Bexar Texas Agreement to Compromise Debt by Returning Secured Property is a legally binding contract designed to facilitate the resolution of a debt issue between two parties. This agreement outlines the terms and conditions under which a debtor can settle their outstanding debt by returning secured property to the creditor. In the state of Texas, there are various types of Bexar Texas Agreement to Compromise Debt by Returning Secured Property, including: 1. Residential Property Agreement: This type of agreement allows debtors who have defaulted on their mortgage payments to negotiate with their lender and return the property in question to settle the debt. 2. Vehicle Repossession Agreement: When borrowers default on their auto loan payments, they can engage in a Bexar Texas Agreement to Compromise Debt by Returning Secured Property specifically for repossessed vehicles. This agreement enables them to return the vehicle to the lender to satisfy their debt. 3. Business Property Agreement: In situations where business owners are unable to meet their financial obligations and have secured loans against their commercial property, a Bexar Texas Agreement to Compromise Debt by Returning Secured Property can be used to determine the terms for returning the property as a form of debt settlement. These agreements are an essential means for debtors and creditors to come to a mutually beneficial arrangement. Debtors may be relieved from their obligations, avoiding bankruptcy or legal actions, while creditors secure the return of valuable assets, which can then be auctioned or resold to recoup their losses. When entering into a Bexar Texas Agreement to Compromise Debt by Returning Secured Property, it's crucial to consider factors such as the fair market value of the secured property, any remaining outstanding debt balance to be forgiven, and the logistics of returning the property safely. It is advisable to consult with legal professionals to draft and review these agreements to ensure compliance with Texas laws and regulations.

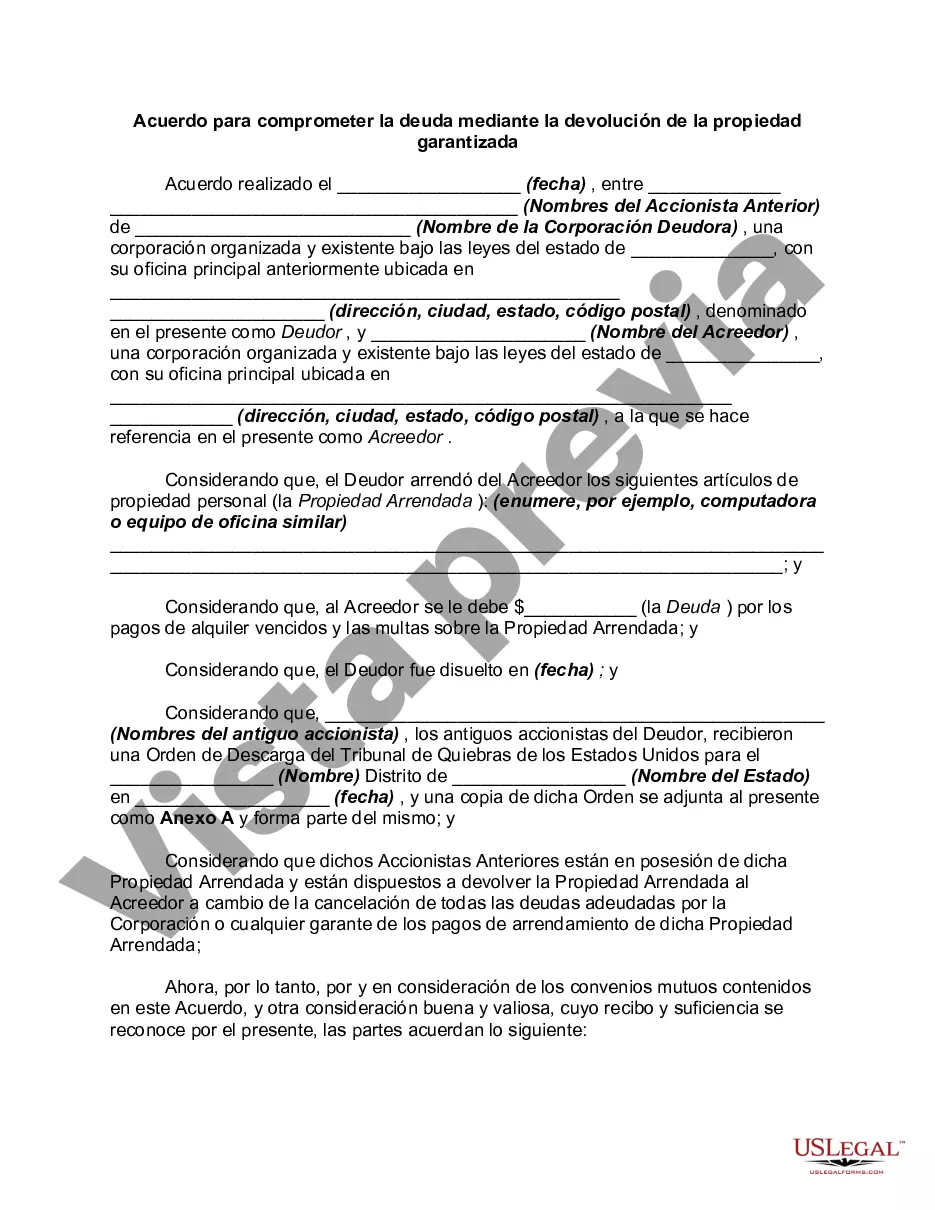

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Bexar Texas Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

Preparing paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Bexar Agreement to Compromise Debt by Returning Secured Property without professional help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Bexar Agreement to Compromise Debt by Returning Secured Property by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Bexar Agreement to Compromise Debt by Returning Secured Property:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!