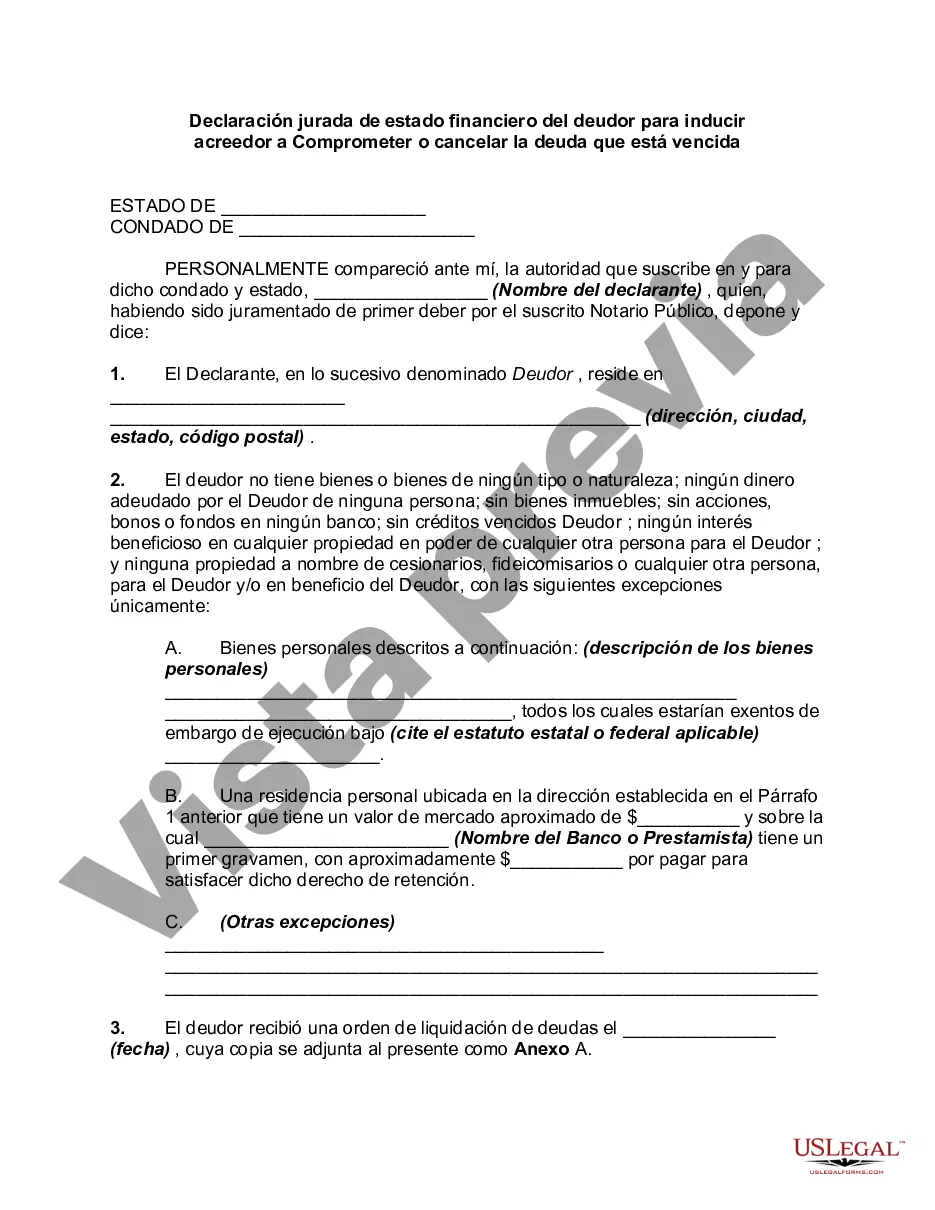

The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Oakland, Michigan is a county located in the southeastern part of the state. It is home to a diverse population and a thriving economy. In cases where individuals in Oakland, Michigan are struggling with a debt that is past due, there is a legal tool available called the Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt. This affidavit serves as a formal document that the debtor submits to their creditor, providing a detailed overview of their current financial situation. It includes a comprehensive breakdown of the debtor's assets and liabilities, enabling the creditor to assess the individual's ability to repay the debt in full or reach a compromise. The Debtor's Affidavit of Financial Status requires the debtor to provide accurate, truthful information about their income, expenses, assets, and liabilities. The goal is to provide the creditor with a clear picture of the debtor's financial resources and obligations, allowing for informed decision-making regarding debt resolution. Some of the key details that may be included in the affidavit are: 1. Personal Information: The debtor's full legal name, contact information, and any relevant identification numbers (such as a social security number or driver's license). 2. Income Details: A comprehensive breakdown of the debtor's income sources, including employment wages, self-employment income, government benefits, and any other sources of funds. 3. Monthly Expenses: A detailed account of the debtor's monthly expenses, including housing costs (rent or mortgage payments), utilities, transportation expenses, healthcare expenses, and other necessary expenditures. 4. Assets: A thorough inventory of the debtor's assets, such as real estate properties, vehicles, bank accounts, retirement accounts, investments, and any other valuable possessions. 5. Liabilities: A list of all outstanding debts and obligations, including credit card balances, loans, outstanding taxes, and other financial liabilities. 6. Financial Hardships: An explanation of any significant financial hardships the debtor is currently facing, such as job loss, medical expenses, divorce, or other extraordinary circumstances that have contributed to the debt. The purpose of the Debtor's Affidavit of Financial Status is to demonstrate to the creditor the debtor's genuine financial inability to repay the debt in full. By disclosing their complete financial situation, debtors in Oakland, Michigan hope to convince their creditors to compromise or write off the debt that is past due, based on the debtor's limited financial means. Although there may not be different types of Debtor's Affidavit of Financial Status in Oakland, Michigan, variations in specific language and requirements may exist depending on the court or creditor involved. It is crucial for debtors to consult with an attorney or legal professional experienced in debt resolution processes in Oakland, Michigan to ensure compliance with local regulations and maximize the chances of a favorable outcome.Oakland, Michigan is a county located in the southeastern part of the state. It is home to a diverse population and a thriving economy. In cases where individuals in Oakland, Michigan are struggling with a debt that is past due, there is a legal tool available called the Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt. This affidavit serves as a formal document that the debtor submits to their creditor, providing a detailed overview of their current financial situation. It includes a comprehensive breakdown of the debtor's assets and liabilities, enabling the creditor to assess the individual's ability to repay the debt in full or reach a compromise. The Debtor's Affidavit of Financial Status requires the debtor to provide accurate, truthful information about their income, expenses, assets, and liabilities. The goal is to provide the creditor with a clear picture of the debtor's financial resources and obligations, allowing for informed decision-making regarding debt resolution. Some of the key details that may be included in the affidavit are: 1. Personal Information: The debtor's full legal name, contact information, and any relevant identification numbers (such as a social security number or driver's license). 2. Income Details: A comprehensive breakdown of the debtor's income sources, including employment wages, self-employment income, government benefits, and any other sources of funds. 3. Monthly Expenses: A detailed account of the debtor's monthly expenses, including housing costs (rent or mortgage payments), utilities, transportation expenses, healthcare expenses, and other necessary expenditures. 4. Assets: A thorough inventory of the debtor's assets, such as real estate properties, vehicles, bank accounts, retirement accounts, investments, and any other valuable possessions. 5. Liabilities: A list of all outstanding debts and obligations, including credit card balances, loans, outstanding taxes, and other financial liabilities. 6. Financial Hardships: An explanation of any significant financial hardships the debtor is currently facing, such as job loss, medical expenses, divorce, or other extraordinary circumstances that have contributed to the debt. The purpose of the Debtor's Affidavit of Financial Status is to demonstrate to the creditor the debtor's genuine financial inability to repay the debt in full. By disclosing their complete financial situation, debtors in Oakland, Michigan hope to convince their creditors to compromise or write off the debt that is past due, based on the debtor's limited financial means. Although there may not be different types of Debtor's Affidavit of Financial Status in Oakland, Michigan, variations in specific language and requirements may exist depending on the court or creditor involved. It is crucial for debtors to consult with an attorney or legal professional experienced in debt resolution processes in Oakland, Michigan to ensure compliance with local regulations and maximize the chances of a favorable outcome.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.