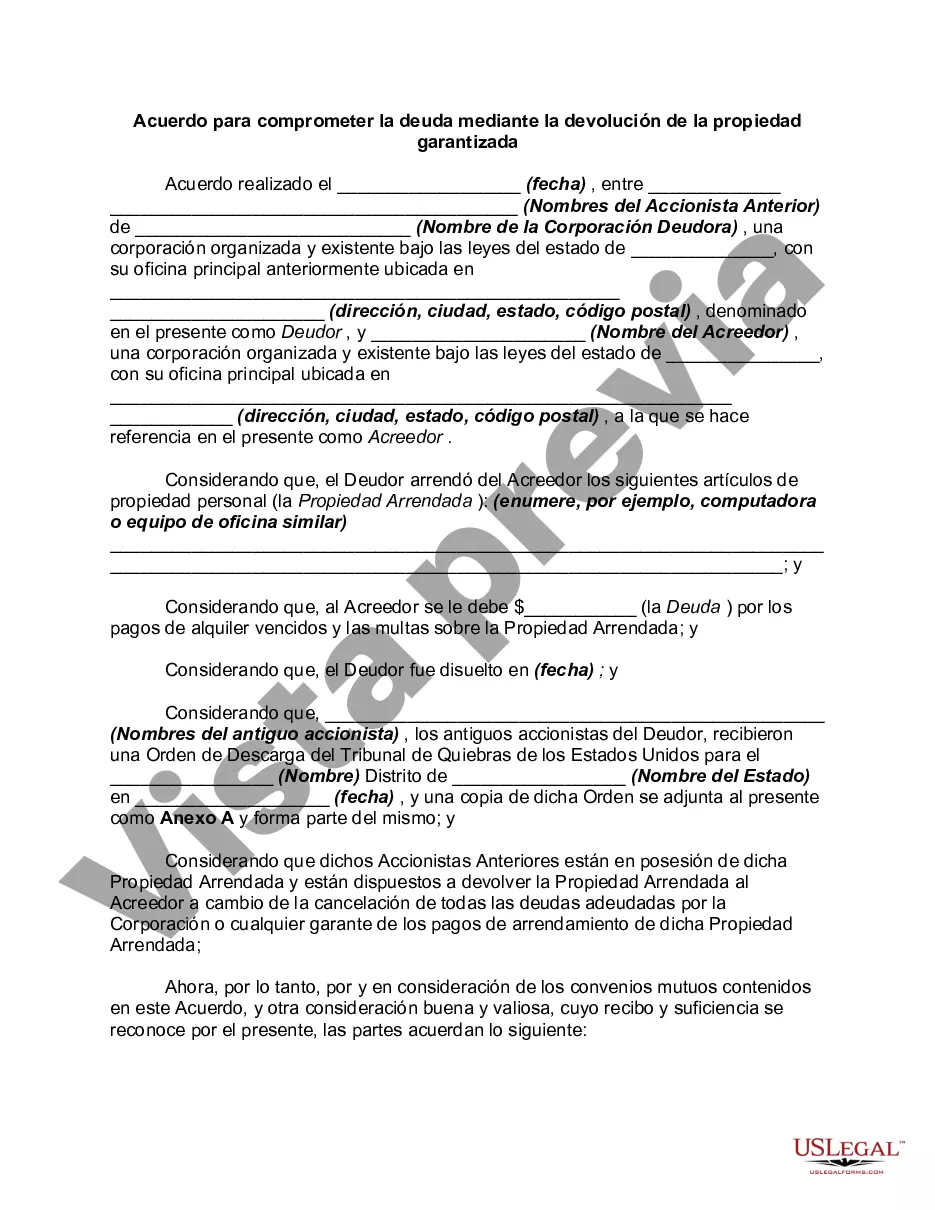

Title: Understanding the Phoenix Arizona Agreement to Compromise Debt by Returning Secured Property Introduction: The Phoenix Arizona Agreement to Compromise Debt by Returning Secured Property is a legal contract designed to resolve debt issues between a debtor and a creditor. This agreement allows the debtor to return secured property to the creditor in exchange for a partial or full discharge of the outstanding debt. It serves as a mutually beneficial solution for both parties involved in debt settlement. In this article, we will delve deeper into the key aspects, types, and benefits of the Phoenix Arizona Agreement to Compromise Debt by Returning Secured Property. Key Components of the Agreement: 1. Identification of Parties Involved: The agreement will clearly state the names and contact details of the debtor (borrower) and the creditor (lender) involved in the debt settlement process. 2. Description of Secured Property: The agreement should provide a detailed description of the property that is being used as collateral for the debt, including its value, condition, and any existing liens or encumbrances. 3. Debt Amount and Terms: The agreement will specify the total outstanding debt owed by the debtor and the agreed-upon terms for the compromise, such as the percentage of debt being discharged and the repayment schedule (if applicable). 4. Return of Secured Property: The agreement outlines the conditions under which the debtor will return the secured property to the creditor, including the timeframe, location, and any necessary maintenance or repair obligations. 5. Release of Liability: Upon successful completion of the agreement, the creditor releases the debtor from any further liability related to the returned secured property, ensuring the debt is fully discharged. Types of Phoenix Arizona Agreements to Compromise Debt by Returning Secured Property: 1. Partial Debt Compromise: In certain cases, debtors may negotiate to return part of the secured property's value to the creditor in exchange for a partial discharge of the debt, allowing them to keep some portion of the collateral. 2. Full Debt Compromise: In other instances, debtors may reach an agreement to return the entire secured property to the creditor in exchange for a full discharge of the outstanding debt, providing a clean slate for both parties involved. Benefits of the Agreement: 1. Debt Resolution: The agreement enables debtors to settle their outstanding debts by returning secured property, helping them regain financial stability and avoid potential legal action or bankruptcy. 2. Creditor Satisfaction: Creditors benefit from this agreement as they regain possession of the secured property, which can be monetized or used to secure alternative financing. 3. Avoidance of Lengthy Legal Proceedings: By negotiating and entering into this agreement, both parties can avoid the time-consuming and expensive legal procedures often associated with debt disputes. 4. Future Creditworthiness: By proactively resolving their debts, debtors can begin rebuilding their credit history and improving their creditworthiness for future financial endeavors. Conclusion: The Phoenix Arizona Agreement to Compromise Debt by Returning Secured Property is a valuable legal instrument that offers a structured approach to resolving debt issues. Whether it involves the partial or full return of secured property, this agreement serves as a win-win solution for both debtors and creditors, facilitating debt settlement and avoiding protracted legal proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Phoenix Arizona Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Phoenix Agreement to Compromise Debt by Returning Secured Property, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the recent version of the Phoenix Agreement to Compromise Debt by Returning Secured Property, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Agreement to Compromise Debt by Returning Secured Property:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Phoenix Agreement to Compromise Debt by Returning Secured Property and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!