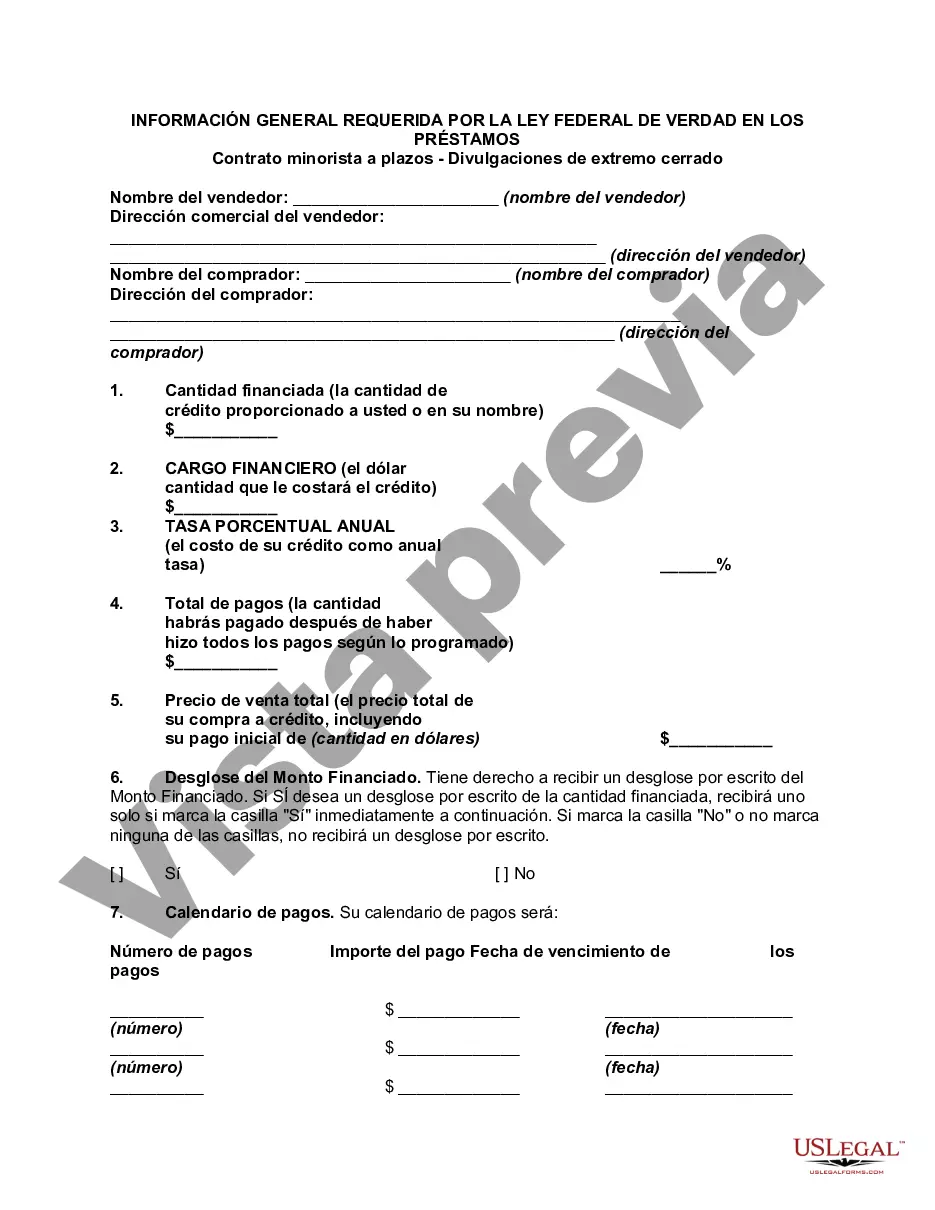

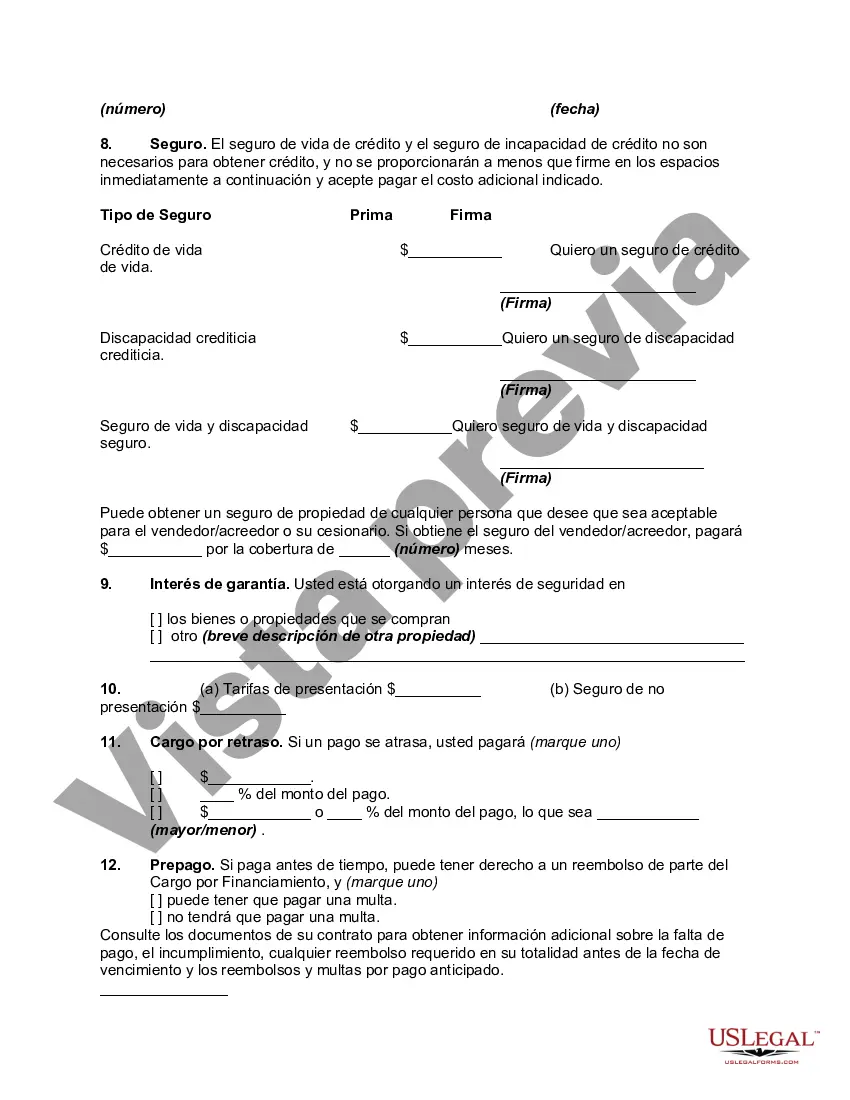

The Wake, North Carolina General Disclosures required by the Federal Truth In Lending Act (TILL) refer to specific provisions that must be included in a retail installment contract for closed-end credit. These disclosures aim to inform borrowers about the terms and costs associated with their credit transaction, enabling them to make informed financial decisions. Compliance with these requirements is crucial for lenders and financial institutions operating in Wake, North Carolina. There are several key types of Wake, North Carolina General Disclosures required by the Federal Truth in Lending Act — Retail InstallmenContractac— - Closed End Disclosures. Some of them include: 1. Annual Percentage Rate (APR) Disclosure: The APR discloses the annual interest rate, including other finance charges such as loan fees and points, expressed as a percentage. This disclosure helps borrowers compare the overall costs of different credit options. 2. Finance Charge Disclosure: The finance charge represents the total dollar amount the credit transaction will cost the borrower. It includes interest charges, loan fees, and other applicable costs associated with the credit. 3. Amount Financed Disclosure: This disclosure outlines the total amount the borrower will receive as credit, excluding finance charges. It helps borrowers understand the actual amount of money they will have available for their specific purpose. 4. Total of Payments Disclosure: This disclosure includes the total amount the borrower will have paid by the time the loan is fully paid off, including principal, interest, and any other finance charges. 5. Payment Schedule Disclosure: This disclosure provides a detailed breakdown of the number of payments required, their periodic amounts, and the repayment period. 6. Prepayment Penalty Disclosure: If applicable, this disclosure reveals any penalties imposed on borrowers if they choose to pay off the loan before the scheduled due date. 7. Late Payment Disclosure: This disclosure informs borrowers about any late payment penalties or fees they may incur for not making payments on time. 8. Right to Rescind Disclosure: For certain types of credit transactions, such as refinancing a mortgage or obtaining a home equity loan, borrowers have the right to cancel their agreement within a specified time frame. This disclosure explains that right. In summary, compliance with Wake, North Carolina General Disclosures required by the Federal Truth In Lending Act is essential for lenders, ensuring transparency and empowering borrowers with the necessary information to make well-informed credit decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Wake North Carolina Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

Are you looking to quickly create a legally-binding Wake General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures or probably any other form to take control of your personal or business affairs? You can select one of the two options: contact a legal advisor to write a valid paper for you or create it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-compliant form templates, including Wake General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures and form packages. We offer documents for an array of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, carefully verify if the Wake General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures is tailored to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Wake General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the documents we offer are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!