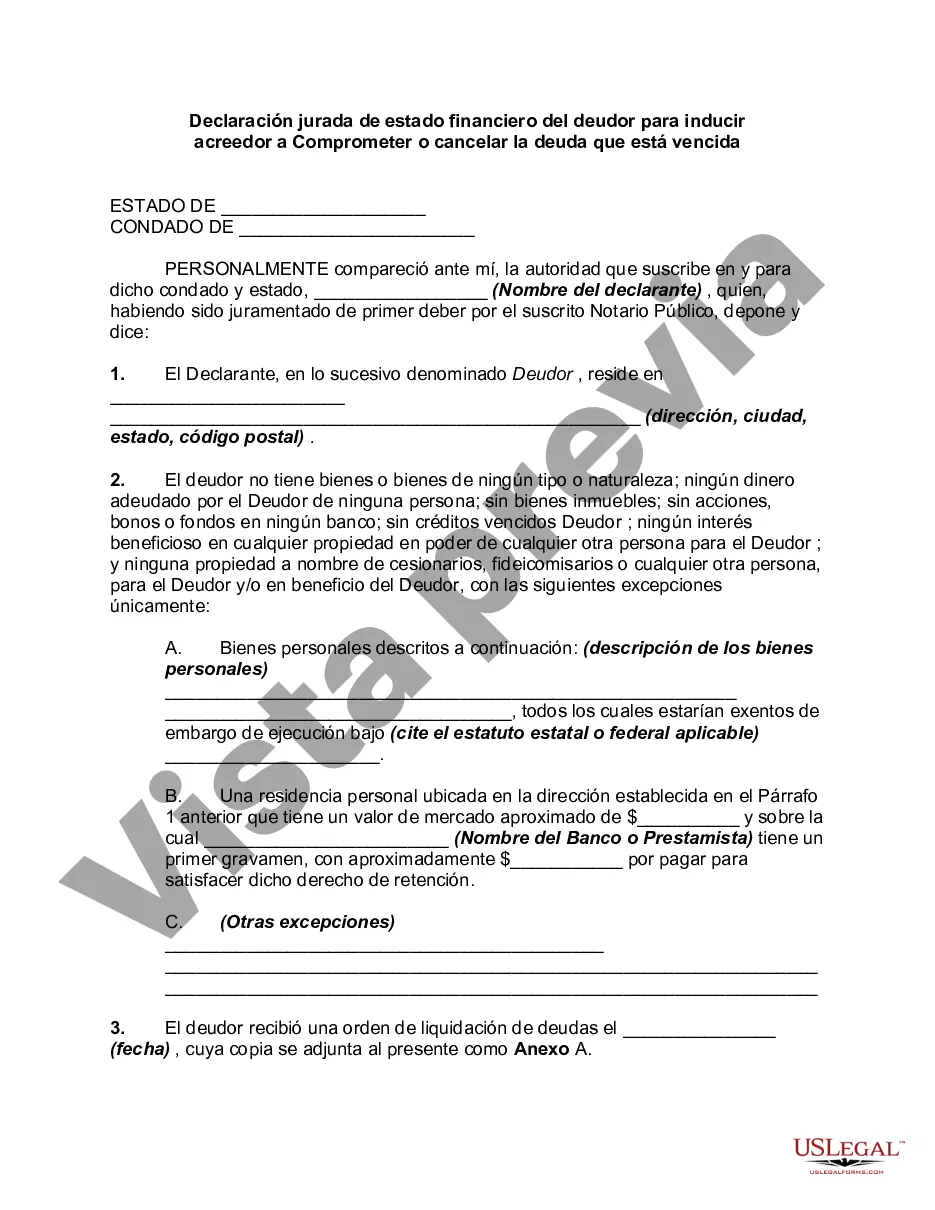

The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Mecklenburg North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used by debtors in Mecklenburg County, North Carolina, to disclose their financial situation to creditors in order to negotiate a settlement or debt forgiveness. This affidavit plays a crucial role in debt resolution processes and provides crucial information regarding the debtor's assets and liabilities. By understanding the debtor's financial status, creditors can assess the likelihood of recovering the debt and determine the best course of action. The Mecklenburg North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities typically includes the following content: 1. Debt details: The debtor must provide comprehensive information about the debt, including the creditor's name, contact details, and the outstanding balance owed. 2. Personal information: The debtor's personal details such as full name, current address, contact information, and social security number will be required. 3. Assets: The debtor is required to reveal all their assets, including real estate properties, vehicles, bank accounts, investments, valuable personal belongings, and any other significant assets. The value of these assets should be accurately stated. 4. Liabilities: A list of all outstanding debts, loans, mortgages, credit card balances, and any other liabilities the debtor has should be provided. This allows the creditor to assess the debtor's financial obligations and overall financial health. 5. Income and expenses: The affidavit will typically require the debtor to disclose their monthly income from all sources, such as salary, investments, rental income, or government benefits. Additionally, the debtor must detail their monthly expenses, including rent or mortgage payments, utilities, insurance, groceries, transportation, and other necessary living costs. 6. Supporting documents: The debtor may need to attach supporting documents such as bank statements, pay stubs, tax returns, or other financial records to verify the provided information. Multiple variations of the Mecklenburg North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities may exist, depending on specific debt resolution processes, creditor requirements, or court forms. However, the core content mentioned above remains essential in all variations. It is crucial for debtors to accurately complete the affidavit, as any intentional misrepresentation of financial information can result in legal consequences. Seeking legal advice and assistance is highly recommended before submitting this document.Mecklenburg North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used by debtors in Mecklenburg County, North Carolina, to disclose their financial situation to creditors in order to negotiate a settlement or debt forgiveness. This affidavit plays a crucial role in debt resolution processes and provides crucial information regarding the debtor's assets and liabilities. By understanding the debtor's financial status, creditors can assess the likelihood of recovering the debt and determine the best course of action. The Mecklenburg North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities typically includes the following content: 1. Debt details: The debtor must provide comprehensive information about the debt, including the creditor's name, contact details, and the outstanding balance owed. 2. Personal information: The debtor's personal details such as full name, current address, contact information, and social security number will be required. 3. Assets: The debtor is required to reveal all their assets, including real estate properties, vehicles, bank accounts, investments, valuable personal belongings, and any other significant assets. The value of these assets should be accurately stated. 4. Liabilities: A list of all outstanding debts, loans, mortgages, credit card balances, and any other liabilities the debtor has should be provided. This allows the creditor to assess the debtor's financial obligations and overall financial health. 5. Income and expenses: The affidavit will typically require the debtor to disclose their monthly income from all sources, such as salary, investments, rental income, or government benefits. Additionally, the debtor must detail their monthly expenses, including rent or mortgage payments, utilities, insurance, groceries, transportation, and other necessary living costs. 6. Supporting documents: The debtor may need to attach supporting documents such as bank statements, pay stubs, tax returns, or other financial records to verify the provided information. Multiple variations of the Mecklenburg North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities may exist, depending on specific debt resolution processes, creditor requirements, or court forms. However, the core content mentioned above remains essential in all variations. It is crucial for debtors to accurately complete the affidavit, as any intentional misrepresentation of financial information can result in legal consequences. Seeking legal advice and assistance is highly recommended before submitting this document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.