The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

The Hennepin Minnesota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows debtors in Hennepin County, Minnesota, to provide detailed information about their financial situation in order to negotiate with creditors. This affidavit is an essential tool for individuals and businesses struggling with past due debts, aiming to convince creditors to compromise or write off the outstanding amount. The affidavit serves as a comprehensive record of both the debtor's assets and liabilities, providing an accurate snapshot of their financial standing. By disclosing this information, debtors hope to demonstrate their inability to pay the full debt and convince creditors to accept a compromise or write off the remaining balance. The affidavit typically includes several sections, each focusing on different aspects of the debtor's financial status. The first section of the affidavit requires the debtor to provide personal information, such as their name, address, contact details, and social security number. Additionally, debtors may be required to disclose their employment status, including their current job and monthly income. The next section involves a detailed breakdown of the debtor's assets. This includes listing all valuable possessions such as real estate, vehicles, investments, bank accounts, and any other assets that can potentially be used as collateral or liquidated to repay the debt. On the other hand, the liabilities section requires the debtor to list all outstanding debts, including the amount owed, the creditor's name and contact information, and the current status of each debt. It is crucial to include all debts, both secured and unsecured, for an accurate representation of the debtor's financial situation. In some cases, there may be variations of this debtor's affidavit, depending on the specific circumstances or the policies of individual creditors. However, the basic structure and purpose of the document remain the same — to provide a clear overview of the debtor's financial status. Other possible variations may include affidavits for specific types of debts, such as credit card debts, medical debts, or mortgage debts. These specific affidavits might require additional information tailored to each type of debt to provide a more accurate representation of the debtor's financial difficulties. Overall, the Hennepin Minnesota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is an essential legal document for debtors seeking to negotiate with creditors. By honestly disclosing their financial situation, debtors hope to reach a compromise or convince creditors to write off a portion of the debt, offering them a potential fresh start to regain their financial stability.The Hennepin Minnesota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows debtors in Hennepin County, Minnesota, to provide detailed information about their financial situation in order to negotiate with creditors. This affidavit is an essential tool for individuals and businesses struggling with past due debts, aiming to convince creditors to compromise or write off the outstanding amount. The affidavit serves as a comprehensive record of both the debtor's assets and liabilities, providing an accurate snapshot of their financial standing. By disclosing this information, debtors hope to demonstrate their inability to pay the full debt and convince creditors to accept a compromise or write off the remaining balance. The affidavit typically includes several sections, each focusing on different aspects of the debtor's financial status. The first section of the affidavit requires the debtor to provide personal information, such as their name, address, contact details, and social security number. Additionally, debtors may be required to disclose their employment status, including their current job and monthly income. The next section involves a detailed breakdown of the debtor's assets. This includes listing all valuable possessions such as real estate, vehicles, investments, bank accounts, and any other assets that can potentially be used as collateral or liquidated to repay the debt. On the other hand, the liabilities section requires the debtor to list all outstanding debts, including the amount owed, the creditor's name and contact information, and the current status of each debt. It is crucial to include all debts, both secured and unsecured, for an accurate representation of the debtor's financial situation. In some cases, there may be variations of this debtor's affidavit, depending on the specific circumstances or the policies of individual creditors. However, the basic structure and purpose of the document remain the same — to provide a clear overview of the debtor's financial status. Other possible variations may include affidavits for specific types of debts, such as credit card debts, medical debts, or mortgage debts. These specific affidavits might require additional information tailored to each type of debt to provide a more accurate representation of the debtor's financial difficulties. Overall, the Hennepin Minnesota Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is an essential legal document for debtors seeking to negotiate with creditors. By honestly disclosing their financial situation, debtors hope to reach a compromise or convince creditors to write off a portion of the debt, offering them a potential fresh start to regain their financial stability.

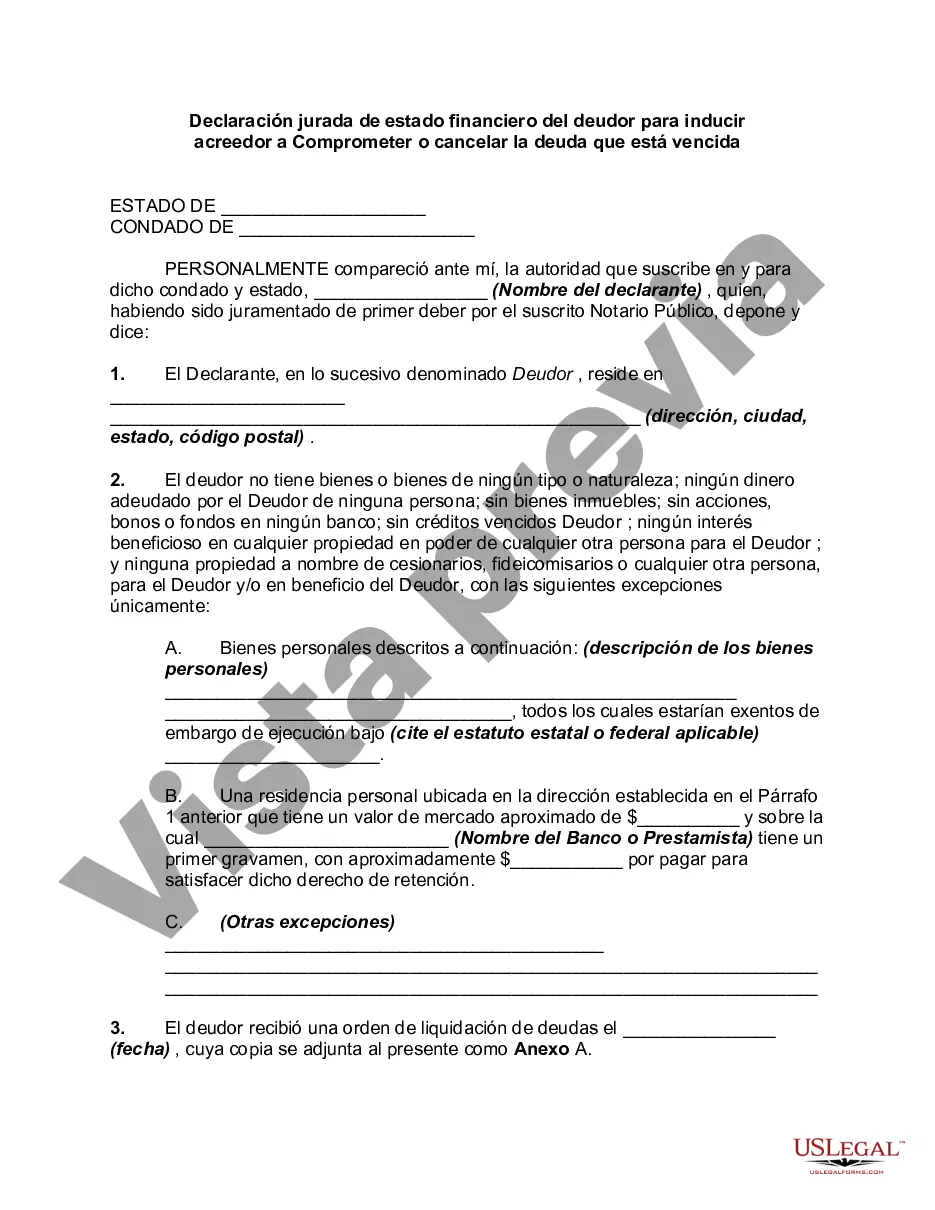

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.