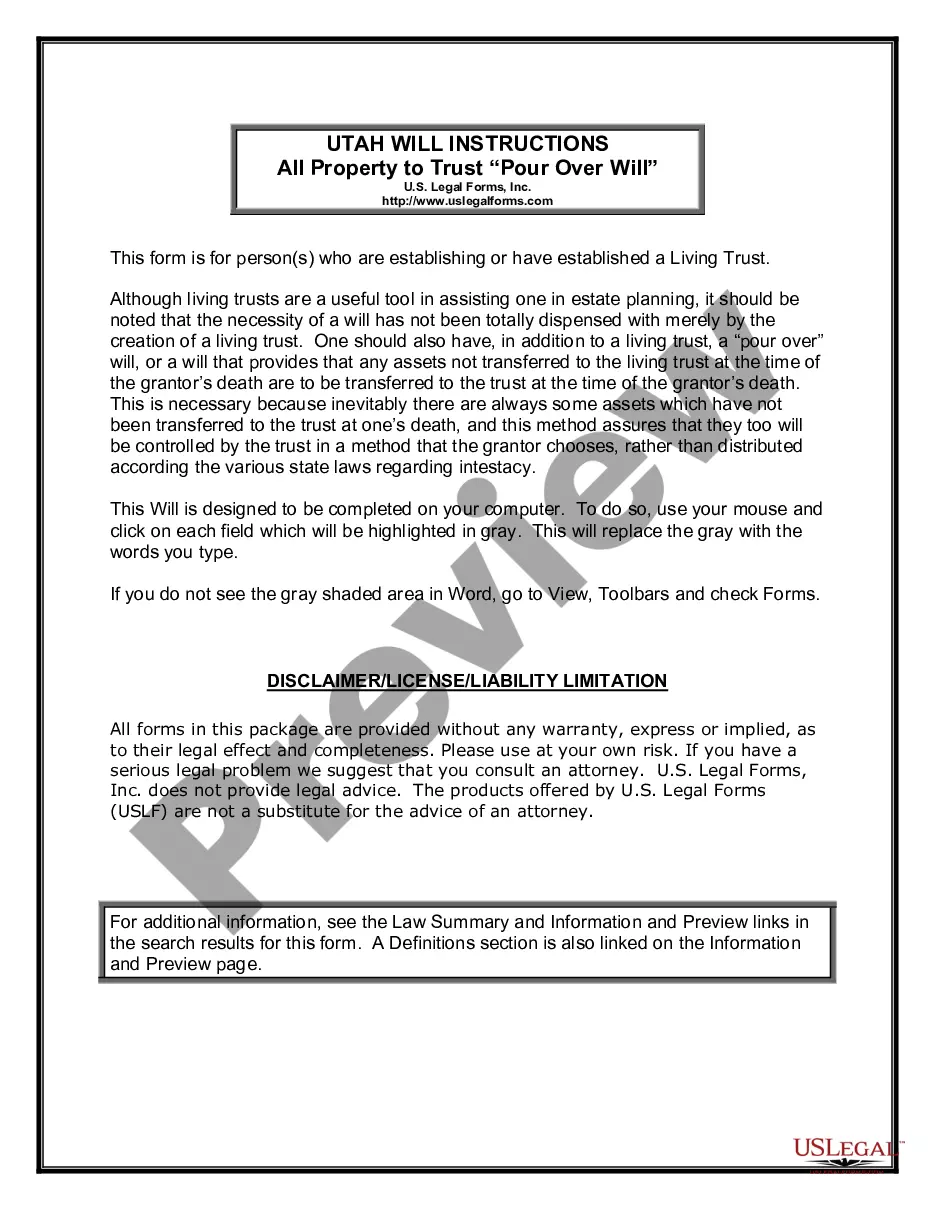

Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo de Fideicomiso Revocable con Esposo y Esposa como Fideicomitentes e Ingresos a - Revocable Trust Agreement with Husband and Wife as Trustors and Income to

State:

Multi-State

County:

Miami-Dade

Control #:

US-02573BG

Format:

Word

Instant download

Description

Free preview