Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

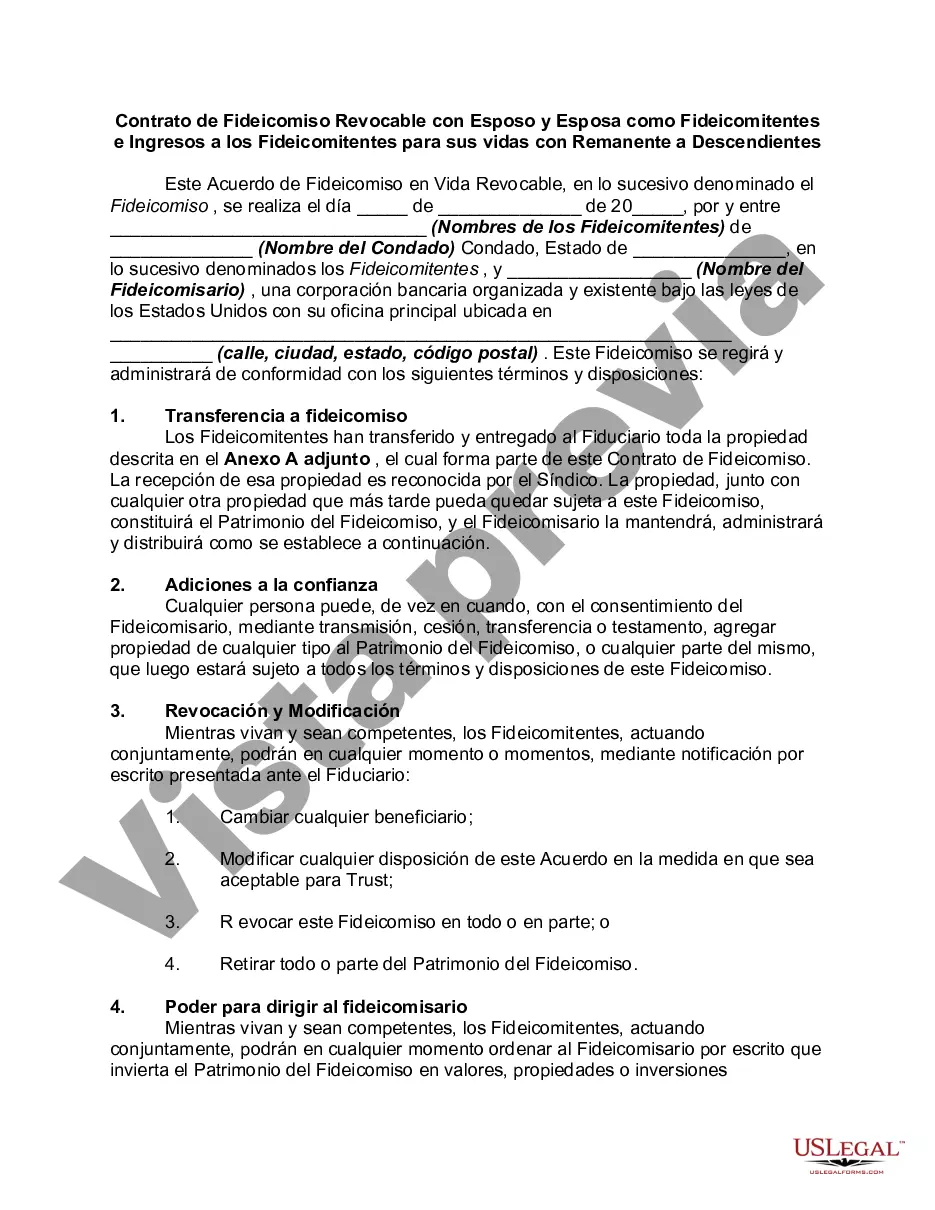

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Acuerdo de Fideicomiso Revocable con Esposo y Esposa como Fideicomitentes e Ingresos a - Revocable Trust Agreement with Husband and Wife as Trustors and Income to

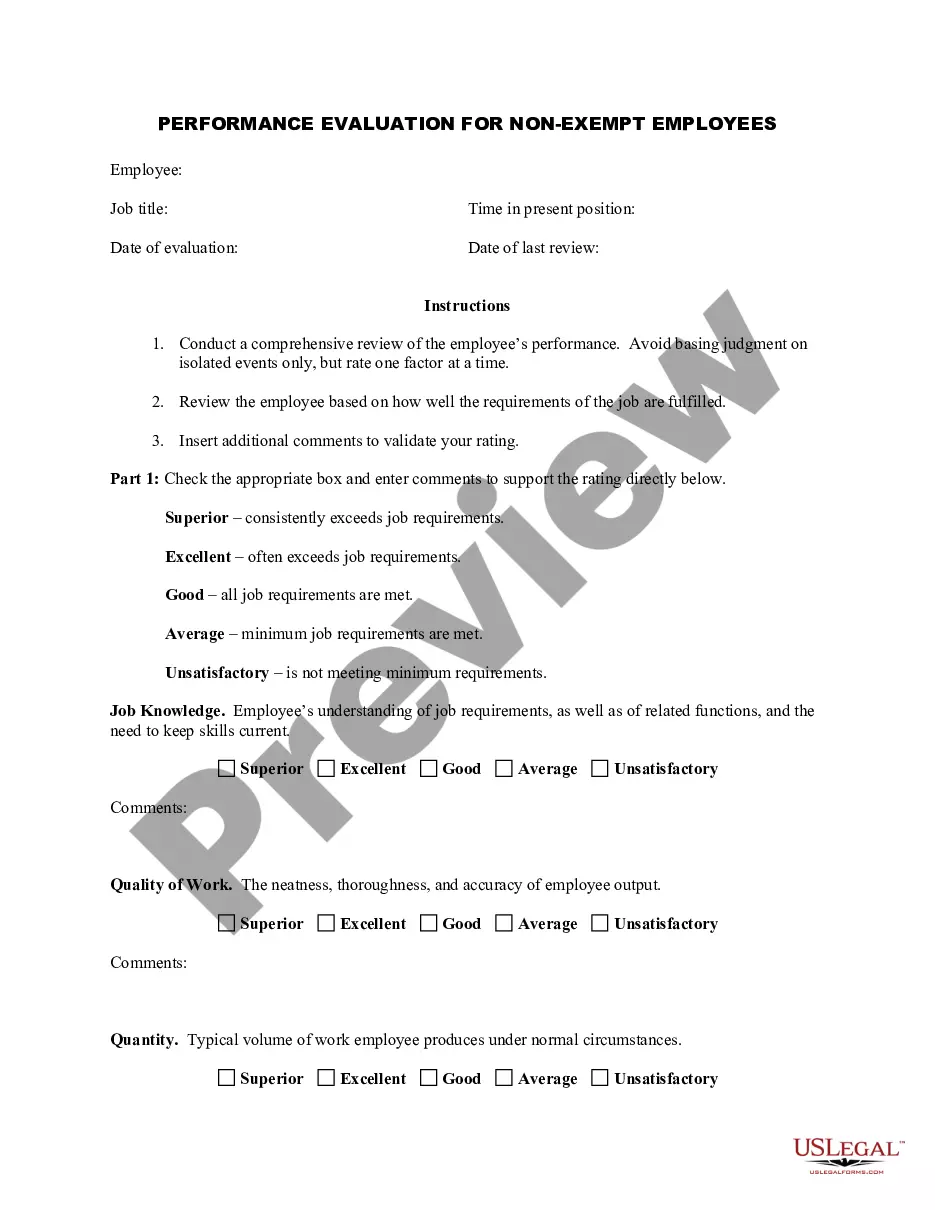

Description

How to fill out Middlesex Massachusetts Acuerdo De Fideicomiso Revocable Con Esposo Y Esposa Como Fideicomitentes E Ingresos A?

Preparing paperwork for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Middlesex Revocable Trust Agreement with Husband and Wife as Trustors and Income to without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Middlesex Revocable Trust Agreement with Husband and Wife as Trustors and Income to on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Middlesex Revocable Trust Agreement with Husband and Wife as Trustors and Income to:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!