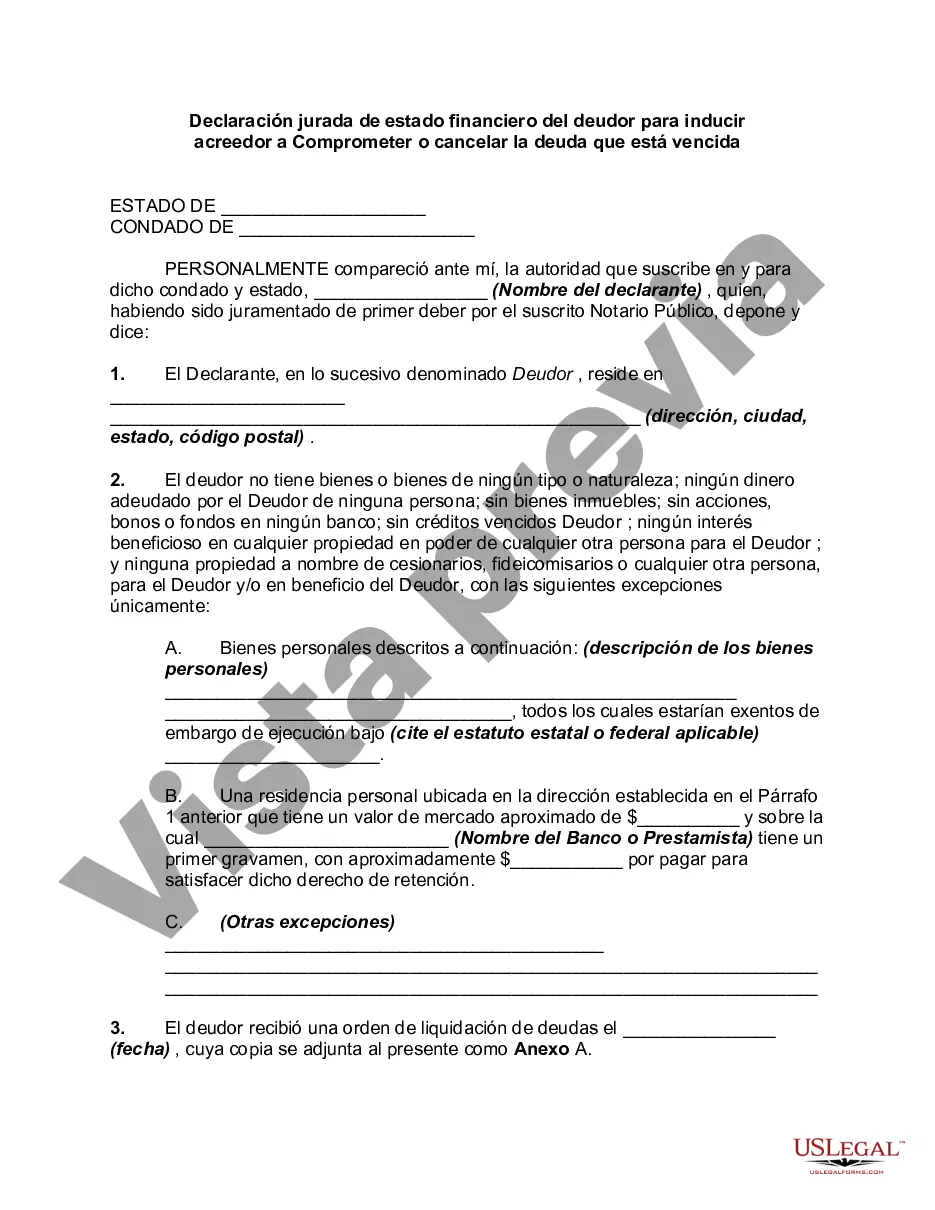

The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

A San Antonio Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows individuals in debt to provide detailed information about their financial situation to their creditors in an effort to negotiate debt settlement or debt forgiveness. This affidavit is crucial for debtors who are struggling to repay their debts and need to demonstrate their current financial position to their creditors. By submitting this affidavit, debtors can present a comprehensive overview of their assets and liabilities, enabling creditors to make informed decisions regarding debt compromise or write-off. Keywords: San Antonio, Texas, debtor's affidavit, financial status, induce creditor, compromise, write off debt, past due, assets, liabilities, detailed description. Different types of San Antonio Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities may include: 1. Personal Debt Affidavit: A debtor submits this affidavit to provide a comprehensive overview of their personal financial situation, including assets and liabilities, to their creditors. 2. Business Debt Affidavit: This affidavit is specifically tailored for business owners who are seeking debt relief. It outlines the financial status of the business, including business assets and liabilities. 3. Real Estate Debt Affidavit: Debtors who have significant real estate assets can use this affidavit to present their properties' value, mortgages, and any outstanding debts on those properties. 4. Medical Debt Affidavit: Individuals burdened with substantial medical debts can use this affidavit to detail their medical expenses and provide evidence of their financial hardships, aiming to negotiate a debt compromise. 5. Student Loan Debt Affidavit: This affidavit is particularly relevant for debtors struggling with student loan payments. It outlines the debtor's education-related debts, financial status, and potential difficulties in repaying the loans. By utilizing any of the above-listed affidavits, debtors can present a complete picture of their financial status to their creditors. The detailed information provided helps creditors understand the debtor's ability to repay the debts and facilitates negotiations for potential compromises or write-offs.A San Antonio Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document that allows individuals in debt to provide detailed information about their financial situation to their creditors in an effort to negotiate debt settlement or debt forgiveness. This affidavit is crucial for debtors who are struggling to repay their debts and need to demonstrate their current financial position to their creditors. By submitting this affidavit, debtors can present a comprehensive overview of their assets and liabilities, enabling creditors to make informed decisions regarding debt compromise or write-off. Keywords: San Antonio, Texas, debtor's affidavit, financial status, induce creditor, compromise, write off debt, past due, assets, liabilities, detailed description. Different types of San Antonio Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities may include: 1. Personal Debt Affidavit: A debtor submits this affidavit to provide a comprehensive overview of their personal financial situation, including assets and liabilities, to their creditors. 2. Business Debt Affidavit: This affidavit is specifically tailored for business owners who are seeking debt relief. It outlines the financial status of the business, including business assets and liabilities. 3. Real Estate Debt Affidavit: Debtors who have significant real estate assets can use this affidavit to present their properties' value, mortgages, and any outstanding debts on those properties. 4. Medical Debt Affidavit: Individuals burdened with substantial medical debts can use this affidavit to detail their medical expenses and provide evidence of their financial hardships, aiming to negotiate a debt compromise. 5. Student Loan Debt Affidavit: This affidavit is particularly relevant for debtors struggling with student loan payments. It outlines the debtor's education-related debts, financial status, and potential difficulties in repaying the loans. By utilizing any of the above-listed affidavits, debtors can present a complete picture of their financial status to their creditors. The detailed information provided helps creditors understand the debtor's ability to repay the debts and facilitates negotiations for potential compromises or write-offs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.