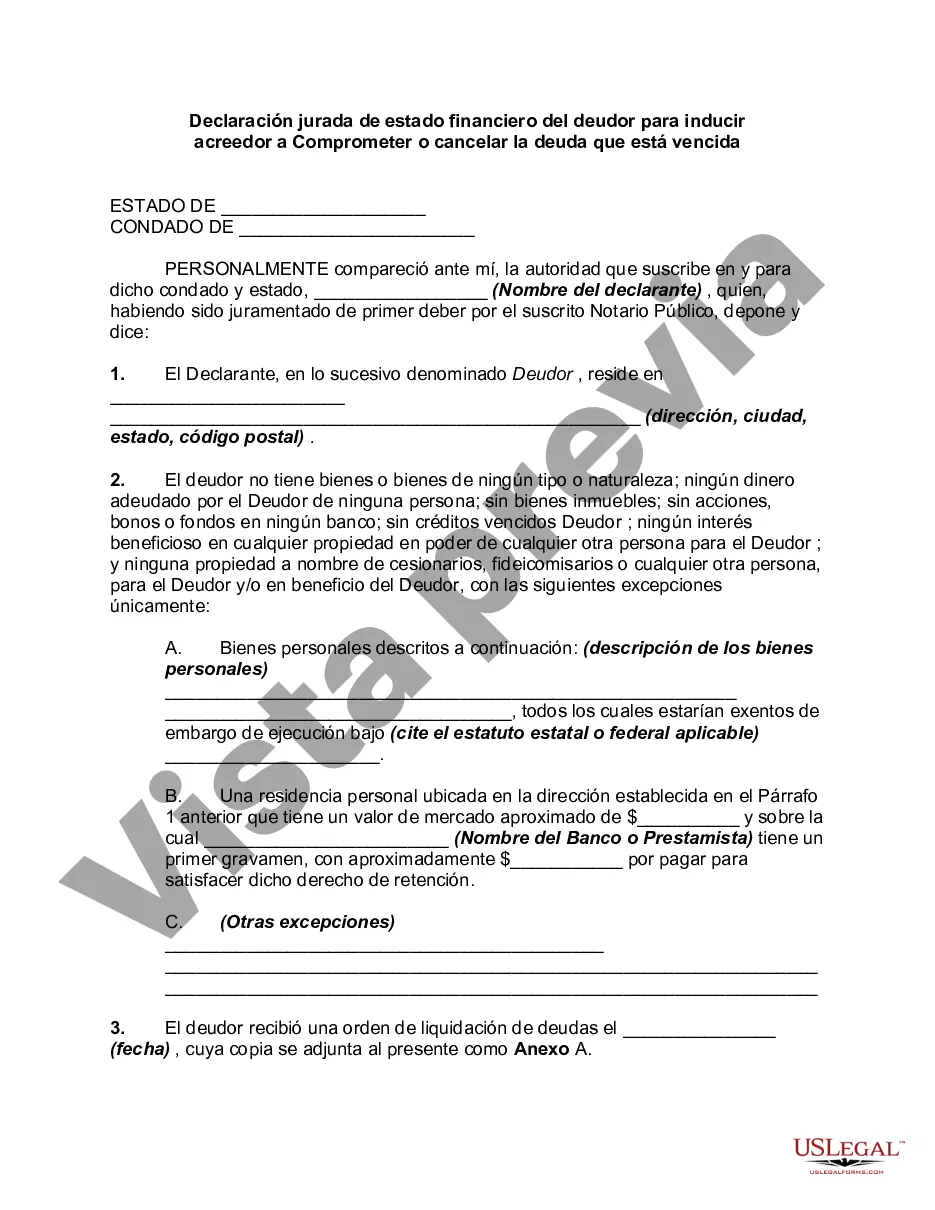

The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

San Diego California Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities In San Diego, California, debtors who are unable to pay their past due debts have the option to file an Affidavit of Financial Status with the aim of convincing creditors to compromise or completely write off their outstanding debts. This legal document provides a detailed overview of the debtor's financial situation, including their assets and liabilities. By providing accurate and comprehensive information, debtors can present a compelling case to creditors, making it more likely for them to consider compromising or forgiving the debt. The Affidavit of Financial Status in San Diego requires debtors to disclose their assets, which can include properties, vehicles, investments, bank accounts, and any other valuable possessions. Debtors must provide thorough and precise descriptions of each asset, along with their approximate values. This information helps creditors evaluate the debtor's ability to make payments, potentially leading to a compromised or forgiven debt. Furthermore, debtors must also list their liabilities in the Affidavit. This encompasses all current outstanding debts, such as mortgages, auto loans, personal loans, credit card balances, and any other financial obligations. Accurate documentation of liabilities is crucial to demonstrate the debtor's financial burden and inability to meet their obligations. It is important to note that different circumstances may require variations of the Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities. Some potential variations may include: 1. Individual Debtor's Affidavit: This affidavit is utilized when a single individual is seeking debt relief and needs to present a comprehensive overview of their personal financial status. 2. Joint Debtor's Affidavit: When multiple debtors are involved, such as married couples who jointly share the debt, a joint debtor's affidavit is filed. This document contains information on the combined assets and liabilities of both parties. 3. Business Debtor's Affidavit: In cases where a debtor is an owner or representative of a business entity, a business debtor's affidavit is submitted. This affidavit includes details about the business's assets and liabilities, providing a comprehensive picture of the debtor's overall financial situation. By accurately completing the Debtor's Affidavit of Financial Status, debtors in San Diego, California can present a clear and persuasive case to creditors, highlighting their financial difficulties and limited ability to repay outstanding debts. The goal is to encourage creditors to consider compromising or forgiving the debt, offering a potential fresh start for individuals burdened by financial hardships.San Diego California Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities In San Diego, California, debtors who are unable to pay their past due debts have the option to file an Affidavit of Financial Status with the aim of convincing creditors to compromise or completely write off their outstanding debts. This legal document provides a detailed overview of the debtor's financial situation, including their assets and liabilities. By providing accurate and comprehensive information, debtors can present a compelling case to creditors, making it more likely for them to consider compromising or forgiving the debt. The Affidavit of Financial Status in San Diego requires debtors to disclose their assets, which can include properties, vehicles, investments, bank accounts, and any other valuable possessions. Debtors must provide thorough and precise descriptions of each asset, along with their approximate values. This information helps creditors evaluate the debtor's ability to make payments, potentially leading to a compromised or forgiven debt. Furthermore, debtors must also list their liabilities in the Affidavit. This encompasses all current outstanding debts, such as mortgages, auto loans, personal loans, credit card balances, and any other financial obligations. Accurate documentation of liabilities is crucial to demonstrate the debtor's financial burden and inability to meet their obligations. It is important to note that different circumstances may require variations of the Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities. Some potential variations may include: 1. Individual Debtor's Affidavit: This affidavit is utilized when a single individual is seeking debt relief and needs to present a comprehensive overview of their personal financial status. 2. Joint Debtor's Affidavit: When multiple debtors are involved, such as married couples who jointly share the debt, a joint debtor's affidavit is filed. This document contains information on the combined assets and liabilities of both parties. 3. Business Debtor's Affidavit: In cases where a debtor is an owner or representative of a business entity, a business debtor's affidavit is submitted. This affidavit includes details about the business's assets and liabilities, providing a comprehensive picture of the debtor's overall financial situation. By accurately completing the Debtor's Affidavit of Financial Status, debtors in San Diego, California can present a clear and persuasive case to creditors, highlighting their financial difficulties and limited ability to repay outstanding debts. The goal is to encourage creditors to consider compromising or forgiving the debt, offering a potential fresh start for individuals burdened by financial hardships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.