The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Wake North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt is a legal document that provides a detailed overview of an individual's financial situation to convince creditors to consider compromising or writing off past due debts. This affidavit is unique to the Wake County, North Carolina area and helps debtors present their financial standing to creditors effectively. The primary purpose of this affidavit is to demonstrate to creditors the debtor's inability to repay the debt in full while showcasing their current assets and liabilities. By providing this detailed financial information, debtors hope to persuade creditors to negotiate a compromise or write off the debt, relieving them from the burden of the full repayment. This affidavit typically includes essential details such as the debtor's personal information, including their name, contact information, and social security number. Additionally, it includes a comprehensive breakdown of the debtor's assets, including real estate properties, vehicles, bank accounts, investments, and any other valuable possessions that hold monetary value. Furthermore, the affidavit also lists all liabilities the debtor holds, such as outstanding loans, credit card debts, medical bills, and any other financial obligations that contribute to the overall debt burden. It is crucial to provide accurate and up-to-date information in this section to ensure transparency and credibility. Additionally, debtors may attach relevant supporting documents such as bank statements, loan agreements, credit card statements, and any other financial paperwork that substantiates their claims regarding their financial status. While there are different types of Wake North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities, they all share the common objective of assisting debtors in their negotiations with creditors. Some potential variations of this affidavit may include additional sections or specific requirements based on the unique circumstances of the debtor or the creditor. Examples could include specific provisions for business debts, government debts, or variations for different sectors of the population, such as military personnel or senior citizens. It is essential for individuals facing overwhelming debt in Wake County, North Carolina, to consult with experienced legal professionals to obtain the proper version of the affidavit and ensure compliance with local laws and regulations. Legal advice can assist debtors in accurately completing the affidavit and increasing the chances of reaching a favorable outcome with their creditors.Wake North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt is a legal document that provides a detailed overview of an individual's financial situation to convince creditors to consider compromising or writing off past due debts. This affidavit is unique to the Wake County, North Carolina area and helps debtors present their financial standing to creditors effectively. The primary purpose of this affidavit is to demonstrate to creditors the debtor's inability to repay the debt in full while showcasing their current assets and liabilities. By providing this detailed financial information, debtors hope to persuade creditors to negotiate a compromise or write off the debt, relieving them from the burden of the full repayment. This affidavit typically includes essential details such as the debtor's personal information, including their name, contact information, and social security number. Additionally, it includes a comprehensive breakdown of the debtor's assets, including real estate properties, vehicles, bank accounts, investments, and any other valuable possessions that hold monetary value. Furthermore, the affidavit also lists all liabilities the debtor holds, such as outstanding loans, credit card debts, medical bills, and any other financial obligations that contribute to the overall debt burden. It is crucial to provide accurate and up-to-date information in this section to ensure transparency and credibility. Additionally, debtors may attach relevant supporting documents such as bank statements, loan agreements, credit card statements, and any other financial paperwork that substantiates their claims regarding their financial status. While there are different types of Wake North Carolina Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities, they all share the common objective of assisting debtors in their negotiations with creditors. Some potential variations of this affidavit may include additional sections or specific requirements based on the unique circumstances of the debtor or the creditor. Examples could include specific provisions for business debts, government debts, or variations for different sectors of the population, such as military personnel or senior citizens. It is essential for individuals facing overwhelming debt in Wake County, North Carolina, to consult with experienced legal professionals to obtain the proper version of the affidavit and ensure compliance with local laws and regulations. Legal advice can assist debtors in accurately completing the affidavit and increasing the chances of reaching a favorable outcome with their creditors.

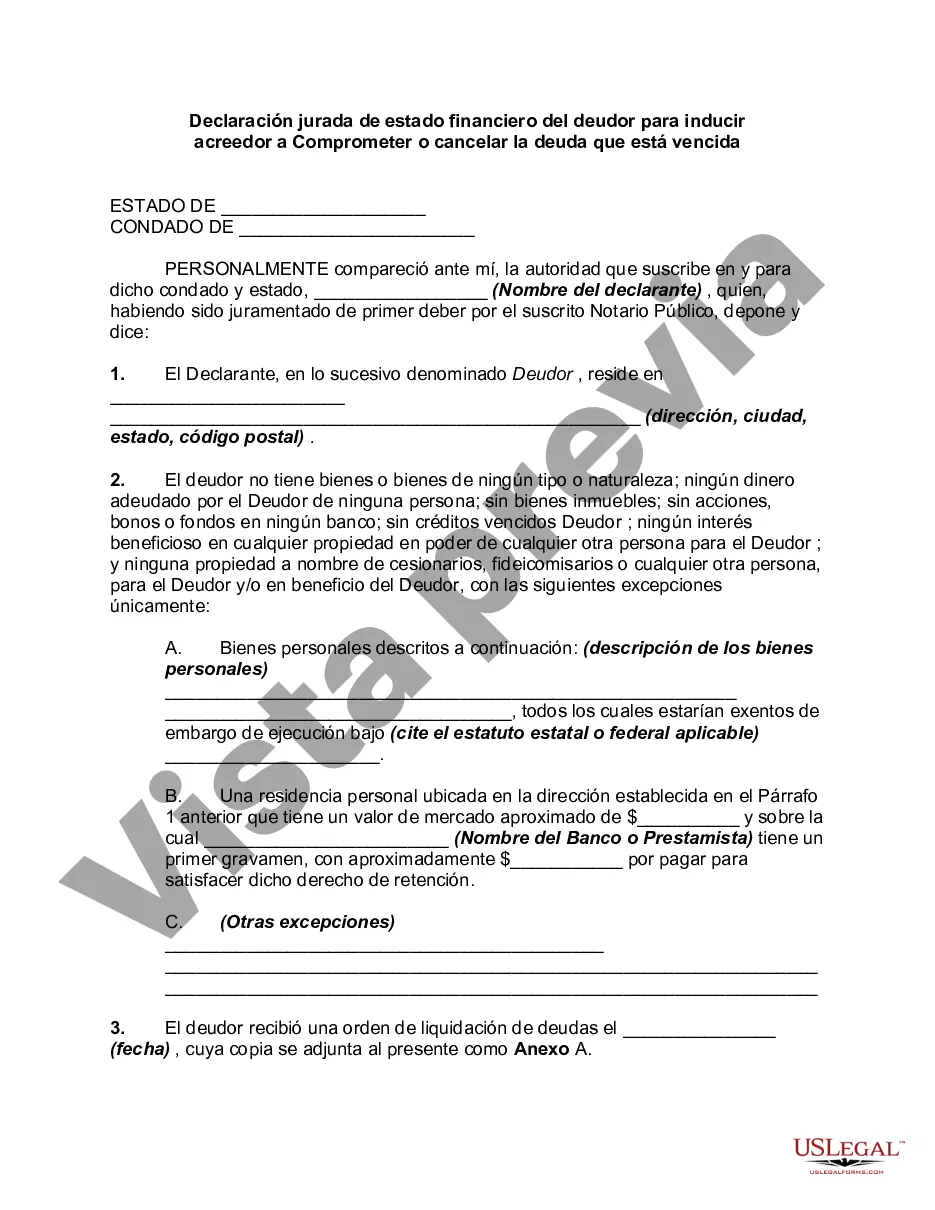

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.