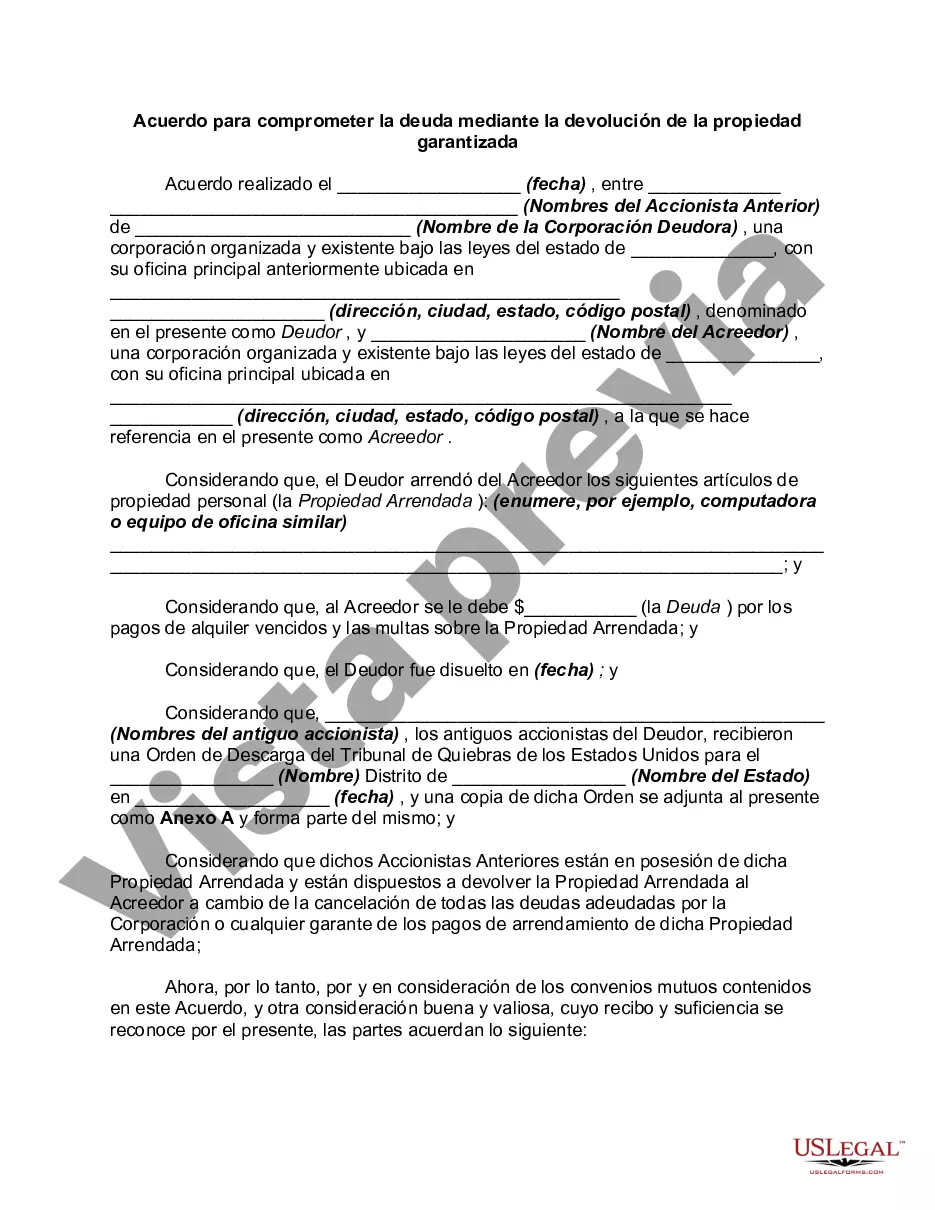

The Montgomery Maryland Agreement to Compromise Debt by Returning Secured Property is a legally binding document that outlines the terms and conditions for resolving debt-related disputes by returning secured property. This agreement is commonly utilized in Montgomery County, Maryland, and provides a structured framework for debtors and creditors to reach a compromise. Keywords: Montgomery Maryland, Agreement, Compromise Debt, Returning Secured Property. 1. Montgomery Maryland Debt Compromise Agreement: A Montgomery Maryland Debt Compromise Agreement is a legal document specific to the jurisdiction of Montgomery County, Maryland. It serves as a formal agreement between a debtor and a creditor, facilitating the resolution of outstanding debts by returning secured property. 2. Purpose of the Agreement: This Agreement to Compromise Debt by Returning Secured Property aims to provide a fair and mutually beneficial solution for both parties involved in a debt dispute. By returning secured property, the debtor can satisfy part or all of their financial obligations, while the creditor can recover their losses or mitigate potential financial harm. 3. Terms and Conditions: The terms and conditions outlined in the Montgomery Maryland Agreement to Compromise Debt by Returning Secured Property include clear guidelines for returning the secured property. These details may involve timelines, delivery methods, and the condition in which the property must be returned to ensure its value is upheld. 4. Identification of Secured Property: The agreement should precisely identify the secured property intended for return. This may include describing the type, quantity, specifications, or any unique identifying features of the property involved, ensuring no confusion or ambiguity arises during the resolution process. 5. Consideration or Compromise: The Agreement to Compromise Debt often includes a clause specifying the consideration or compromise being offered by the creditor in return for the secured property. This may involve forgiving a portion of the debt, reducing interest accrual, extending payment terms, or providing other forms of financial relief. 6. Legal Implications: It is crucial to highlight that signing the Montgomery Maryland Agreement to Compromise Debt by Returning Secured Property has legal implications for both parties involved. Once signed, it serves as a binding contract, and non-compliance can result in potential legal consequences. 7. Review by Legal Professionals: Given the legal nature of the agreement, it is advisable for both parties to seek the advice of legal professionals to review its terms and conditions. This ensures that the interests of both debtor and creditor are adequately protected and that the agreement complies with all applicable laws and regulations. In conclusion, the Montgomery Maryland Agreement to Compromise Debt by Returning Secured Property is a vital tool for resolving debt-related disputes in Montgomery County, Maryland. By adhering to the terms and conditions set forth in this agreement, debtors and creditors can find a middle ground that facilitates the return of secured property while effectively addressing outstanding debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Montgomery Maryland Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

Whether you intend to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Montgomery Agreement to Compromise Debt by Returning Secured Property is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Montgomery Agreement to Compromise Debt by Returning Secured Property. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Agreement to Compromise Debt by Returning Secured Property in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!