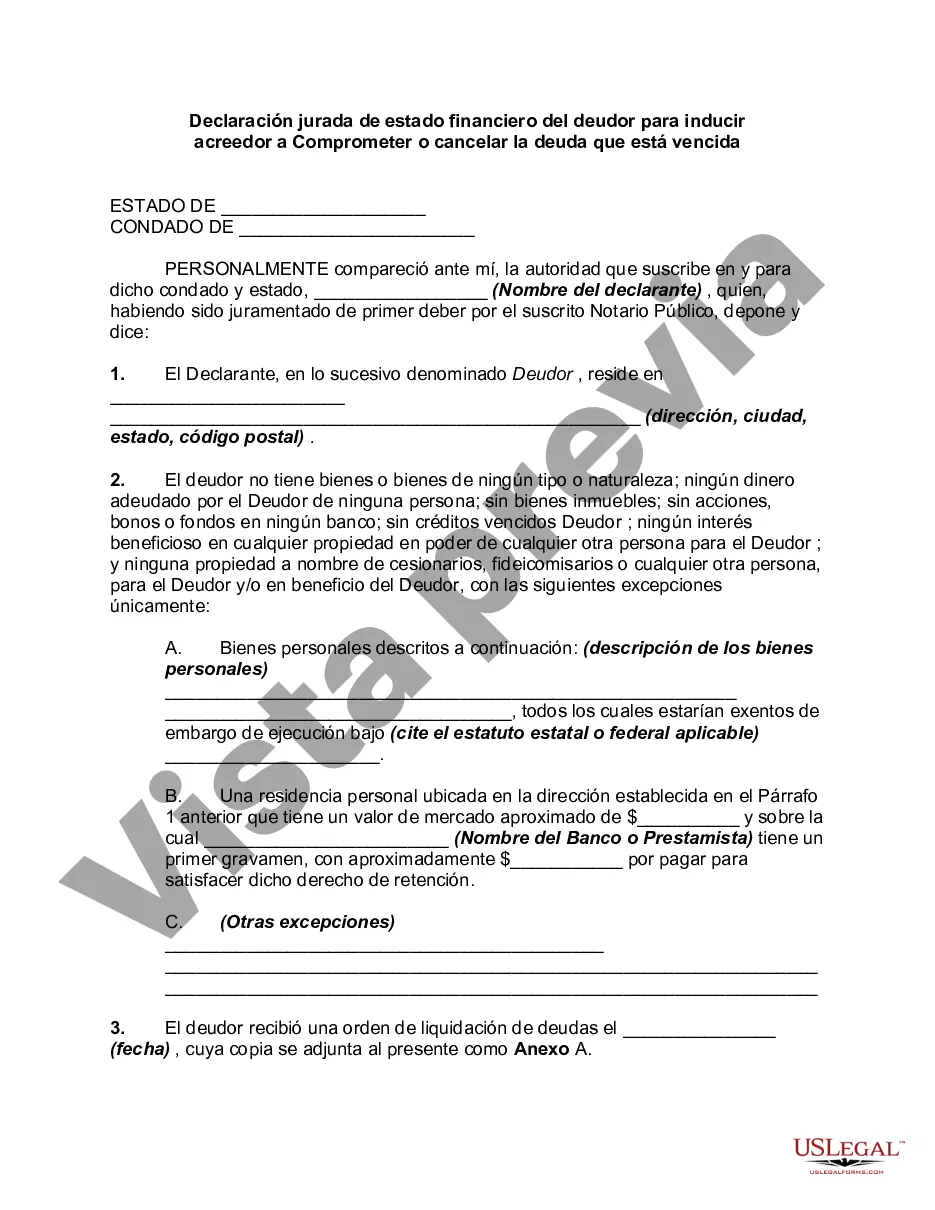

The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Nassau New York Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that debtors in Nassau, New York can use to present a comprehensive overview of their financial situation to creditors in order to negotiate debt settlement or debt forgiveness. This affidavit plays a crucial role in convincing creditors to consider compromising or writing off past-due debts based on the debtor's current financial circumstances. The Debtor's Affidavit of Financial Status typically includes detailed information about the debtor's assets and liabilities, providing a transparent view of their financial standing. Relevant keywords for this document may include: 1. Nassau County, New York: This affidavit is specific to the geographical area of Nassau County, New York, and may contain references to local laws and regulations. 2. Debt settlement: The primary objective of this affidavit is to encourage creditors to enter into negotiations for debt settlement with the debtor. 3. Debt forgiveness: In some cases, debtors may request complete debt forgiveness if their financial situation is determined to be dire or beyond their means to repay. 4. Compromise: Debtors may propose a compromise to creditors, offering a reduced payment plan or an alternative agreement that is mutually beneficial. 5. Past-due debts: This affidavit is specifically aimed at addressing outstanding debts that have not been paid within the agreed-upon timeframe. 6. Assets: Debtors are required to outline their assets, including properties, bank accounts, investments, and any other tangible or intangible assets that contribute to their overall financial worth. 7. Liabilities: This section includes a comprehensive list of the debtor's outstanding debts, such as loans, mortgages, credit card bills, medical bills, and any other financial obligations. There may not be different types of this specific affidavit since it pertains to a legal document for debtors in Nassau, New York, to present their financial status to induce creditors for debt compromise or write off. However, variations in the specifics may arise based on individual circumstances and the type of debt involved. Please note that it is crucial to consult with a legal professional or financial advisor when dealing with debt-related matters and drafting legal documents to ensure compliance with local regulations and laws.Nassau New York Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that debtors in Nassau, New York can use to present a comprehensive overview of their financial situation to creditors in order to negotiate debt settlement or debt forgiveness. This affidavit plays a crucial role in convincing creditors to consider compromising or writing off past-due debts based on the debtor's current financial circumstances. The Debtor's Affidavit of Financial Status typically includes detailed information about the debtor's assets and liabilities, providing a transparent view of their financial standing. Relevant keywords for this document may include: 1. Nassau County, New York: This affidavit is specific to the geographical area of Nassau County, New York, and may contain references to local laws and regulations. 2. Debt settlement: The primary objective of this affidavit is to encourage creditors to enter into negotiations for debt settlement with the debtor. 3. Debt forgiveness: In some cases, debtors may request complete debt forgiveness if their financial situation is determined to be dire or beyond their means to repay. 4. Compromise: Debtors may propose a compromise to creditors, offering a reduced payment plan or an alternative agreement that is mutually beneficial. 5. Past-due debts: This affidavit is specifically aimed at addressing outstanding debts that have not been paid within the agreed-upon timeframe. 6. Assets: Debtors are required to outline their assets, including properties, bank accounts, investments, and any other tangible or intangible assets that contribute to their overall financial worth. 7. Liabilities: This section includes a comprehensive list of the debtor's outstanding debts, such as loans, mortgages, credit card bills, medical bills, and any other financial obligations. There may not be different types of this specific affidavit since it pertains to a legal document for debtors in Nassau, New York, to present their financial status to induce creditors for debt compromise or write off. However, variations in the specifics may arise based on individual circumstances and the type of debt involved. Please note that it is crucial to consult with a legal professional or financial advisor when dealing with debt-related matters and drafting legal documents to ensure compliance with local regulations and laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.