The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Fulton Georgia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities In Fulton, Georgia, debtors who are struggling with past-due debts have the option to submit a Debtor's Affidavit of Financial Status to their creditors in order to seek a compromise or debt write-off. This legal document provides a detailed overview of the debtor's current financial situation, including their assets and liabilities, to demonstrate their inability to fully repay the outstanding debt. The Fulton Georgia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt is a crucial tool for individuals facing financial hardship and seeking a resolution with their creditors. By disclosing their financial information, debtors can present a compelling case for why the creditor should consider compromising or forgiving the debt entirely. The affidavit consists of two major sections: assets and liabilities. Debtors are required to provide an accurate and complete account of their financial status in these sections, using relevant keywords to ensure clarity and transparency. Let's delve into each section in detail: 1. Assets: In this section, the debtor provides a comprehensive list of their assets. Common keywords to include are: — Real estate properties (homes, land, rental properties) — Personal property (vehicles, jewelry, electronics) — Bank accounts (checking, savings, investments) — Retirement accounts (401(k), IRAs— - Life insurance policies (cash value) — Any other valuable assets or sources of income For each asset, the debtor should specify the approximate value, ownership details, and any existing liens or encumbrances. 2. Liabilities: In this section, the debtor outlines their outstanding debts and obligations. Pertinent keywords include: — Credit card debt— - Loans (personal, auto, student, mortgage) — Medical bill— - Taxes owed - Utility bills (past-due) — Outstanding judgments or lien— - Any other financial obligations The debtor needs to provide details such as the creditor's name, outstanding balance, monthly payment, and the status of each debt (past-due, in collections, etc.). It is important to note that there might be variations or additional types of Debtor's Affidavit of Financial Status in Fulton, Georgia, depending on specific circumstances or court requirements. Some variations may focus on specific industries or professions, such as small business owners or self-employed individuals. Submitting a Fulton Georgia Debtor's Affidavit of Financial Status demonstrates a debtor's sincere intention to resolve their financial obligations, allowing them to explore potential compromises or debt write-offs. By accurately and transparently disclosing assets and liabilities, debtors can present a compelling case for why a creditor should consider their request. Seeking professional legal advice is always recommended for individuals considering this type of legal document.Fulton Georgia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities In Fulton, Georgia, debtors who are struggling with past-due debts have the option to submit a Debtor's Affidavit of Financial Status to their creditors in order to seek a compromise or debt write-off. This legal document provides a detailed overview of the debtor's current financial situation, including their assets and liabilities, to demonstrate their inability to fully repay the outstanding debt. The Fulton Georgia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt is a crucial tool for individuals facing financial hardship and seeking a resolution with their creditors. By disclosing their financial information, debtors can present a compelling case for why the creditor should consider compromising or forgiving the debt entirely. The affidavit consists of two major sections: assets and liabilities. Debtors are required to provide an accurate and complete account of their financial status in these sections, using relevant keywords to ensure clarity and transparency. Let's delve into each section in detail: 1. Assets: In this section, the debtor provides a comprehensive list of their assets. Common keywords to include are: — Real estate properties (homes, land, rental properties) — Personal property (vehicles, jewelry, electronics) — Bank accounts (checking, savings, investments) — Retirement accounts (401(k), IRAs— - Life insurance policies (cash value) — Any other valuable assets or sources of income For each asset, the debtor should specify the approximate value, ownership details, and any existing liens or encumbrances. 2. Liabilities: In this section, the debtor outlines their outstanding debts and obligations. Pertinent keywords include: — Credit card debt— - Loans (personal, auto, student, mortgage) — Medical bill— - Taxes owed - Utility bills (past-due) — Outstanding judgments or lien— - Any other financial obligations The debtor needs to provide details such as the creditor's name, outstanding balance, monthly payment, and the status of each debt (past-due, in collections, etc.). It is important to note that there might be variations or additional types of Debtor's Affidavit of Financial Status in Fulton, Georgia, depending on specific circumstances or court requirements. Some variations may focus on specific industries or professions, such as small business owners or self-employed individuals. Submitting a Fulton Georgia Debtor's Affidavit of Financial Status demonstrates a debtor's sincere intention to resolve their financial obligations, allowing them to explore potential compromises or debt write-offs. By accurately and transparently disclosing assets and liabilities, debtors can present a compelling case for why a creditor should consider their request. Seeking professional legal advice is always recommended for individuals considering this type of legal document.

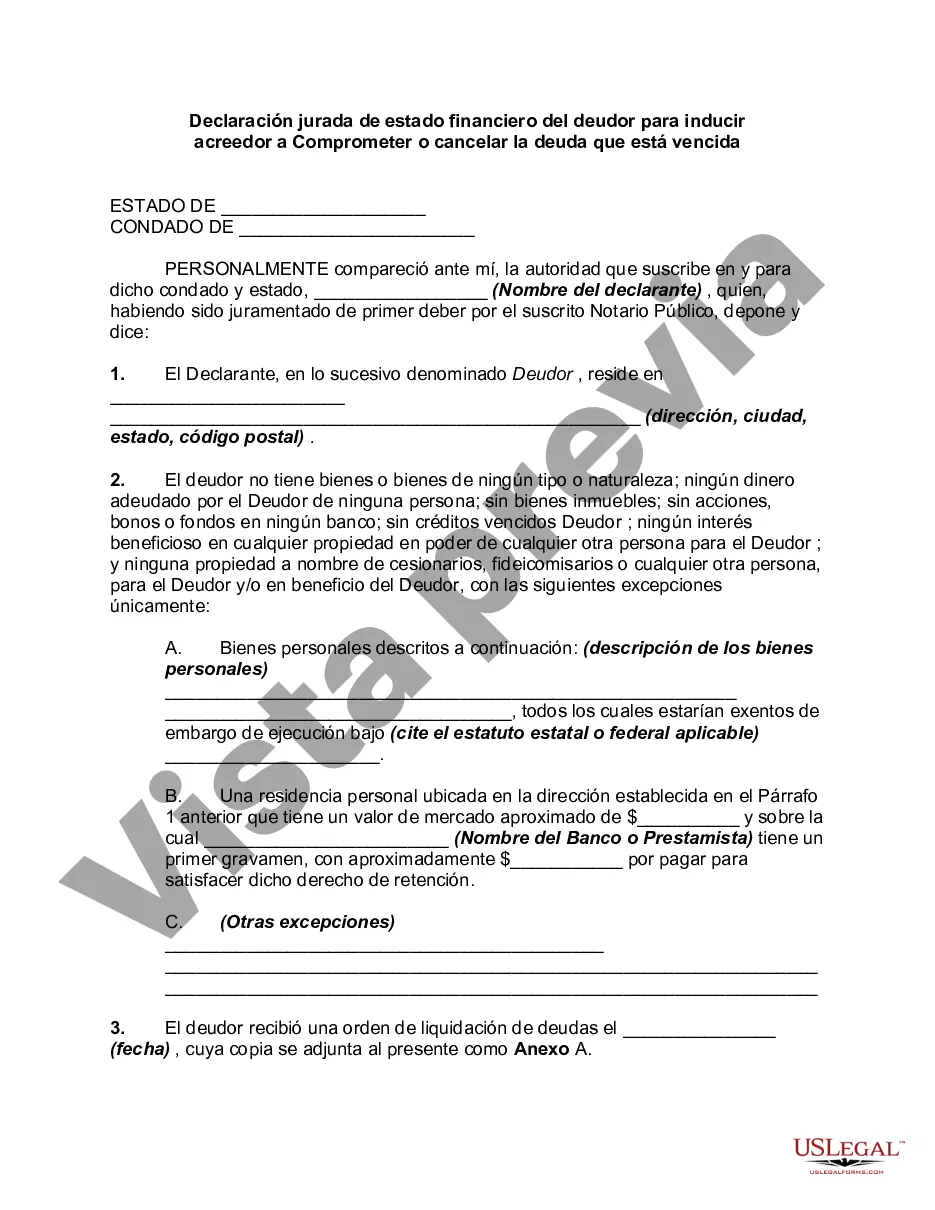

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.