The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Fairfax Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that debtors in Fairfax, Virginia can use to provide a detailed overview of their financial status in order to convince creditors to compromise or write off their past-due debts. This affidavit contains essential information about the debtor's assets, liabilities, and overall financial condition. Keywords: Fairfax Virginia, debtor, affidavit, financial status, induce creditor, compromise, write off, debt, past due, assets, liabilities. Different Types of Fairfax Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities may include: 1. Individual Debtor's Affidavit: This type of affidavit is used by individuals who owe money to a creditor and want to provide a comprehensive overview of their financial situation to negotiate a settlement or debt forgiveness. 2. Business Debtor's Affidavit: This variant of the affidavit is specifically designed for business entities or companies that have outstanding debts. It allows them to present their financial standing and request a compromise or debt write-off. 3. Joint Debtor's Affidavit: In cases where the debt is shared by multiple individuals, a joint debtor's affidavit can be used to provide a collective overview of the financial status of all the debtors involved. 4. Secured Debtor's Affidavit: This type of affidavit is used when the debtor has secured debts, such as a mortgage or car loan, and wishes to provide details of these specific assets and liabilities. 5. Unsecured Debtor's Affidavit: For debtors with unsecured debts, such as credit card balances or personal loans, an unsecured debtor's affidavit can be utilized to outline the financial information associated with these debts and potential compromise options. These variations may have differences in the specific sections or requirements based on the nature of the debt and the debtor's circumstances. However, the fundamental purpose of all Fairfax Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities remains the same — to provide an accurate and detailed account of the debtor's financial situation to encourage a resolution of the debt.Fairfax Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that debtors in Fairfax, Virginia can use to provide a detailed overview of their financial status in order to convince creditors to compromise or write off their past-due debts. This affidavit contains essential information about the debtor's assets, liabilities, and overall financial condition. Keywords: Fairfax Virginia, debtor, affidavit, financial status, induce creditor, compromise, write off, debt, past due, assets, liabilities. Different Types of Fairfax Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities may include: 1. Individual Debtor's Affidavit: This type of affidavit is used by individuals who owe money to a creditor and want to provide a comprehensive overview of their financial situation to negotiate a settlement or debt forgiveness. 2. Business Debtor's Affidavit: This variant of the affidavit is specifically designed for business entities or companies that have outstanding debts. It allows them to present their financial standing and request a compromise or debt write-off. 3. Joint Debtor's Affidavit: In cases where the debt is shared by multiple individuals, a joint debtor's affidavit can be used to provide a collective overview of the financial status of all the debtors involved. 4. Secured Debtor's Affidavit: This type of affidavit is used when the debtor has secured debts, such as a mortgage or car loan, and wishes to provide details of these specific assets and liabilities. 5. Unsecured Debtor's Affidavit: For debtors with unsecured debts, such as credit card balances or personal loans, an unsecured debtor's affidavit can be utilized to outline the financial information associated with these debts and potential compromise options. These variations may have differences in the specific sections or requirements based on the nature of the debt and the debtor's circumstances. However, the fundamental purpose of all Fairfax Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities remains the same — to provide an accurate and detailed account of the debtor's financial situation to encourage a resolution of the debt.

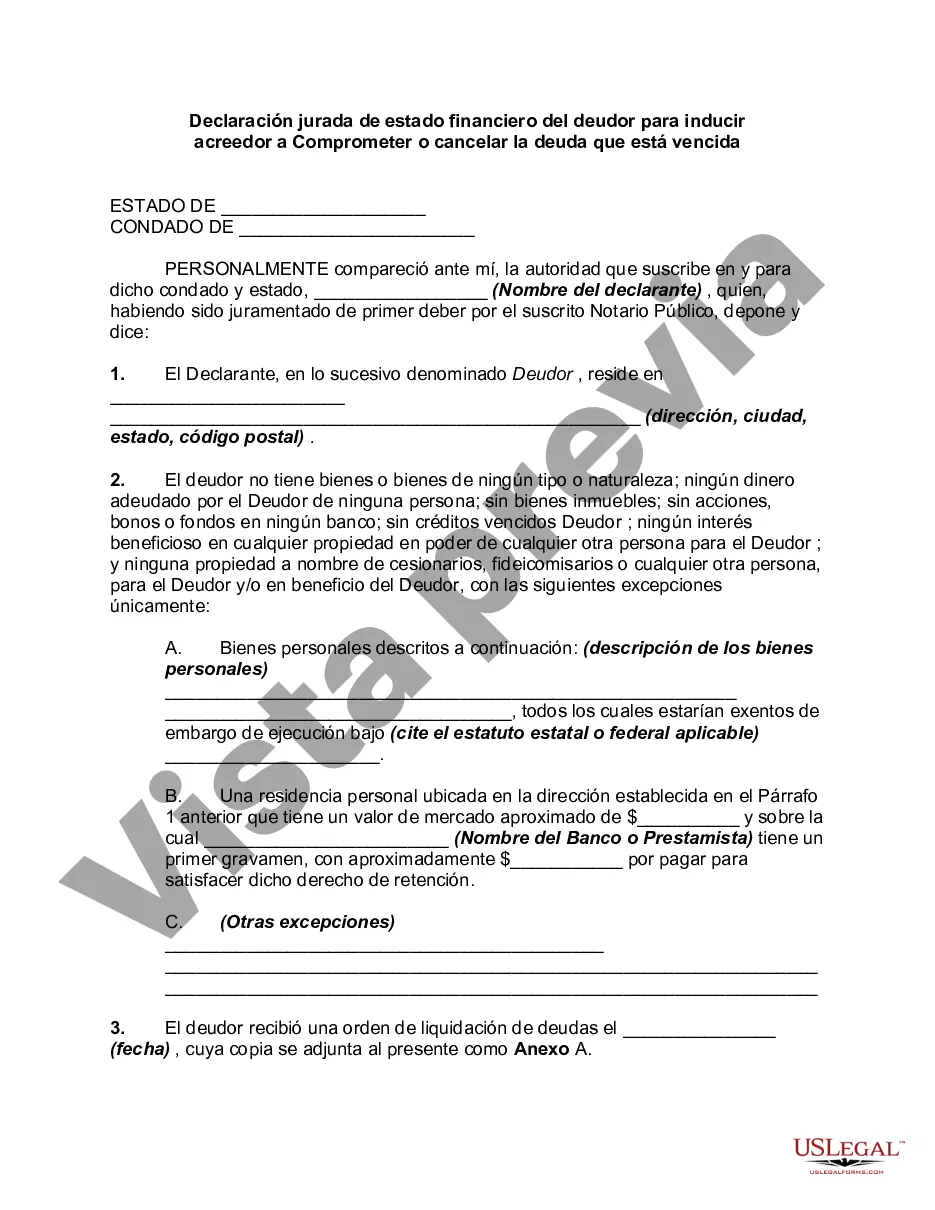

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.