Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Acuerdo de Fideicomiso Revocable con Esposo y Esposa como Fideicomitentes e Ingresos a - Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

How to fill out Queens New York Acuerdo De Fideicomiso Revocable Con Esposo Y Esposa Como Fideicomitentes E Ingresos A?

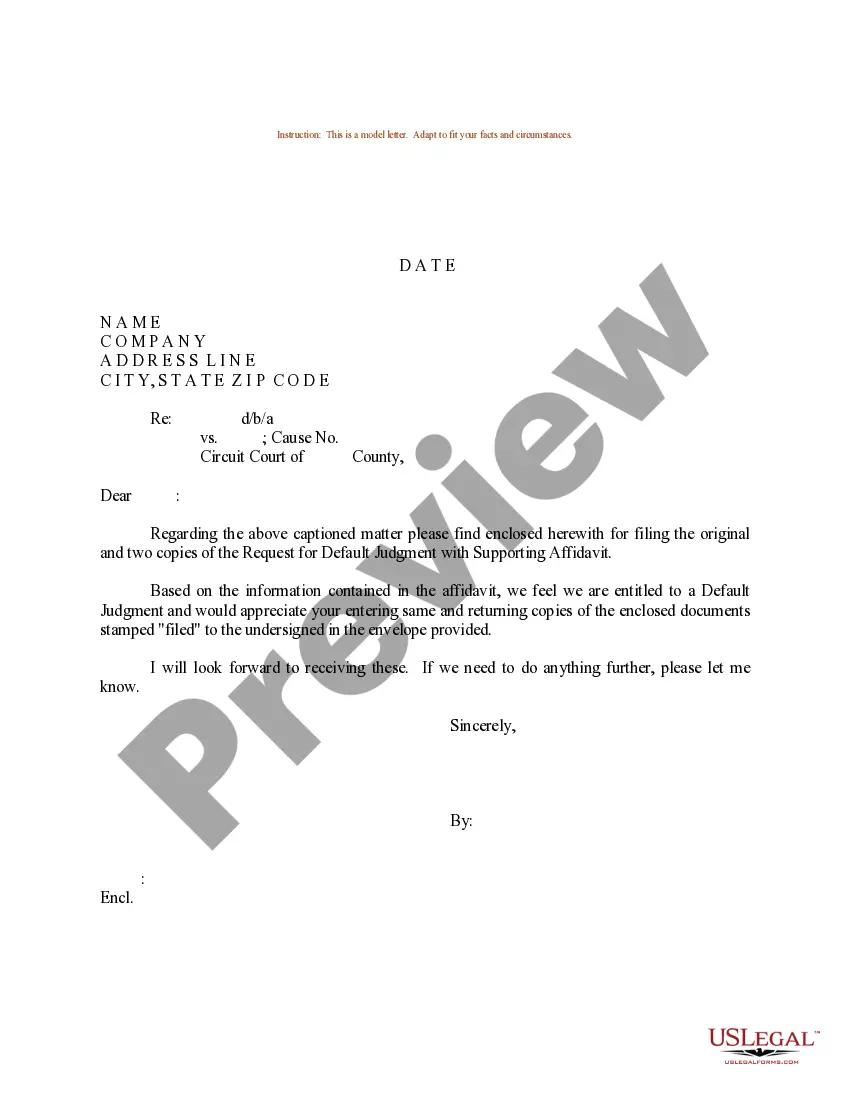

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Queens Revocable Trust Agreement with Husband and Wife as Trustors and Income to, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any tasks related to document completion straightforward.

Here's how to locate and download Queens Revocable Trust Agreement with Husband and Wife as Trustors and Income to.

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the legality of some records.

- Check the similar forms or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Queens Revocable Trust Agreement with Husband and Wife as Trustors and Income to.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Queens Revocable Trust Agreement with Husband and Wife as Trustors and Income to, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you need to cope with an extremely difficult situation, we recommend getting an attorney to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!