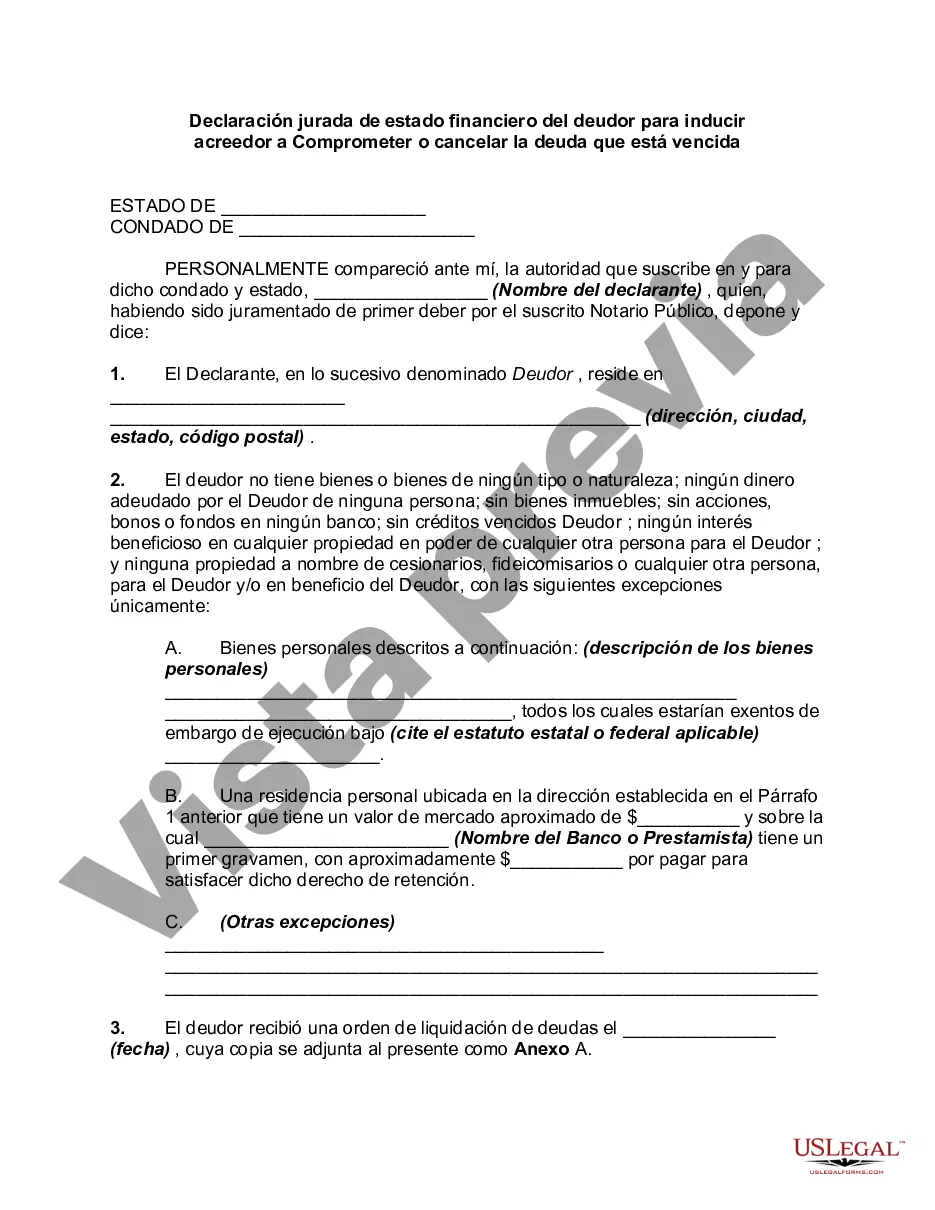

The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

A Hillsborough Florida Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used by debtors in Hillsborough County, Florida, to present a detailed overview of their financial situation to their creditors. This affidavit is specifically designed to encourage creditors to consider compromising or writing off the debt that the debtor owes due to financial difficulties. The purpose of the affidavit is to provide the creditor with an understanding of the debtor's current financial state, including their assets and liabilities. By disclosing this information, debtors aim to convince their creditors that they are unable to repay the debt in full and request a settlement arrangement or to have a portion of the debt forgiven. The debtor's affidavit typically includes the following sections: 1. Debtor Information: This section requires the debtor to provide their full name, address, contact details, and any relevant identification or account numbers associated with the debt. 2. Financial Summary: Here, the debtor provides a comprehensive overview of their income, expenses, and financial obligations. This includes detailing their monthly income, such as salary, benefits, or any other sources, as well as monthly expenses, such as rent or mortgage, utilities, transportation, and groceries. Included in this section are the debtor's monthly debt payments towards other obligations, such as loans or credit cards. 3. Assets: In this section, the debtor lists all their assets, such as real estate, vehicles, investments, bank accounts, and any other valuable possessions. The debtor may need to provide supporting documentation, such as property deeds, account statements, or valuations, to verify the value and ownership of the assets. 4. Liabilities: Here, the debtor outlines all their outstanding debts, including the debt in question and any other loans, credit card balances, or financial obligations. The debtor needs to provide details of the creditors, the current balances owed, and the terms of repayment. 5. Financial Hardship Explanation: This section allows the debtor to explain the circumstances that led to their financial hardship and their inability to repay the debt in full. It may include factors such as job loss, medical expenses, divorce, or other significant life events that have affected their financial stability. It's important to note that there may not be different types of Hillsborough Florida Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities. However, different debtors may have unique circumstances and financial situations, which will lead to variations in the content and details provided within the affidavit. Overall, the purpose of this affidavit is to provide debtors with an opportunity to present a transparent and detailed snapshot of their financial situation to creditors. By doing so, debtors hope to persuade their creditors to consider compromising or forgiving a portion of the past-due debt, thus offering them a chance to resolve their financial difficulties.A Hillsborough Florida Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used by debtors in Hillsborough County, Florida, to present a detailed overview of their financial situation to their creditors. This affidavit is specifically designed to encourage creditors to consider compromising or writing off the debt that the debtor owes due to financial difficulties. The purpose of the affidavit is to provide the creditor with an understanding of the debtor's current financial state, including their assets and liabilities. By disclosing this information, debtors aim to convince their creditors that they are unable to repay the debt in full and request a settlement arrangement or to have a portion of the debt forgiven. The debtor's affidavit typically includes the following sections: 1. Debtor Information: This section requires the debtor to provide their full name, address, contact details, and any relevant identification or account numbers associated with the debt. 2. Financial Summary: Here, the debtor provides a comprehensive overview of their income, expenses, and financial obligations. This includes detailing their monthly income, such as salary, benefits, or any other sources, as well as monthly expenses, such as rent or mortgage, utilities, transportation, and groceries. Included in this section are the debtor's monthly debt payments towards other obligations, such as loans or credit cards. 3. Assets: In this section, the debtor lists all their assets, such as real estate, vehicles, investments, bank accounts, and any other valuable possessions. The debtor may need to provide supporting documentation, such as property deeds, account statements, or valuations, to verify the value and ownership of the assets. 4. Liabilities: Here, the debtor outlines all their outstanding debts, including the debt in question and any other loans, credit card balances, or financial obligations. The debtor needs to provide details of the creditors, the current balances owed, and the terms of repayment. 5. Financial Hardship Explanation: This section allows the debtor to explain the circumstances that led to their financial hardship and their inability to repay the debt in full. It may include factors such as job loss, medical expenses, divorce, or other significant life events that have affected their financial stability. It's important to note that there may not be different types of Hillsborough Florida Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities. However, different debtors may have unique circumstances and financial situations, which will lead to variations in the content and details provided within the affidavit. Overall, the purpose of this affidavit is to provide debtors with an opportunity to present a transparent and detailed snapshot of their financial situation to creditors. By doing so, debtors hope to persuade their creditors to consider compromising or forgiving a portion of the past-due debt, thus offering them a chance to resolve their financial difficulties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.