The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

The Allegheny Pennsylvania Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows debtors in Allegheny County to provide a detailed account of their financial situation in order to persuade creditors to compromise or write off past due debts. This affidavit is crucial for individuals who find themselves unable to repay outstanding debts and need a structured approach to resolve their financial burdens. The affidavit typically includes the following information: 1. Debtor Information: The debtor must provide their full legal name, contact information, and any aliases or alternate names they may have used. Additionally, their social security number and date of birth may be required for identification purposes. 2. Creditor Details: This section outlines the name and contact information of the creditor or creditors to whom the debt is owed. It is important to list all relevant creditors to ensure a comprehensive overview of the debt situation. 3. Financial Holdings and Assets: The debtor will be required to disclose all their financial holdings, including but not limited to bank accounts, investment portfolios, real estate holdings, vehicles, and other valuable assets. Accurate valuations of these assets are crucial to give creditors a clear understanding of the debtor's overall financial position. 4. Income and Employment Details: Debtors need to provide detailed information about their current employment status, including employer name, job title, salary or wages earned, and any other sources of income. This section also covers information regarding self-employment income, royalties, rental income, or any other form of regular monetary inflow. 5. Debt Summary: This section is dedicated to outlining the nature of the debt, including the original amount owed, current outstanding balance, interest rate, creditor's name, account numbers, and payment history. Debtors may be required to provide supporting documentation, such as loan agreements, credit card statements, or collection notices. 6. Monthly Expense Breakdown: It is essential for debtors to provide a detailed breakdown of their monthly expenses, including rent/mortgage payments, utilities, groceries, transportation costs, medical expenses, insurance, and any other necessary expenditures. This information aids in assessing the debtor's ability to fulfill their financial obligations. 7. Declaration and Signature: The affidavit must conclude with a declaration stating that all the information provided is true and accurate to the best of the debtor's knowledge. The debtor must then sign the document, often in the presence of a notary public or other authorized witness. While the basic structure and content of the Allegheny Pennsylvania Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities are generally standard, it is possible that specific variations of this document might exist to address unique circumstances or legal requirements. These variations can include modifications for different types of debts, such as credit card debt, medical bills, student loans, or other financial obligations. Additionally, certain sectors like businesses or organizations may have their own specific forms or requirements when filing the affidavit.The Allegheny Pennsylvania Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows debtors in Allegheny County to provide a detailed account of their financial situation in order to persuade creditors to compromise or write off past due debts. This affidavit is crucial for individuals who find themselves unable to repay outstanding debts and need a structured approach to resolve their financial burdens. The affidavit typically includes the following information: 1. Debtor Information: The debtor must provide their full legal name, contact information, and any aliases or alternate names they may have used. Additionally, their social security number and date of birth may be required for identification purposes. 2. Creditor Details: This section outlines the name and contact information of the creditor or creditors to whom the debt is owed. It is important to list all relevant creditors to ensure a comprehensive overview of the debt situation. 3. Financial Holdings and Assets: The debtor will be required to disclose all their financial holdings, including but not limited to bank accounts, investment portfolios, real estate holdings, vehicles, and other valuable assets. Accurate valuations of these assets are crucial to give creditors a clear understanding of the debtor's overall financial position. 4. Income and Employment Details: Debtors need to provide detailed information about their current employment status, including employer name, job title, salary or wages earned, and any other sources of income. This section also covers information regarding self-employment income, royalties, rental income, or any other form of regular monetary inflow. 5. Debt Summary: This section is dedicated to outlining the nature of the debt, including the original amount owed, current outstanding balance, interest rate, creditor's name, account numbers, and payment history. Debtors may be required to provide supporting documentation, such as loan agreements, credit card statements, or collection notices. 6. Monthly Expense Breakdown: It is essential for debtors to provide a detailed breakdown of their monthly expenses, including rent/mortgage payments, utilities, groceries, transportation costs, medical expenses, insurance, and any other necessary expenditures. This information aids in assessing the debtor's ability to fulfill their financial obligations. 7. Declaration and Signature: The affidavit must conclude with a declaration stating that all the information provided is true and accurate to the best of the debtor's knowledge. The debtor must then sign the document, often in the presence of a notary public or other authorized witness. While the basic structure and content of the Allegheny Pennsylvania Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities are generally standard, it is possible that specific variations of this document might exist to address unique circumstances or legal requirements. These variations can include modifications for different types of debts, such as credit card debt, medical bills, student loans, or other financial obligations. Additionally, certain sectors like businesses or organizations may have their own specific forms or requirements when filing the affidavit.

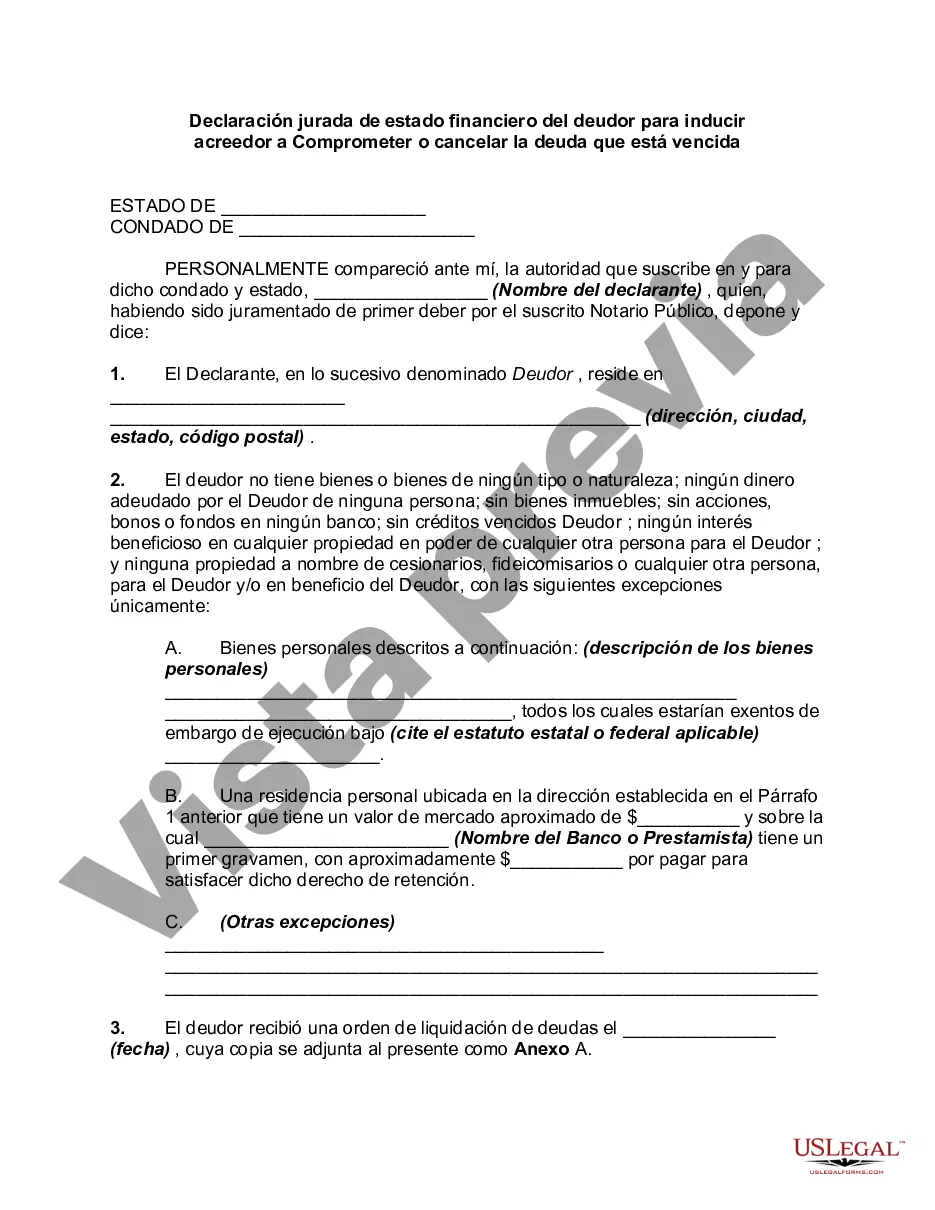

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.