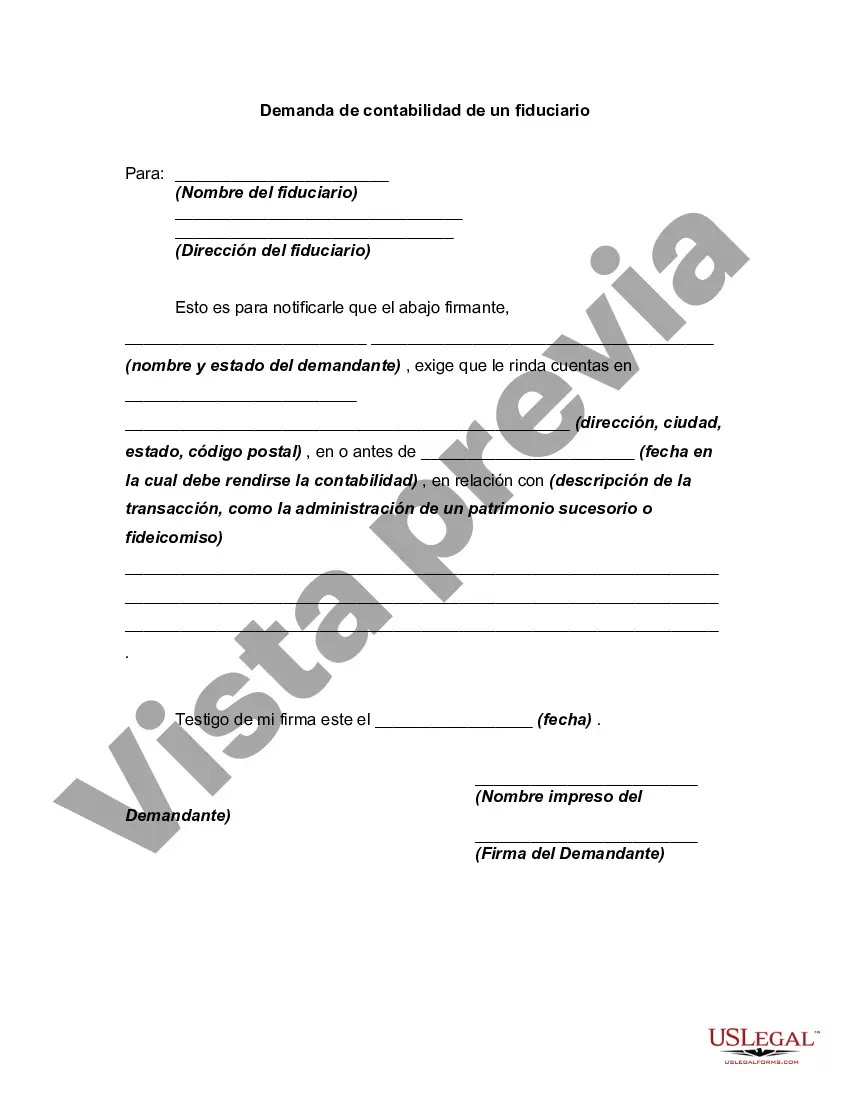

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Allegheny Pennsylvania Demand for Accounting from a Fiduciary: Understanding the Types and Importance In the dynamic financial landscape of Allegheny County, Pennsylvania, demand for accounting services from fiduciaries has been on the rise. As individuals, businesses, and organizations seek trusted financial advisors to manage their assets, it becomes crucial to comprehend the various types of fiduciaries and the key role they play in ensuring accountability and transparency. This article aims to explore the different types of Allegheny Pennsylvania Demand for Accounting from a Fiduciary, shedding light on their significance and the crucial role they serve in safeguarding financial interests. 1. Individual Fiduciaries: Individual fiduciaries are professionals entrusted by individuals or families to manage their financial affairs. This includes managing investments, properties, and other assets on behalf of the individual for their benefit. The demand for accounting services arises from the need to ensure accurate bookkeeping, tax compliance, and comprehensive financial reporting. Clients rely on individual fiduciaries to maintain accurate records, create financial statements, and prepare tax returns, providing a clear picture of their financial health. 2. Corporate Fiduciaries: Corporate fiduciaries refer to financial institutions, such as banks, trust companies, or investment firms, that act as trustees or executors for their clients' assets. They are responsible for managing investments, administering trusts, and executing estate plans. Due to the often complex nature of their responsibilities, the demand for accounting services from corporate fiduciaries remains high. These firms require precise accounting practices to accurately track investments, monitor fund distributions, and ensure compliance with legal and regulatory requirements. 3. Nonprofit Organization Fiduciaries: Nonprofit organizations also require fiduciaries to oversee their financial operations and ensure compliance with relevant laws and regulations. Demand for accounting services from nonprofit organization fiduciaries arises due to the need for transparent financial reporting maintaining public trust. These fiduciaries are accountable for handling donated funds, managing budgets, and providing financial insights to board members and stakeholders. Comprehensive accounting practices help them track donations, manage expenditures, and demonstrate responsible financial stewardship. The demand for accounting from fiduciaries in Allegheny Pennsylvania is driven by several factors. Firstly, fiduciaries serve as financial custodians, playing a critical role in managing and protecting their clients' assets. Accurate accounting practices ensure full transparency, reducing the risk of financial mismanagement or fraud. Secondly, accounting services aid fiduciaries in meeting legal and regulatory obligations, enabling them to steer clear of penalties and legal complications. Lastly, thorough accounting practices provide clients with confidence and peace of mind, knowing that their financial affairs are in responsible hands. In conclusion, Allegheny Pennsylvania demand for accounting from fiduciaries is a crucial aspect of ensuring financial integrity and accountability. Individual, corporate, and nonprofit organization fiduciaries all require precise accounting practices fulfilling their responsibilities effectively. By maintaining accurate records, preparing financial statements, and adhering to legal and regulatory requirements, fiduciaries safeguard their clients' assets and maintain public trust. Therefore, the demand for accounting from fiduciaries is expected to continue growing in Allegheny Pennsylvania as individuals and organizations prioritize the need for expert financial stewardship.Allegheny Pennsylvania Demand for Accounting from a Fiduciary: Understanding the Types and Importance In the dynamic financial landscape of Allegheny County, Pennsylvania, demand for accounting services from fiduciaries has been on the rise. As individuals, businesses, and organizations seek trusted financial advisors to manage their assets, it becomes crucial to comprehend the various types of fiduciaries and the key role they play in ensuring accountability and transparency. This article aims to explore the different types of Allegheny Pennsylvania Demand for Accounting from a Fiduciary, shedding light on their significance and the crucial role they serve in safeguarding financial interests. 1. Individual Fiduciaries: Individual fiduciaries are professionals entrusted by individuals or families to manage their financial affairs. This includes managing investments, properties, and other assets on behalf of the individual for their benefit. The demand for accounting services arises from the need to ensure accurate bookkeeping, tax compliance, and comprehensive financial reporting. Clients rely on individual fiduciaries to maintain accurate records, create financial statements, and prepare tax returns, providing a clear picture of their financial health. 2. Corporate Fiduciaries: Corporate fiduciaries refer to financial institutions, such as banks, trust companies, or investment firms, that act as trustees or executors for their clients' assets. They are responsible for managing investments, administering trusts, and executing estate plans. Due to the often complex nature of their responsibilities, the demand for accounting services from corporate fiduciaries remains high. These firms require precise accounting practices to accurately track investments, monitor fund distributions, and ensure compliance with legal and regulatory requirements. 3. Nonprofit Organization Fiduciaries: Nonprofit organizations also require fiduciaries to oversee their financial operations and ensure compliance with relevant laws and regulations. Demand for accounting services from nonprofit organization fiduciaries arises due to the need for transparent financial reporting maintaining public trust. These fiduciaries are accountable for handling donated funds, managing budgets, and providing financial insights to board members and stakeholders. Comprehensive accounting practices help them track donations, manage expenditures, and demonstrate responsible financial stewardship. The demand for accounting from fiduciaries in Allegheny Pennsylvania is driven by several factors. Firstly, fiduciaries serve as financial custodians, playing a critical role in managing and protecting their clients' assets. Accurate accounting practices ensure full transparency, reducing the risk of financial mismanagement or fraud. Secondly, accounting services aid fiduciaries in meeting legal and regulatory obligations, enabling them to steer clear of penalties and legal complications. Lastly, thorough accounting practices provide clients with confidence and peace of mind, knowing that their financial affairs are in responsible hands. In conclusion, Allegheny Pennsylvania demand for accounting from fiduciaries is a crucial aspect of ensuring financial integrity and accountability. Individual, corporate, and nonprofit organization fiduciaries all require precise accounting practices fulfilling their responsibilities effectively. By maintaining accurate records, preparing financial statements, and adhering to legal and regulatory requirements, fiduciaries safeguard their clients' assets and maintain public trust. Therefore, the demand for accounting from fiduciaries is expected to continue growing in Allegheny Pennsylvania as individuals and organizations prioritize the need for expert financial stewardship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.