Nassau New York Acuerdo de Accionistas entre Dos Accionistas de una Sociedad Anónima Cerrada con Disposiciones de Compra-Venta - Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Acuerdo De Accionistas Entre Dos Accionistas De Una Sociedad Anónima Cerrada Con Disposiciones De Compra-Venta?

A document protocol always accompanies any legal action you undertake.

Forming a company, applying for or accepting a job offer, transferring ownership, and numerous other life circumstances require you to compile official paperwork that differs from state to state.

That is why having everything organized in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

Utilize it as required: print it or complete it electronically, sign it, and submit where necessary. This is the simplest and most dependable method to acquire legal documents. All the templates available in our library are professionally constructed and confirmed for compliance with local laws and regulations. Prepare your documentation and manage your legal activities efficiently with US Legal Forms!

- Here, you can effortlessly find and download a document for any personal or business purpose used in your area, including the Nassau Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions.

- Finding forms on the platform is exceptionally straightforward.

- If you already possess a subscription to our service, Log In to your account, locate the sample through the search bar, and click Download to save it on your device.

- Subsequently, the Nassau Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions will be available for future use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this uncomplicated guide to obtain the Nassau Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions.

- Ensure you have accessed the correct page containing your local form.

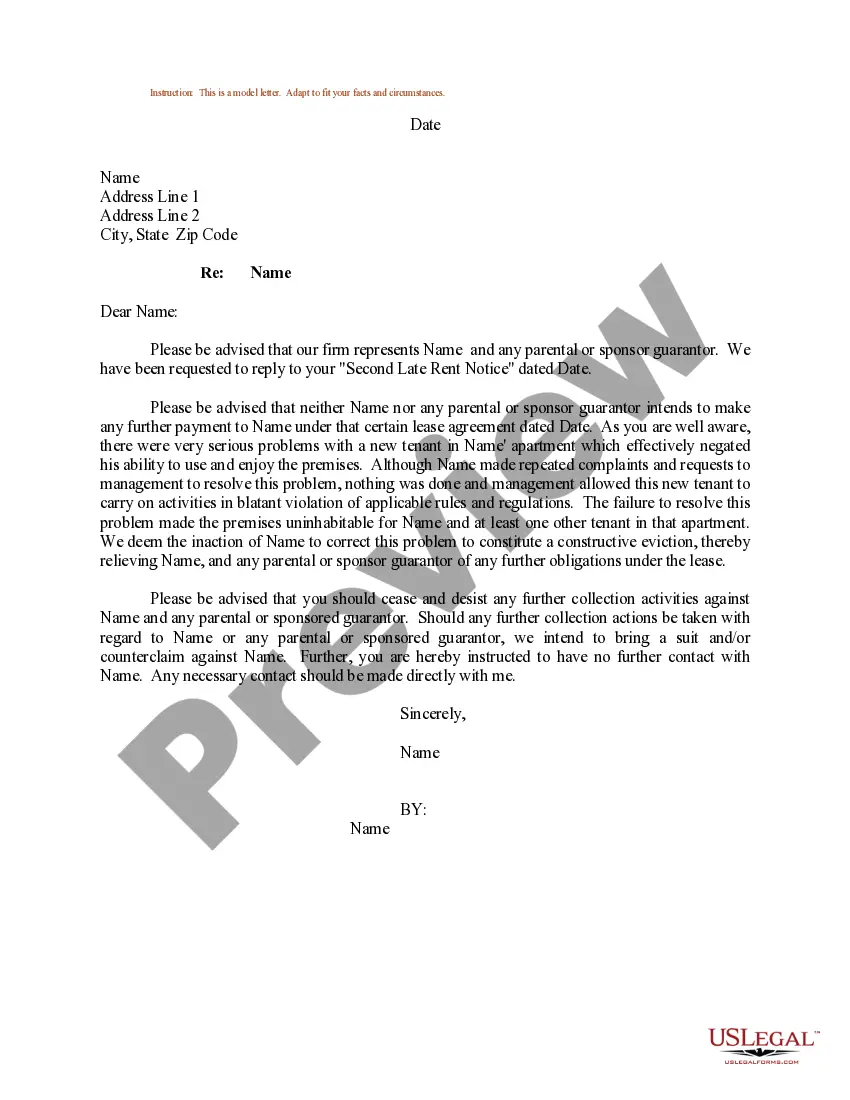

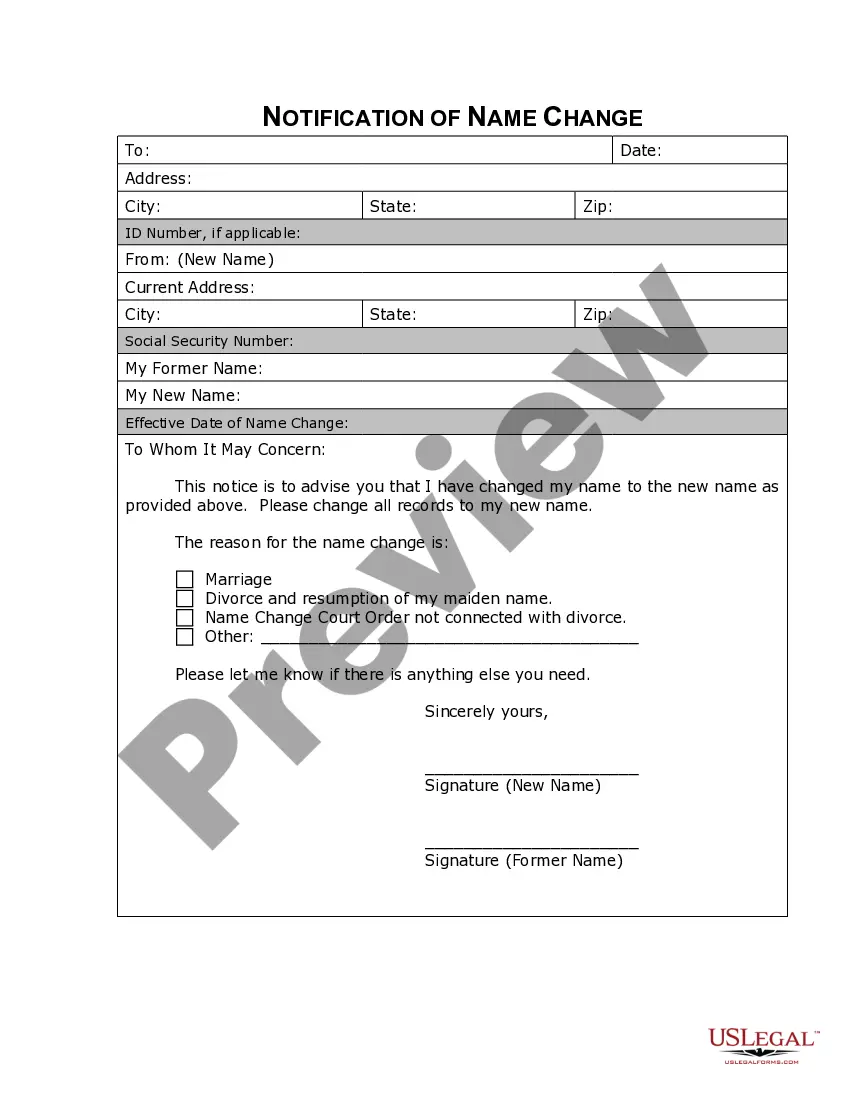

- Use the Preview mode (if available) to review the sample.

- Examine the description (if any) to confirm the form meets your needs.

- Search for an alternative document using the search feature if the sample does not suit you.

- Click Buy Now once you identify the necessary template.

- Select the suitable subscription plan, then Log In or create a new account.

- Choose the preferred payment method (using credit card or PayPal) to continue.

- Select the file format and save the Nassau Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions on your device.

Form popularity

FAQ

En las sociedades anonimas cerradas sus acciones no se transan en la bolsa de valores y la negociacion de sus acciones opera en transacciones privadas en un mercado privado.

Segun la resolucion DGT-ICD-R-006-2020, las personas juridicas que deben presentar esta declaracion son: Sociedades anonimas. Sociedades de responsabilidad limitada. Sociedad en nombre colectivo. Sociedades en comandita. Sociedades extranjeras con cedula juridica nacional. Sociedades civiles y sociedades profesionales.

Tener minimo 2 socios y no mas de 20 socios. Es la ventaja de esta sociedad dado que usualmente las sociedades anonimas cerradas se forman con 2 socios.

La declaracion de Registro de Transparencia y Beneficiarios Finales (RTBF), tambien conocida como Registro de Accionistas, es una declaracion que deben presentar las personas juridicas de forma obligatoria en el mes de abril de cada ano, segun lo establece el Articulo 5 de la Ley para mejorar la lucha contra el fraude

La compraventa de acciones es una transaccion comercial muy comun dentro de las Sociedades Anonimas de Capital Variable, la principal manera de transmitirlas es por medio del endoso y entrega del titulo, sin perjuicio que puedan transmitirse por cualquier otro medio legal de acuerdo al articulo 26 de la Ley General de

Obtenga su firma digital: los representantes legales o apoderados deben adquirir la firma digital para poder cumplir con el registro de accionistas. Ingrese a la pagina de Central Directo y suscribase con la firma digital.

En terminos generales, los acuerdos de accionistas pueden versar sobre cualquier tema o contenido que los accionistas consideren relevante, entre otros, regulacion de sus relaciones, eleccion de organos administrativos de la sociedad, administracion y control de la sociedad, etc.

La transferencia de acciones en este tipo de sociedades se realiza simplemente mediante un documento privado. Puede ser una compra venta o cualquier otra modalidad para transferir propiedades como una donacion por ejemplo. La entrega del Certificado de Acciones sera necesario en caso de haberse emitido los mismos.

¿Que datos se deben incluir en el libro de accionistas? Nombre, domicilio, cedula de identidad o RUT de cada accionista. El numero de acciones de propiedad de cada accionista. La fecha en la que se inscriben las acciones a nombre de un accionista.

El libro de registro de acciones contendra: nombre, nacionalidad, y domicilio del accionista y la indicacion de las acciones que le pertenezcan, expresandose los numeros, series, clases y demas particularidades. indicacion de las exhibiciones que se efectuen para cubrir su pago, y.