Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

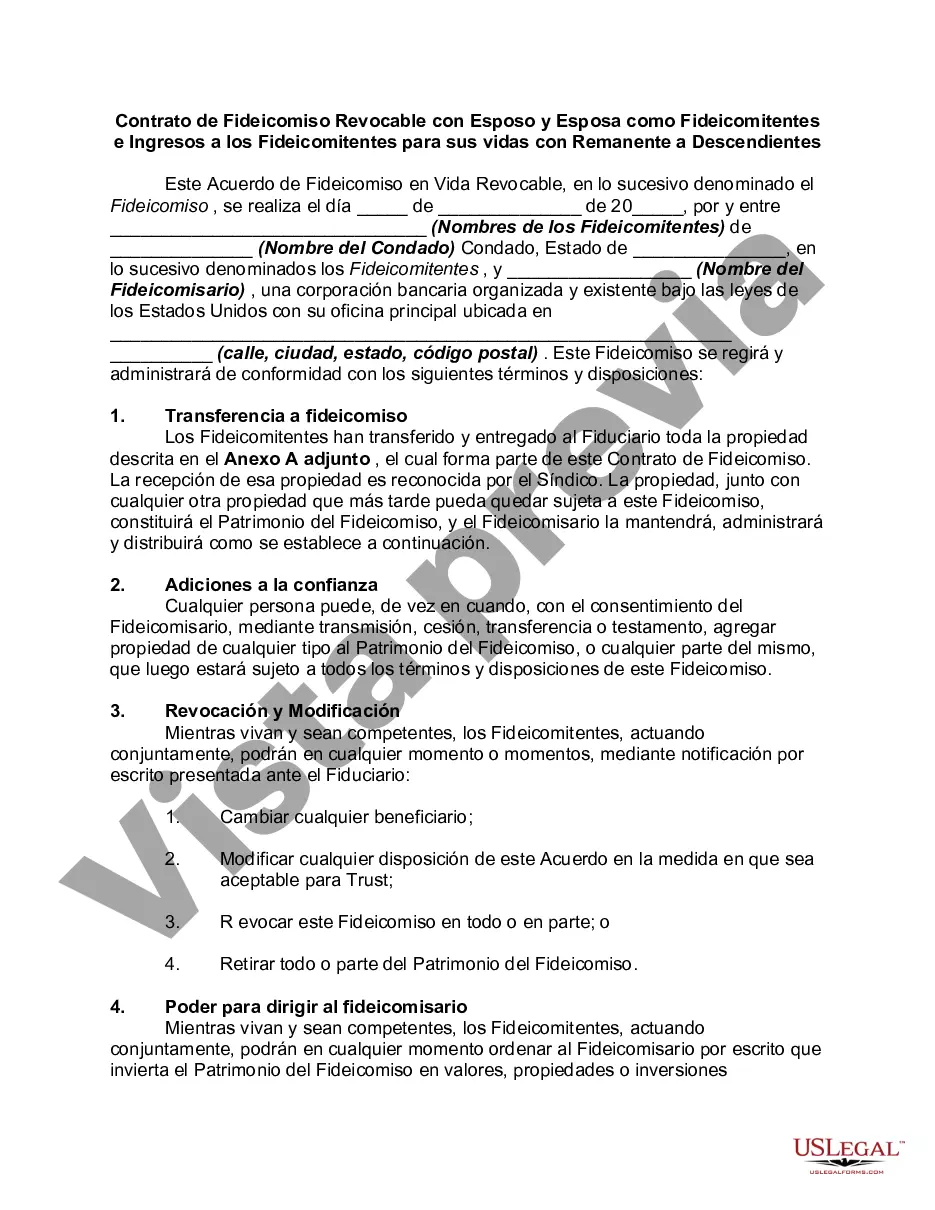

A Santa Clara California Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a legal document that establishes a trust in which a married couple acts as the Trustees. It allows them to place their assets and property into a trust for the purpose of managing and distributing them during their lifetimes and after their passing. This type of trust is commonly used by couples in California for estate planning purposes. The Santa Clara California Revocable Trust Agreement offers numerous benefits for the Trustees, including privacy, avoidance of probate, and the ability to control the distribution of their assets. This document provides a comprehensive and detailed plan for the management and distribution of the Trustees' estate, ensuring their wishes are carried out effectively. Furthermore, this trust agreement can also encompass additional provisions based on the specific needs and goals of the Trustees. Some variations of the Santa Clara California Revocable Trust Agreement with Husband and Wife as Trustees and Income to include: 1. Joint Revocable Trust: This is the most common type of Santa Clara California Revocable Trust Agreement used by married couples. It allows both spouses to establish a single trust together, pooling their assets and property. 2. Separate Revocable Trusts: In certain cases, a husband and wife may opt to create separate revocable trusts instead of a joint trust. This approach can be beneficial if they have separate assets, different estate planning goals, or if they prefer to maintain individual control over their respective assets. 3. Income-only Revocable Trust: This type of trust agreement focuses primarily on ensuring a steady income stream for the Trustees during their lifetimes, with the bulk of the assets distributed upon their passing. It provides financial security and peace of mind, especially for elderly couples looking to secure their retirement income. 4. Holographic Revocable Trust: This variation of the trust agreement allows the Trustees to create their trust using their own handwriting. It may be used when one or both Trustees are unable to sign a formal document due to illness, disability, or other reasons. However, it is crucial to consult a legal professional to ensure compliance with all legal requirements. In conclusion, a Santa Clara California Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a versatile and effective estate planning tool designed for married couples residing in Santa Clara, California. It offers enhanced control, privacy, and flexibility regarding asset management and distribution. Different variations of this trust agreement can be tailored to meet the unique needs and preferences of the Trustees.A Santa Clara California Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a legal document that establishes a trust in which a married couple acts as the Trustees. It allows them to place their assets and property into a trust for the purpose of managing and distributing them during their lifetimes and after their passing. This type of trust is commonly used by couples in California for estate planning purposes. The Santa Clara California Revocable Trust Agreement offers numerous benefits for the Trustees, including privacy, avoidance of probate, and the ability to control the distribution of their assets. This document provides a comprehensive and detailed plan for the management and distribution of the Trustees' estate, ensuring their wishes are carried out effectively. Furthermore, this trust agreement can also encompass additional provisions based on the specific needs and goals of the Trustees. Some variations of the Santa Clara California Revocable Trust Agreement with Husband and Wife as Trustees and Income to include: 1. Joint Revocable Trust: This is the most common type of Santa Clara California Revocable Trust Agreement used by married couples. It allows both spouses to establish a single trust together, pooling their assets and property. 2. Separate Revocable Trusts: In certain cases, a husband and wife may opt to create separate revocable trusts instead of a joint trust. This approach can be beneficial if they have separate assets, different estate planning goals, or if they prefer to maintain individual control over their respective assets. 3. Income-only Revocable Trust: This type of trust agreement focuses primarily on ensuring a steady income stream for the Trustees during their lifetimes, with the bulk of the assets distributed upon their passing. It provides financial security and peace of mind, especially for elderly couples looking to secure their retirement income. 4. Holographic Revocable Trust: This variation of the trust agreement allows the Trustees to create their trust using their own handwriting. It may be used when one or both Trustees are unable to sign a formal document due to illness, disability, or other reasons. However, it is crucial to consult a legal professional to ensure compliance with all legal requirements. In conclusion, a Santa Clara California Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a versatile and effective estate planning tool designed for married couples residing in Santa Clara, California. It offers enhanced control, privacy, and flexibility regarding asset management and distribution. Different variations of this trust agreement can be tailored to meet the unique needs and preferences of the Trustees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.