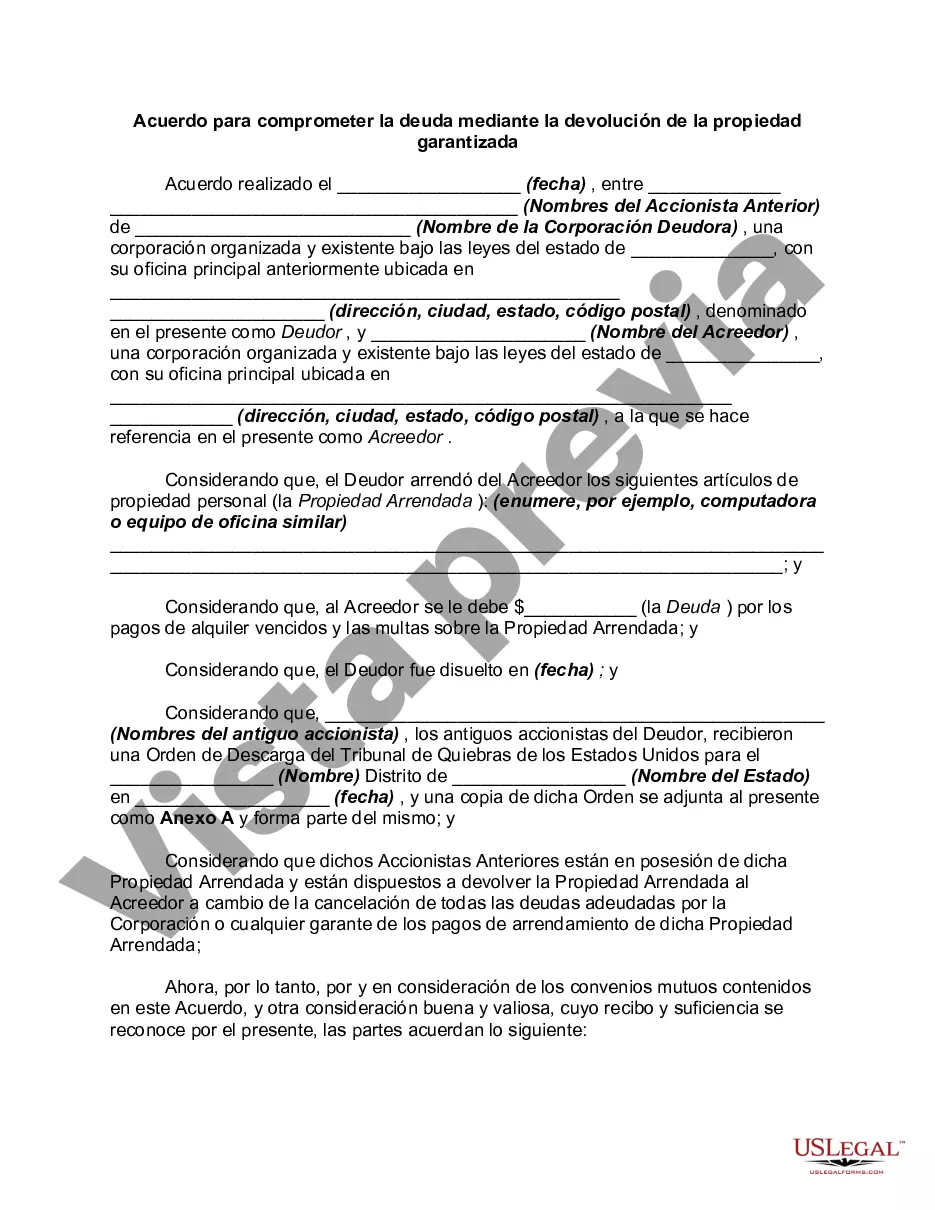

The Cuyahoga Ohio Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions for settling a debt by returning the secured property to the creditor. This agreement provides a way for debtors to resolve their financial obligations while maintaining their ownership rights over the secured assets. In Cuyahoga Ohio, there are various types of agreements that fall under the Agreement to Compromise Debt by Returning Secured Property. These agreements include: 1. Mortgage Compromise Agreement: This type of agreement is commonly used in cases where a debtor is unable to repay their mortgage loan. It allows the debtor to return the mortgaged property to the lender to settle the outstanding debt. 2. Vehicle Loan Compromise Agreement: When a borrower is unable to make payments on their vehicle loan, a Vehicle Loan Compromise Agreement can be utilized. This agreement allows the debtor to return the vehicle to the lender, resolving the debt issue. 3. Personal Property Compromise Agreement: In situations where personal property is used as collateral for a loan, this agreement provides a framework for returning the property to the creditor as a means of compromise to settle the debt. The Cuyahoga Ohio Agreement to Compromise Debt by Returning Secured Property includes several key components. It starts by clearly identifying the debtor and creditor involved, along with their contact information. The agreement then outlines the specific details of the debt, including the amount owed and the secured property being returned. Additionally, the agreement may stipulate any conditions or requirements for returning the secured property, such as its condition upon return or the need for any necessary documentation. It may also address any remaining outstanding debt balances that may be due after the property is returned. The Cuyahoga Ohio Agreement to Compromise Debt by Returning Secured Property aims to provide a mutually beneficial resolution to debt issues while ensuring that both parties' rights and obligations are respected. It is crucial for debtors and creditors to carefully review and understand the terms of this agreement before signing to ensure a fair and lawful compromise is reached.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Cuyahoga Ohio Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Cuyahoga Agreement to Compromise Debt by Returning Secured Property suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Cuyahoga Agreement to Compromise Debt by Returning Secured Property, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Cuyahoga Agreement to Compromise Debt by Returning Secured Property:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cuyahoga Agreement to Compromise Debt by Returning Secured Property.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!