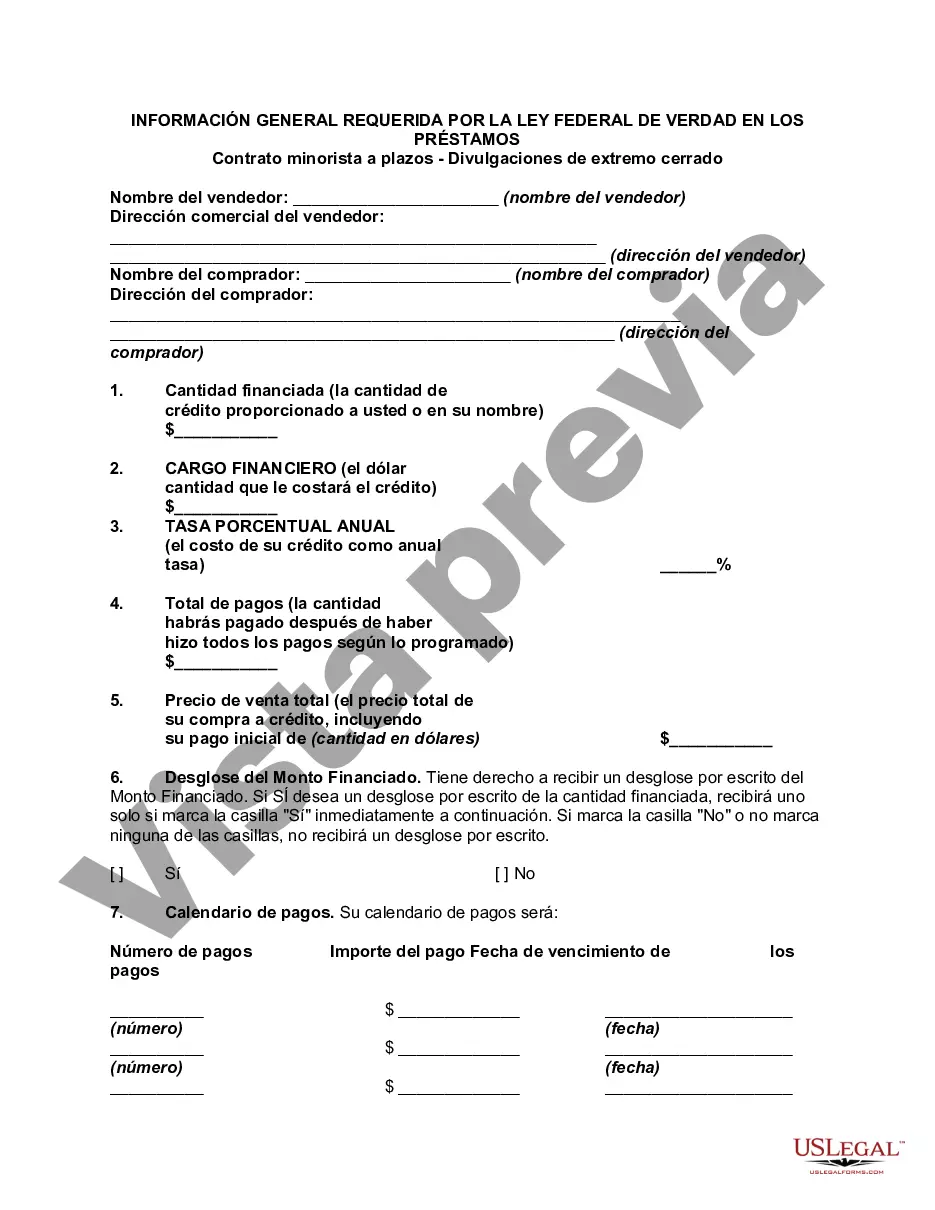

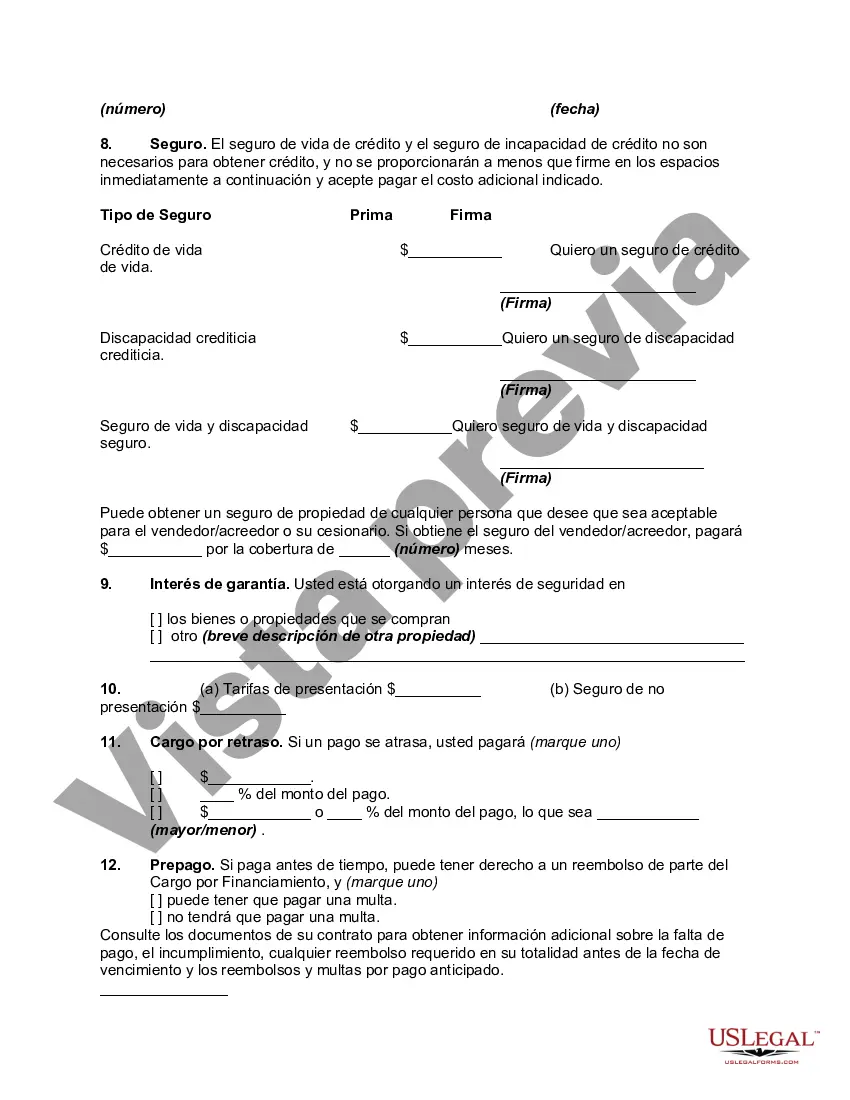

Travis Texas General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures are an essential component of loan agreements in the state of Texas. These disclosures ensure that borrowers are provided with complete and accurate information about the terms of their loan, including interest rates, fees, repayment schedules, and potential penalties. Compliance with these disclosures is mandated by the Federal Truth In Lending Act (TILL) to protect consumers from unfair lending practices. There are several types of Travis Texas General Disclosures required by the Federal Truth In Lending Act for Retail Installment Contracts — Closed End Disclosures: 1. Annual Percentage Rate (APR) Disclosure: The APR represents the true cost of credit to the borrower and includes both the interest rate and any applicable fees or charges. This disclosure helps borrowers compare different loan offers and understand the total cost of their loan over its duration. 2. Finance Charge Disclosure: This disclosure outlines the total cost of credit, including both interest charges and certain fees imposed by the lender. It enables borrowers to understand the specific costs associated with their loan and compare it with other offers. 3. Amount Financed Disclosure: This disclosure represents the actual amount of credit provided to the borrower, excluding any finance charges. It helps borrowers understand precisely how much money they are borrowing and how it is calculated. 4. Total of Payments Disclosure: This disclosure illustrates the total amount repayable by the borrower over the life of the loan, including both principal and interest. It assists borrowers in assessing their ability to afford the loan and plan their budget accordingly. 5. Payment Schedule Disclosure: This disclosure outlines the number of payments, frequency (monthly, bi-weekly, etc.), and due date of each payment. It provides borrowers with a clear understanding of their repayment obligations and helps them plan their finances accordingly. 6. Late Payment and Default Disclosures: These disclosures specify the penalties and consequences that borrowers may face in case of late payments or default on the loan. It is crucial for borrowers to fully comprehend these terms to avoid any unexpected fees or adverse effects on their credit history. Compliance with these Travis Texas General Disclosures is vital for lenders to uphold transparency and ensure borrowers are well-informed about the terms and costs associated with their loans. By adhering to these requirements, lenders contribute to a fair and accountable lending environment while empowering borrowers to make informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Travis Texas Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Travis General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Travis General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Travis General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!