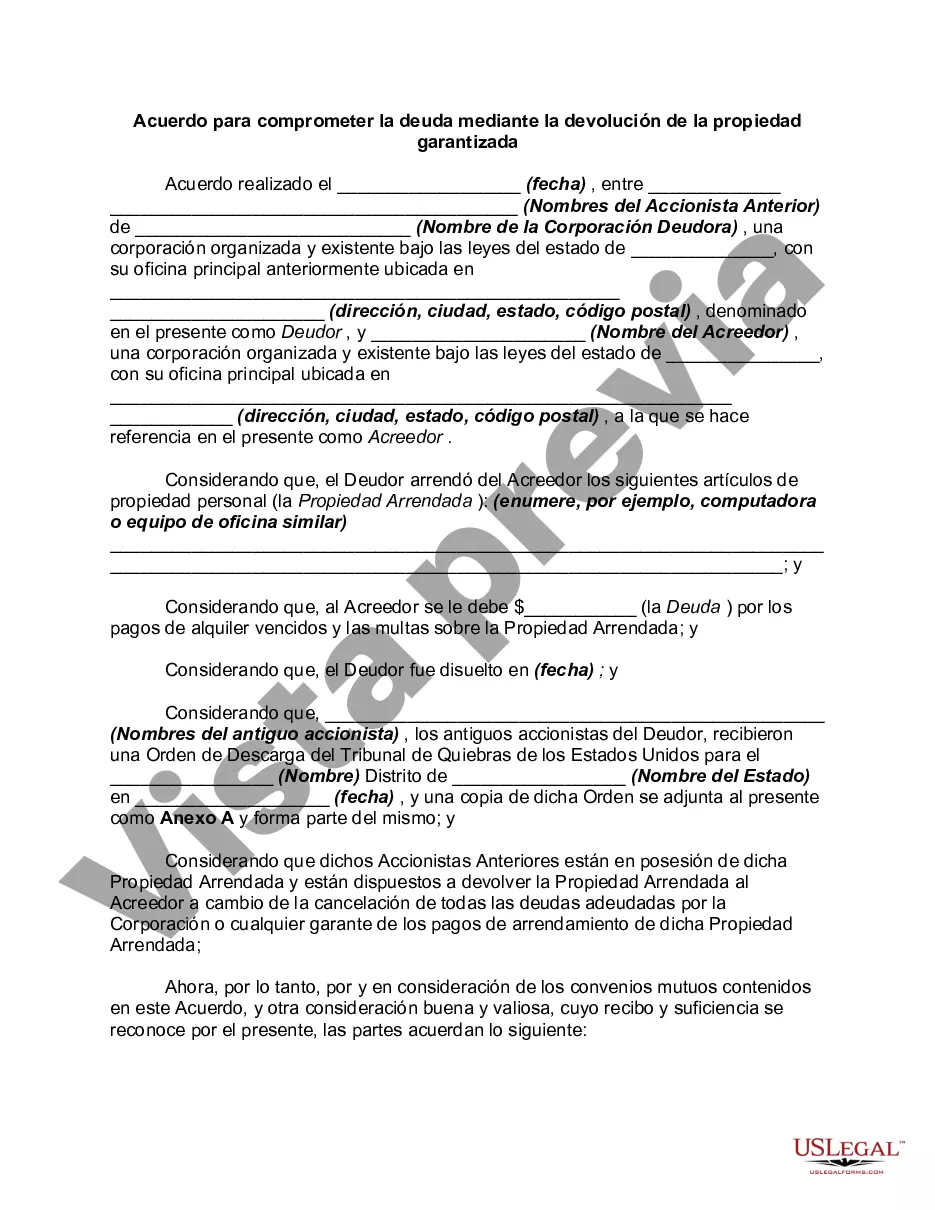

Fulton Georgia Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions under which a debtor can settle their debt by returning the secured property to the creditor. This agreement allows both parties to reach a compromise and avoid lengthy legal proceedings. The Fulton Georgia Agreement to Compromise Debt by Returning Secured Property serves as a legally binding contract between the debtor and the creditor and provides a clear understanding of the responsibilities and obligations of each party involved. By returning the secured property, the debtor is able to satisfy their debt, while the creditor has the opportunity to recover a portion of their losses. Keywords: Fulton Georgia Agreement to Compromise Debt, returning secured property, settlement, debtor, creditor, legal document, compromise, debt resolution, responsibilities, obligations, satisfaction, recovery, losses. Types of Fulton Georgia Agreement to Compromise Debt by Returning Secured Property: 1. Residential Property Compromise Agreement: This type of agreement is specifically used when the secured property in question is a residential property, such as a house or apartment. It outlines the terms and conditions for the debtor to return the property and settle the debt. 2. Commercial Property Compromise Agreement: If the secured property involves a commercial property, such as a retail store or office space, this specific agreement is utilized. It covers the details of returning the property and resolving the debt through compromise. 3. Vehicle Compromise Agreement: In cases where the secured property is a vehicle, such as a car or truck, this agreement will be employed. It provides a framework for the debtor to return the vehicle to the creditor as a method of fulfilling their debt obligation. 4. Personal Property Compromise Agreement: This type of agreement applies to secured debts involving personal property, such as electronics, jewelry, or furnishings. It outlines the terms and conditions for the debtor to return the specific items to the creditor in order to reach an agreement on the outstanding debt. 5. Real Estate Compromise Agreement: When the secured property is real estate, such as land or a building, this agreement is used. It addresses the specific requirements and conditions for the debtor to transfer the property to the creditor as a method of debt compromise. It is important to note that the actual names of the different types of Fulton Georgia Agreement to Compromise Debt by Returning Secured Property may vary depending on the legal terminology used in the state or by individual lawyers or creditors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Fulton Georgia Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Fulton Agreement to Compromise Debt by Returning Secured Property, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Fulton Agreement to Compromise Debt by Returning Secured Property from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Fulton Agreement to Compromise Debt by Returning Secured Property:

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Los bonos pueden dividirse en: Bonos a tasa fija: la tasa de interes esta prefijada y es igual durante toda la vida del bono. Bonos con tasa variable (floating rate): la tasa de interes que se paga en cada cupon es distinta ya que esta en funcion a una tasa de interes de referencia como puede ser la Libor.

Es una cuenta de mercancias, se maneja a precio de costo; su saldo es deudor y expresa el costo de lo vendido. Se carga del valor de las ventas (a precio de costo) y se abona del valor de las devoluciones sobre ventas (a precio de costo).

Esta situacion perduro hasta que el gobierno del licenciado Julio Cesar Mendez Montenegro efectuo el pago del remanente de bonos de la Deuda Inglesa.

La deuda viva es la totalidad de la deuda pendiente de pagar que tiene el Ayuntamiento procedente de prestamos a largo plazo con entidades financieras y avales, es decir, es el capital pendiente de amortizar mas los intereses generados.

En terminos generales, existen dos tipos de bonos: aquellos que pagan intereses o cupones periodicos durante la vigencia de la inversion y los que solo pagan en la fecha de maduracion, los cuales se conocen como Bonos Cero Cupon. En el mercado existen bonos de deuda publica y bonos de deuda privada.

Bonos Bono cupon cero: establece una cantidad fija a pagarse a futuro. Bono cuponado: se paga a los inversionistas su valor nominal. Bono bajo par: define que dicho valor del bono cotiza por debajo de su valor de emision. Bono sobre par: define al valor del bono como cotizado por arriba de valor de emision.

La gestion de la deuda soberana consiste en establecer e implementar una estrategia para la gestion de la deuda publica con el objeto de obtener el monto de financiamiento fijado, alcanzar los objetivos de riesgo y costo y satisfacer cualquier otra meta de gestion de la deuda soberana que se haya propuesto el gobierno,

La deuda perpetua se define como aquella que no tiene fecha de vencimiento, ni tampoco obligacion de devolucion. Sin embargo, mientras la deuda perpetua no se devuelva, los emisores tienen el derecho de solicitar unos intereses.

La deuda perpetua se define como aquella que no tiene fecha de vencimiento, ni tampoco obligacion de devolucion. Sin embargo, mientras la deuda perpetua no se devuelva, los emisores tienen el derecho de solicitar unos intereses.

Caracteristicas. Los bonos son instrumentos de deuda emitidos por sociedades anonimas, y otro tipo de entidades como por ejemplo una institucion publica, un Estado, un gobierno, municipio, etc., con el objetivo de obtener recursos directamente de los mercados de valores.