Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Chicago Illinois Revocable Trust Agreement with Husband and Wife as Trustees and Income to: A Chicago Illinois Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a legal document that establishes a trust in the state of Illinois. This trust agreement is specifically designed for married couples who wish to protect and manage their assets and ensure the smooth transfer of those assets to their beneficiaries upon their passing. The trustees, in this case, are the husband and wife who create the trust and transfer their assets into it. By doing so, they become the granter of the trust, relinquishing legal ownership of the assets and placing them under the control of a trustee. The primary objective of this trust agreement is to provide flexibility and control over assets both during the trust or's lifetime and after their death. The Chicago Illinois Revocable Trust Agreement offers several benefits to the trustees, including tax advantages, privacy, probate avoidance, and efficient asset management. By establishing a revocable trust, the trustees can reduce estate taxes, bypass probate court, and ensure their assets are distributed according to their wishes while maintaining control over those assets. There are different types of Chicago Illinois Revocable Trust Agreements with Husband and Wife as Trustees and Income to, each serving unique purposes depending on the specific needs of the couple. Some common types include: 1. Joint Revocable Trust: This type of trust is created jointly by both spouses, allowing them to pool their assets and manage them collectively. It provides equal control and management of assets during their lifetime and ensures a smooth transfer of those assets to the surviving spouse or beneficiaries after the death of the first spouse. 2. Pour-Over Will Trust: This trust agreement is used in conjunction with a pour-over will, which transfers any assets not already in the trust into the trust upon the death of the trustees. It provides a safety net to ensure all assets are properly accounted for and protected under the trust. 3. Irrevocable Life Insurance Trust: In some cases, couples may choose to establish an irrevocable trust specifically to hold and manage life insurance policies. This can be an effective way to reduce estate taxes and ensure the benefits from the life insurance policies are distributed according to the trust or's wishes. It is important to consult with an experienced attorney when creating a Chicago Illinois Revocable Trust Agreement with Husband and Wife as Trustees and Income to ensure it meets all legal requirements and addresses the specific needs and goals of the couple. Professional advice can help navigate the complexities of estate planning and ensure a comprehensive and effective trust agreement.

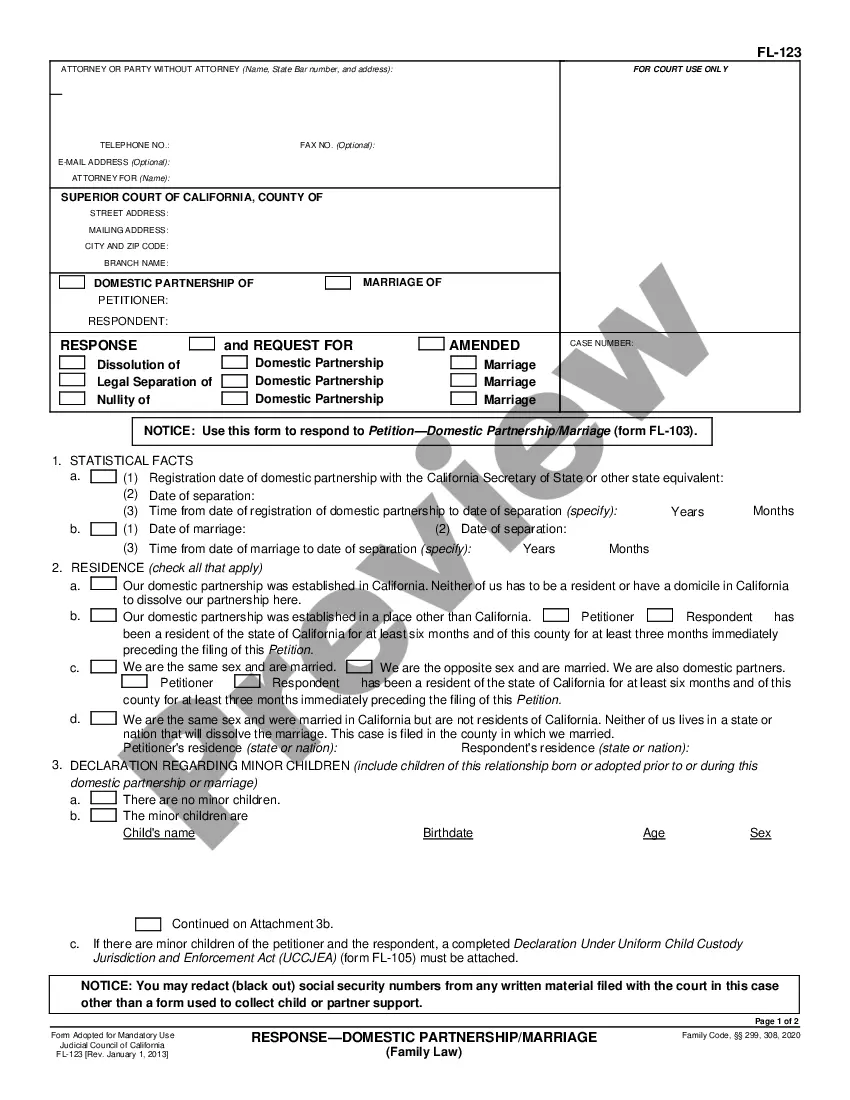

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.