Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Bronx, New York is a vibrant borough located in New York City. With a rich cultural history and diverse population, the demand for accounting services from fiduciaries in the Bronx is significant. Accounting professionals specializing in fiduciary services play a crucial role in managing financial affairs and ensuring compliance with legal and ethical obligations. The demand for accounting from a fiduciary in the Bronx stems from various types of individuals and organizations requiring expert financial guidance. Here are a few examples: 1. Individual Fiduciary Accounting: Many individuals in the Bronx may appoint a fiduciary, such as a trustee, executor, or guardian, to manage their assets, investments, or estate after their passing. The fiduciary is responsible for accurate accounting, ensuring asset protection, and distributing assets according to the individual's wishes or legal requirements. 2. Estate Planning and Settlement: Bronx residents often seek estate planning assistance from fiduciary accountants to develop comprehensive strategies for managing assets and minimizing tax liabilities. Fiduciaries play a crucial role in estate settlement as they oversee the distribution of assets, preparation of estate tax returns, and the administration of trusts. 3. Non-profit Organizations: The Bronx is home to numerous non-profit organizations dedicated to social causes, providing vital services to the community. These organizations often engage fiduciary accounting services to maintain transparent financial records, budget management, and compliance with state and federal guidelines. 4. Small Business Accounting: The Bronx has a thriving small business community. For small business owners and entrepreneurs, fiduciary accountants provide indispensable services such as bookkeeping, tax planning, financial analysis, and assistance with regulatory obligations. Their expertise ensures accurate financial reporting and helps businesses make informed decisions. 5. Investment Management: Individuals and organizations in the Bronx with substantial investments often rely on fiduciary accountants to manage their portfolios. These professionals offer investment oversight, performance analysis, risk assessment, and compliance monitoring to safeguard their clients' financial interests. Keywords: Bronx, New York, fiduciary accounting, estate planning, estate settlement, trust administration, non-profit organizations, small business accounting, investment management.Bronx, New York is a vibrant borough located in New York City. With a rich cultural history and diverse population, the demand for accounting services from fiduciaries in the Bronx is significant. Accounting professionals specializing in fiduciary services play a crucial role in managing financial affairs and ensuring compliance with legal and ethical obligations. The demand for accounting from a fiduciary in the Bronx stems from various types of individuals and organizations requiring expert financial guidance. Here are a few examples: 1. Individual Fiduciary Accounting: Many individuals in the Bronx may appoint a fiduciary, such as a trustee, executor, or guardian, to manage their assets, investments, or estate after their passing. The fiduciary is responsible for accurate accounting, ensuring asset protection, and distributing assets according to the individual's wishes or legal requirements. 2. Estate Planning and Settlement: Bronx residents often seek estate planning assistance from fiduciary accountants to develop comprehensive strategies for managing assets and minimizing tax liabilities. Fiduciaries play a crucial role in estate settlement as they oversee the distribution of assets, preparation of estate tax returns, and the administration of trusts. 3. Non-profit Organizations: The Bronx is home to numerous non-profit organizations dedicated to social causes, providing vital services to the community. These organizations often engage fiduciary accounting services to maintain transparent financial records, budget management, and compliance with state and federal guidelines. 4. Small Business Accounting: The Bronx has a thriving small business community. For small business owners and entrepreneurs, fiduciary accountants provide indispensable services such as bookkeeping, tax planning, financial analysis, and assistance with regulatory obligations. Their expertise ensures accurate financial reporting and helps businesses make informed decisions. 5. Investment Management: Individuals and organizations in the Bronx with substantial investments often rely on fiduciary accountants to manage their portfolios. These professionals offer investment oversight, performance analysis, risk assessment, and compliance monitoring to safeguard their clients' financial interests. Keywords: Bronx, New York, fiduciary accounting, estate planning, estate settlement, trust administration, non-profit organizations, small business accounting, investment management.

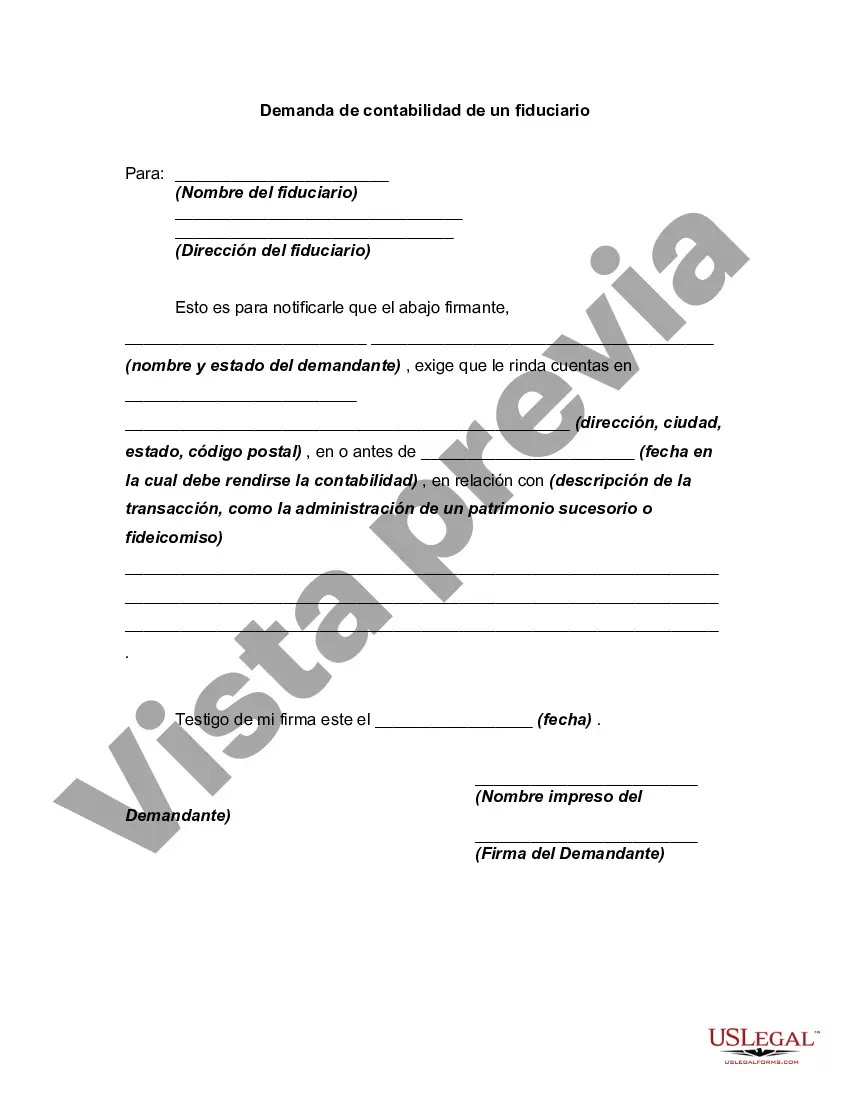

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.