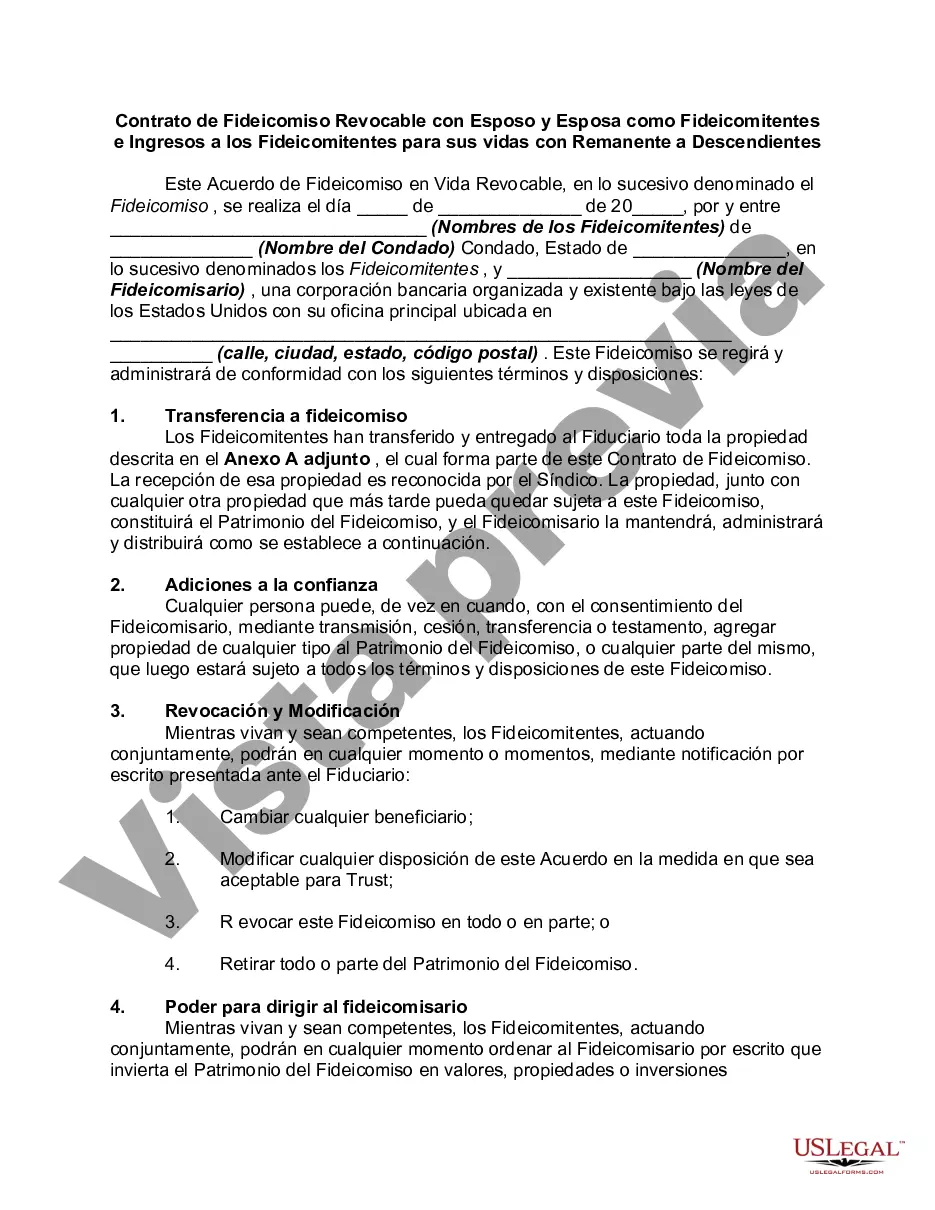

Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Acuerdo de Fideicomiso Revocable con Esposo y Esposa como Fideicomitentes e Ingresos a - Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

How to fill out Philadelphia Pennsylvania Acuerdo De Fideicomiso Revocable Con Esposo Y Esposa Como Fideicomitentes E Ingresos A?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Philadelphia Revocable Trust Agreement with Husband and Wife as Trustors and Income to.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Philadelphia Revocable Trust Agreement with Husband and Wife as Trustors and Income to will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Philadelphia Revocable Trust Agreement with Husband and Wife as Trustors and Income to:

- Make sure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Philadelphia Revocable Trust Agreement with Husband and Wife as Trustors and Income to on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!