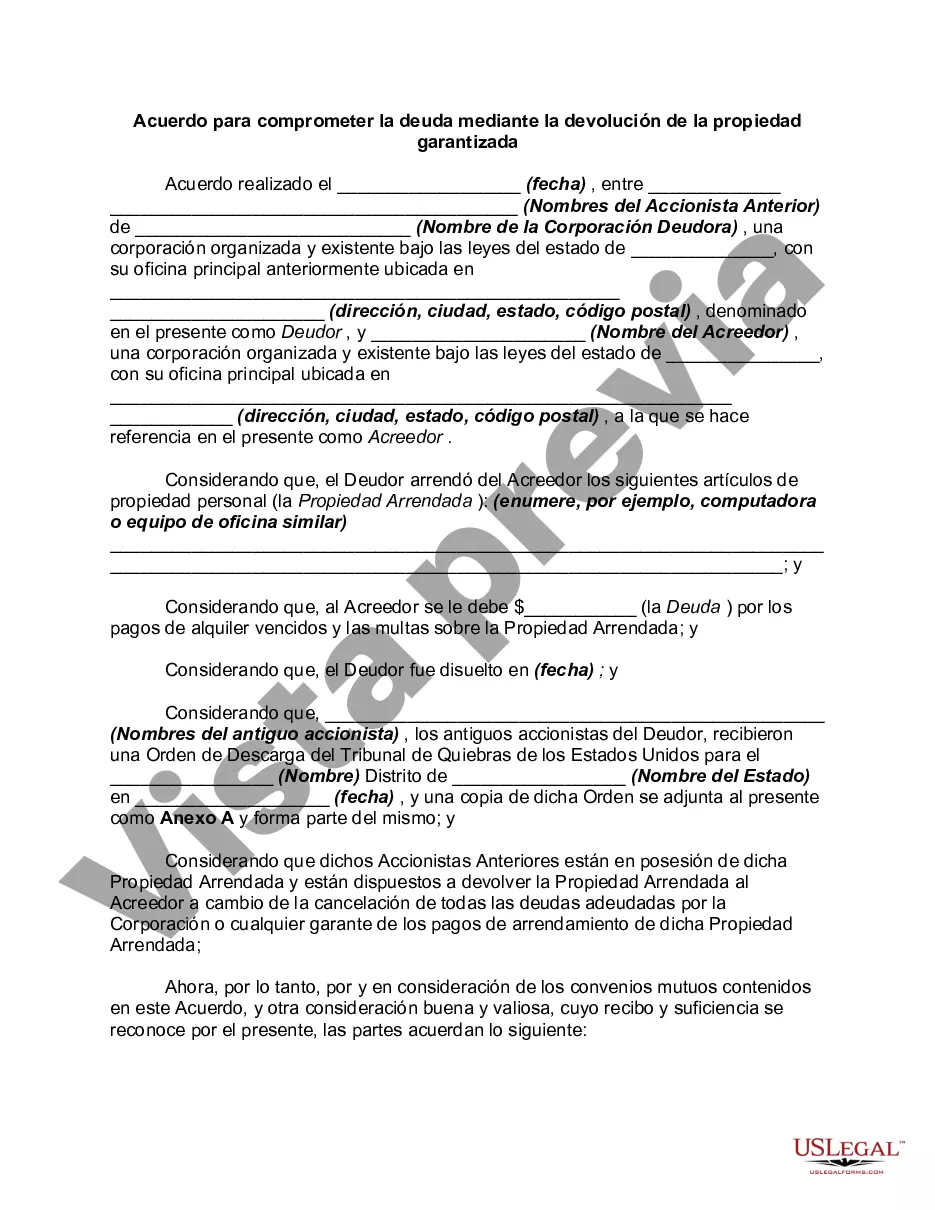

Cook Illinois Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions under which a debtor can settle their debt by returning secured property to the creditor. This agreement is commonly used in situations where the debtor is unable to fulfill their financial obligations and wishes to reach a compromise with the creditor. The Cook Illinois Agreement to Compromise Debt by Returning Secured Property involves the negotiation between the debtor and the creditor, aiming to find a mutually beneficial solution to the outstanding debt. This type of agreement is often preferred by both parties as it offers an opportunity to avoid lengthy legal proceedings and the associated costs. The agreement generally specifies the details of the secured property to be returned, such as its description, value, and condition. It outlines the timeline within which the property needs to be returned, ensuring that the creditor receives it in a satisfactory condition. By entering into this agreement, the debtor acknowledges their inability to repay the outstanding debt in its entirety and agrees to surrender the secured property as a partial repayment. In return, the creditor agrees to accept the returned property as a settlement, forgiving a portion of the outstanding debt. Cook Illinois Agreement to Compromise Debt by Returning Secured Property can have different variations depending on the specific circumstances of the parties involved. Some variations may include: 1. Residential Property Agreement: This specific type of agreement involves the compromise of debt through the return of residential property, such as a house or an apartment. 2. Vehicle Agreement: In cases where a debtor is unable to repay a debt secured by a vehicle, this type of agreement allows for the return of the vehicle as a settlement. 3. Equipment or Machinery Agreement: This agreement variation relates to debts secured against equipment or machinery, where the debtor returns the secured items to the creditor as a partial repayment of the debt. 4. Real Estate Agreement: When the debt is secured by real estate, such as land or commercial property, this agreement allows for the return of the real estate as a means of debt settlement. Overall, Cook Illinois Agreement to Compromise Debt by Returning Secured Property provides a flexible and practical solution for debtors who are facing financial hardship and cannot meet their repayment obligations. It allows them to return secured property while receiving debt relief, enabling both parties to avoid costly legal actions and find an amicable resolution.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Cook Illinois Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Cook Agreement to Compromise Debt by Returning Secured Property, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Cook Agreement to Compromise Debt by Returning Secured Property from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Cook Agreement to Compromise Debt by Returning Secured Property:

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!