The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

King Washington Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that provides a comprehensive overview of an individual's financial situation, aiming to convince a creditor to settle or forgive a past due debt. This affidavit outlines the debtor's assets, liabilities, and financial status to present a clear picture of their ability to repay the debt. By disclosing their financial information, debtors can seek a compromise or debt write-off, indicating to creditors their intent to address the outstanding debt responsibly and work towards a favorable resolution. There may be different variations or types of King Washington Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt based on specific circumstances or jurisdiction. These variations may include: 1. Individual Debtor's Affidavit: This affidavit is specifically designed for individuals who wish to negotiate a compromise or debt write-off with a creditor for their personal liabilities. 2. Business Debtor's Affidavit: This type of affidavit is tailored for business entities seeking to settle or write off outstanding debts owed to creditors. This may involve disclosing the business's assets, liabilities, and financial status to showcase the ability to repay the debt. 3. Joint Debtor's Affidavit: A joint debtor's affidavit is used when multiple individuals or entities are jointly liable for a debt. In this case, all parties involved would disclose their respective assets and liabilities to portray a collective financial status in support of a compromise or debt write-off request. 4. Affidavit Based on Financial Hardship: This specific affidavit emphasizes the debtor's financial hardship, detailing circumstances such as job loss, medical emergencies, or unforeseen financial burdens. By highlighting these hardships, debtors aim to convey their inability to repay the debt fully and request a compromise from the creditor. 5. Affidavit for Negotiating a Settlement or Debt Write-Off: This type of affidavit generally covers both assets and liabilities relevant to the debt in question. It includes a detailed breakdown of all current assets, such as real estate, vehicles, investments, bank accounts, and the valuation of each. Liabilities, including other outstanding debts, monthly expenses, and income sources, are also documented to provide a comprehensive overview of the debtor's financial capacity. In all cases, the King Washington Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt emphasizes the debtor's sincerity in resolving the past due debt while considering the limitations of their financial situation. By presenting an accurate and honest portrayal of their assets and liabilities, debtors hope to persuade creditors to agree to a settlement or debt forgiveness arrangement that is mutually beneficial. It is essential to consult with legal professionals or advisors to ensure the content within the affidavit aligns with specific jurisdictional requirements and legal standards.King Washington Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that provides a comprehensive overview of an individual's financial situation, aiming to convince a creditor to settle or forgive a past due debt. This affidavit outlines the debtor's assets, liabilities, and financial status to present a clear picture of their ability to repay the debt. By disclosing their financial information, debtors can seek a compromise or debt write-off, indicating to creditors their intent to address the outstanding debt responsibly and work towards a favorable resolution. There may be different variations or types of King Washington Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt based on specific circumstances or jurisdiction. These variations may include: 1. Individual Debtor's Affidavit: This affidavit is specifically designed for individuals who wish to negotiate a compromise or debt write-off with a creditor for their personal liabilities. 2. Business Debtor's Affidavit: This type of affidavit is tailored for business entities seeking to settle or write off outstanding debts owed to creditors. This may involve disclosing the business's assets, liabilities, and financial status to showcase the ability to repay the debt. 3. Joint Debtor's Affidavit: A joint debtor's affidavit is used when multiple individuals or entities are jointly liable for a debt. In this case, all parties involved would disclose their respective assets and liabilities to portray a collective financial status in support of a compromise or debt write-off request. 4. Affidavit Based on Financial Hardship: This specific affidavit emphasizes the debtor's financial hardship, detailing circumstances such as job loss, medical emergencies, or unforeseen financial burdens. By highlighting these hardships, debtors aim to convey their inability to repay the debt fully and request a compromise from the creditor. 5. Affidavit for Negotiating a Settlement or Debt Write-Off: This type of affidavit generally covers both assets and liabilities relevant to the debt in question. It includes a detailed breakdown of all current assets, such as real estate, vehicles, investments, bank accounts, and the valuation of each. Liabilities, including other outstanding debts, monthly expenses, and income sources, are also documented to provide a comprehensive overview of the debtor's financial capacity. In all cases, the King Washington Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt emphasizes the debtor's sincerity in resolving the past due debt while considering the limitations of their financial situation. By presenting an accurate and honest portrayal of their assets and liabilities, debtors hope to persuade creditors to agree to a settlement or debt forgiveness arrangement that is mutually beneficial. It is essential to consult with legal professionals or advisors to ensure the content within the affidavit aligns with specific jurisdictional requirements and legal standards.

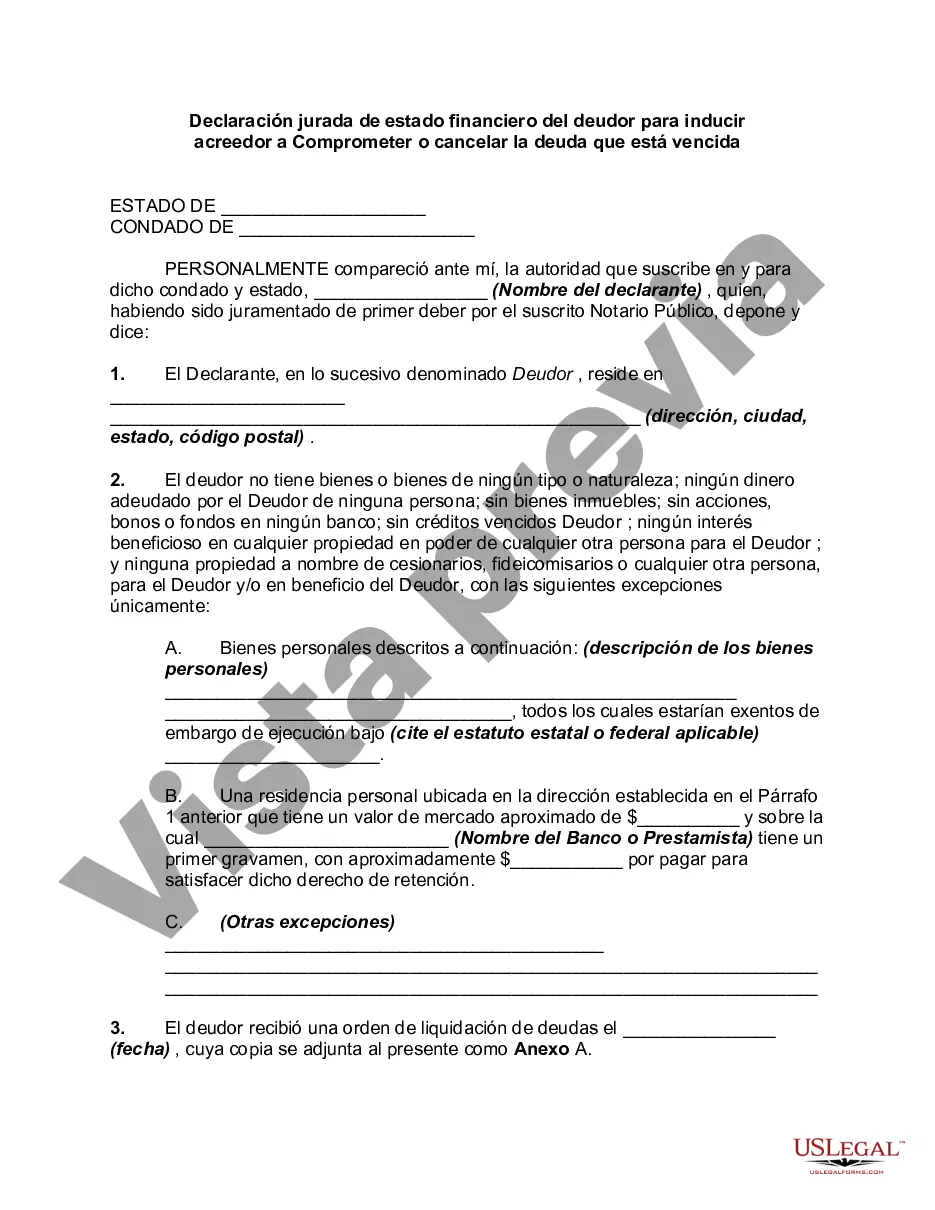

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.